Top Supplement Ads

We dove deep into the world of performance advertising to uncover what truly drives results for supplement brands.

This time, we analyzed the top-performing supplement ads from 50 global brands, placing greater emphasis on longevity-focused companies specifically. Brands with real ad spend, strong presence on Meta, and enough creative firepower to give us statistically relevant insights.

As performance strategists working directly with supplement and wellness companies, we set out to answer key questions:

- What differentiates brands that run ads for hundreds of days versus those whose ads disappear within weeks?

- What are the key factors of ad longevity?

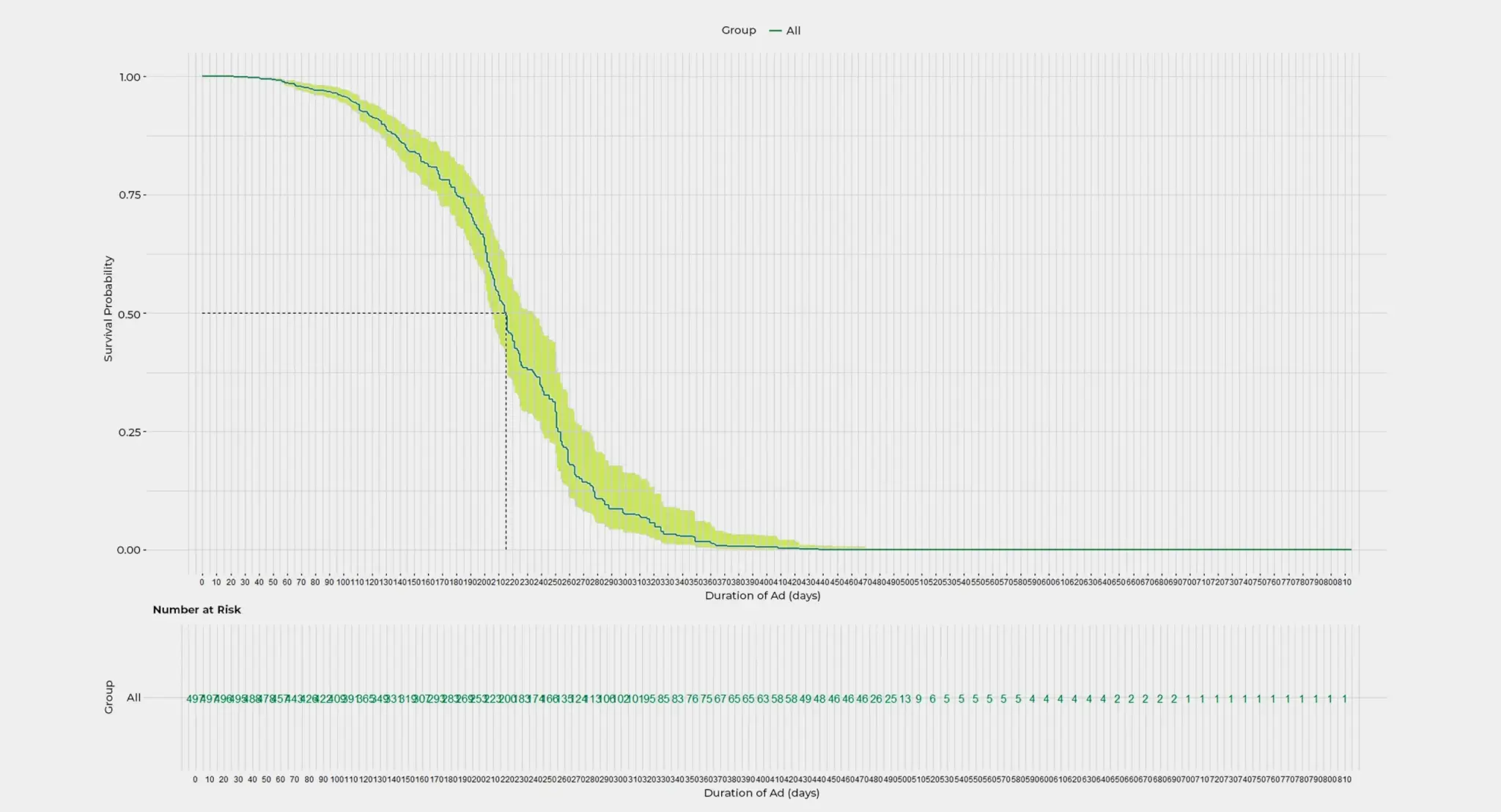

To find out, we didn’t rely on gut feelings or guesswork. We applied advanced statistical modeling (including Kaplan–Meier survival analysis, Cox regression, chi-square testing, and logistic regression) to extract patterns from real-world ad performance.

With the help of MagicBrief, we collected and selected 500 of the strongest Meta ads from these 50 brands and spent 2 months breaking them down.

The result? A strategic playbook backed by data. And you can access all of it here, including a curated ad library below that you can subscribe to.

The Brands Behind the Data

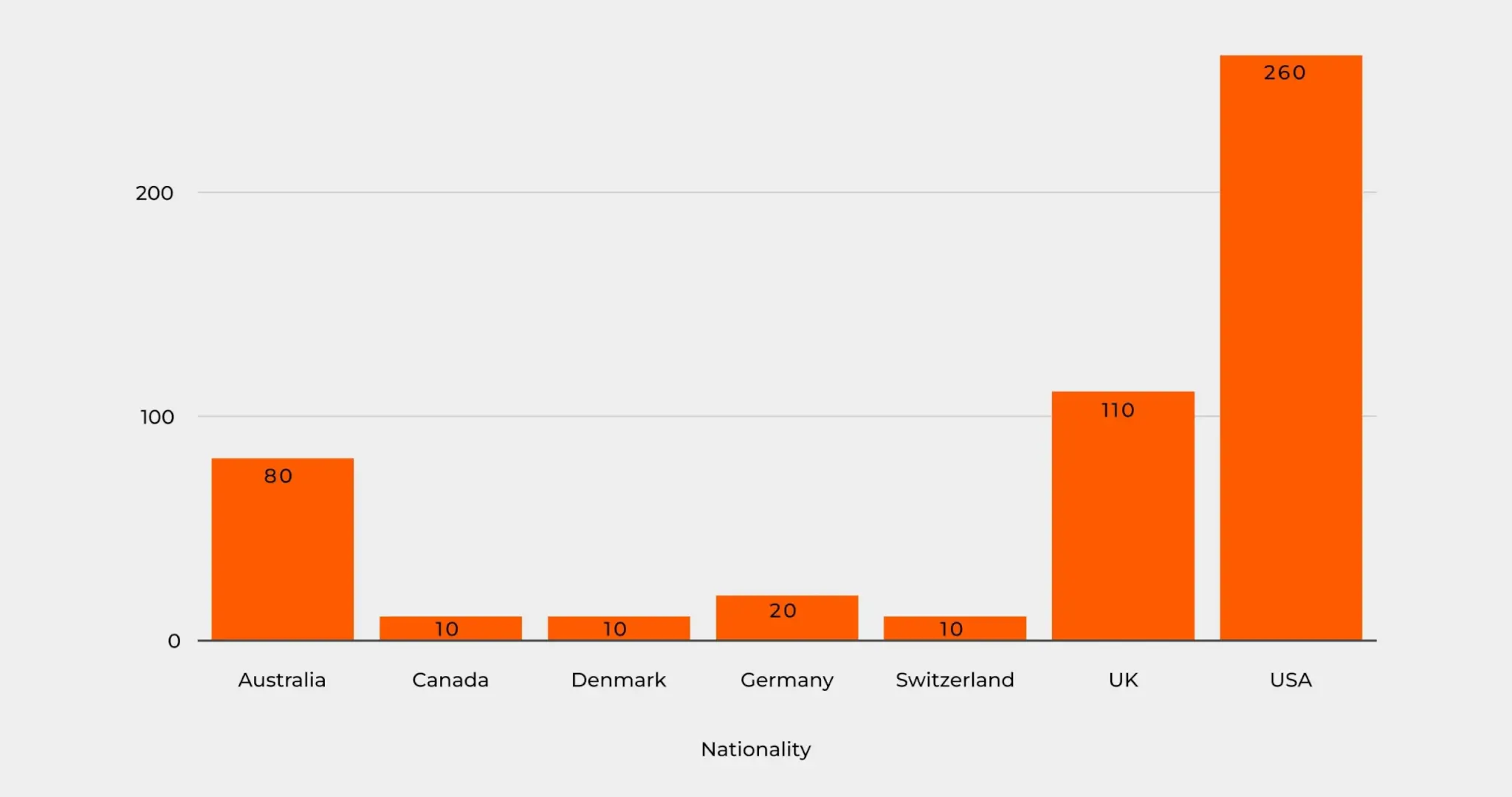

We selected a diverse mix of supplement brands with strong digital ad presence, primarily from the US like MaryRuth, Olly, MUD\WTR or Thorne. But also included top players from the UK (e.g. The Nue Co., Feel London, Hairburst, Spacegoods), Australia (e.g. Simply Nootropics, Happy Mammoth), and Western Europe (e.g. Timeline Nutrition, Puori).

Each brand was chosen based on consistent ad activity and creative variety, ensuring a representative view of what’s working globally.

/Our statistical methods are written at the end of the article if you’re interested in the methodology./

Industry Snapshot

The global supplement market continues its upward trajectory, fueled by shifting health priorities, increased preventive care awareness, and a wave of digitally native brands reshaping how supplements are marketed and consumed.

In this analysis, we focused on a strong advertising presence across Meta platforms, primarily from the U.S., U.K., Western Europe, and Australia. This mix reflects the epicenter of innovation in wellness – where functional health, performance optimization, and longevity have converged into everyday consumer needs.

From legacy names like AG1 and Onnit to new-wave disruptors such as Spacegoods, David Protein, and Feel, the market is no longer dominated by pharmaceutical aesthetics or clinical messaging. Instead, we see a clear shift toward lifestyle branding, identity-based differentiation, and community-led credibility.

Supplementation today sits at the intersection of performance, beauty, mental clarity, and biohacking, blurring traditional category lines.

With growth projected to continue at over 7% CAGR globally through 2030, brands that master strategic creative and cross-platform storytelling will be best positioned to capture attention and market share.

We’ve hand-selected 50 top supplement brands and their best-performing, longest-running ads, featuring Onnit, AG1, Happy Mammoth, Olly, Feel London, Timeline, Thorne, David Protein, Spacegoods, Care/of and many more.

Want to see all the ads, including their copies, visuals, and videos? Drop your name and email below, and we’ll send you a private link to browse our exclusive winner ad library, curated by our performance team.

Top Supplement Ads - Ad Formats, Creative Types

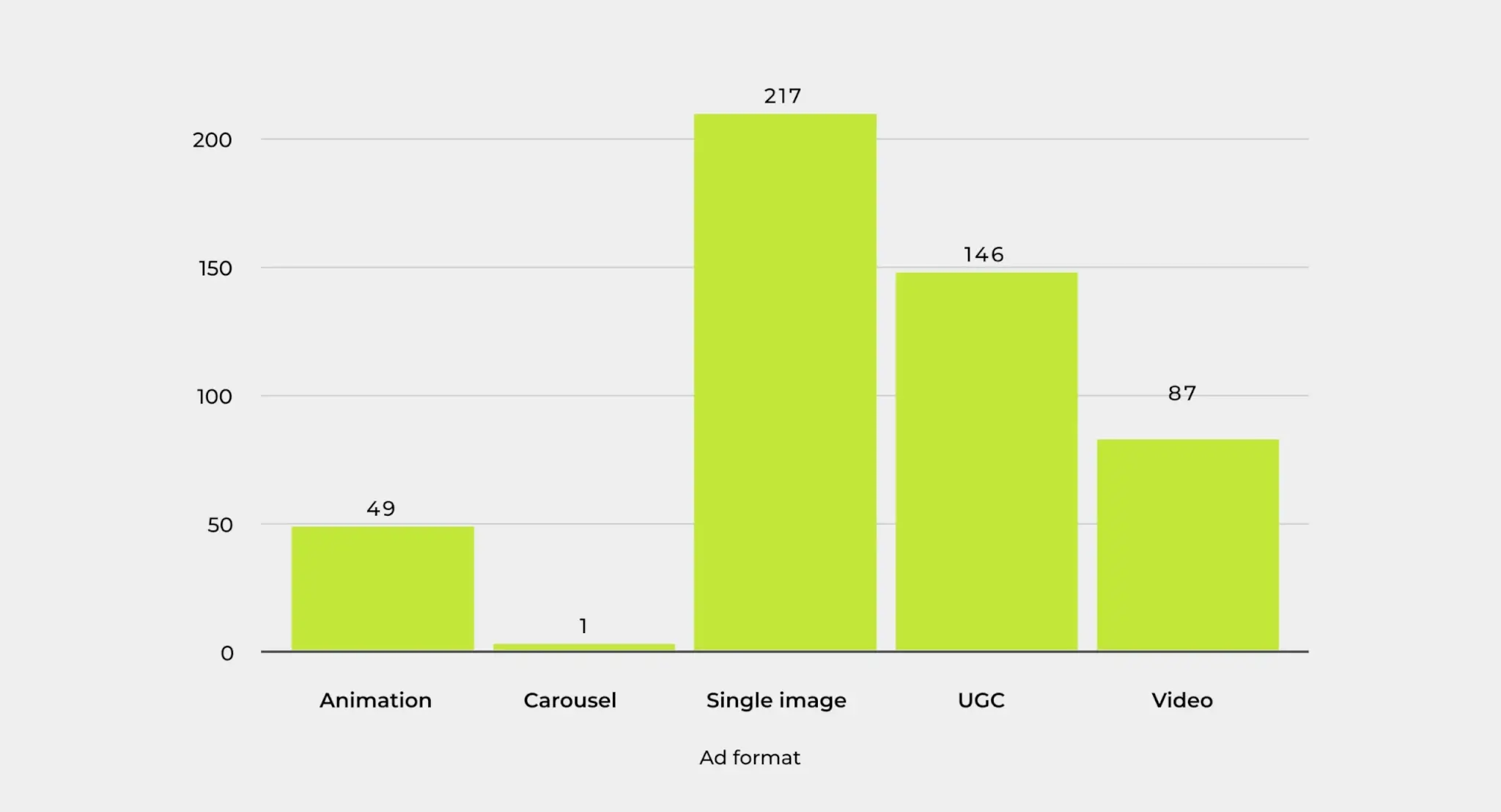

In our analysis of 500 high-performing top supplement ads, two clear patterns emerged: the dominance of single image formats and the overwhelming preference for demonstration-style creatives.

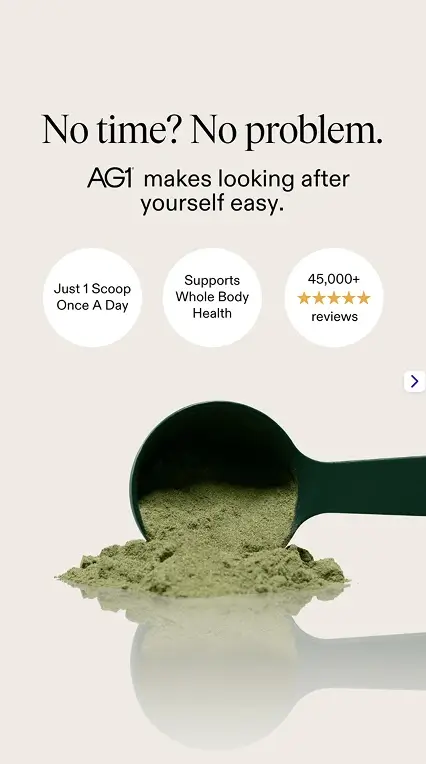

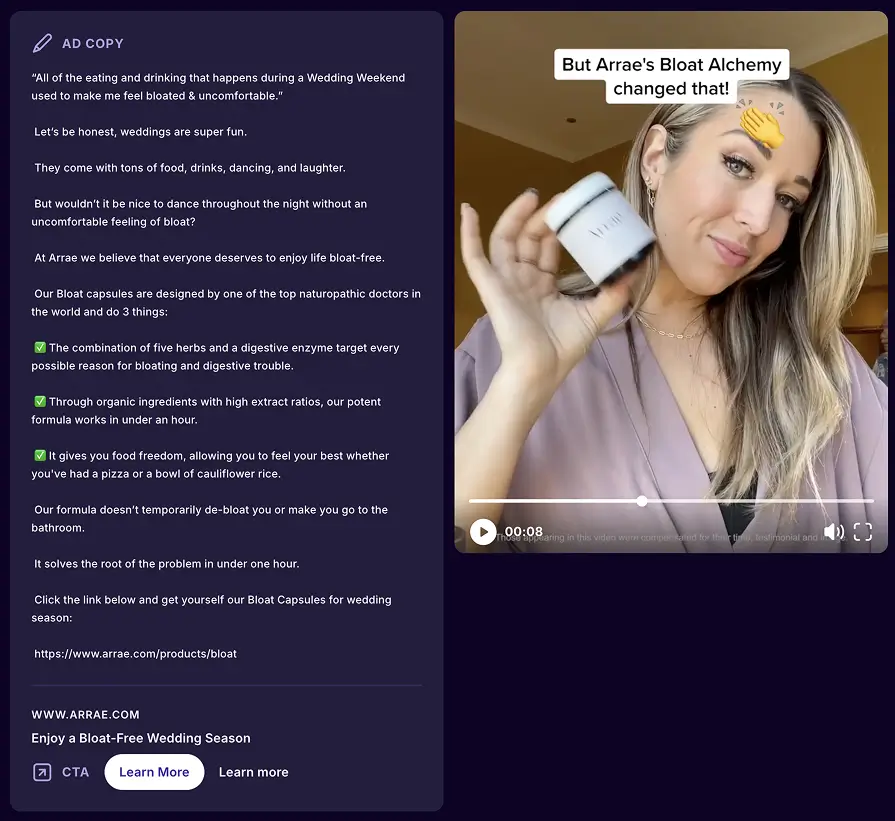

Single images accounted for 43.4% of all ad formats (217 ads), continuing to prove that simplicity and clarity still work in supplement advertising. Brands like AG1 and JSHealth heavily utilize static visuals to communicate benefits quickly and effectively, especially in retargeting scenarios.

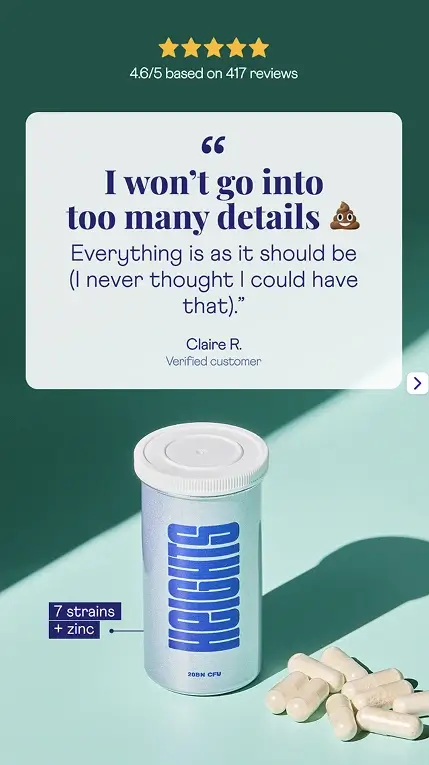

UGC (User-Generated Content – somewhere others call these CGC) formats followed closely at 29.2% (146 ads), reflecting the growing trust consumers place in peer-to-peer recommendations.

Brands such as Happy Mammoth and Hairburst rely on UGC to build authenticity and emotional resonance.

Happy Mammoth UGC ad

Hairburst UGC ad

Tropeaka UGC ad

Video ads made up 17.4% (87 ads), while animations came in at 9.8% (49 ads), and carousel ads were nearly nonexistent, with only 1 recorded.

The Dominant Creative Type

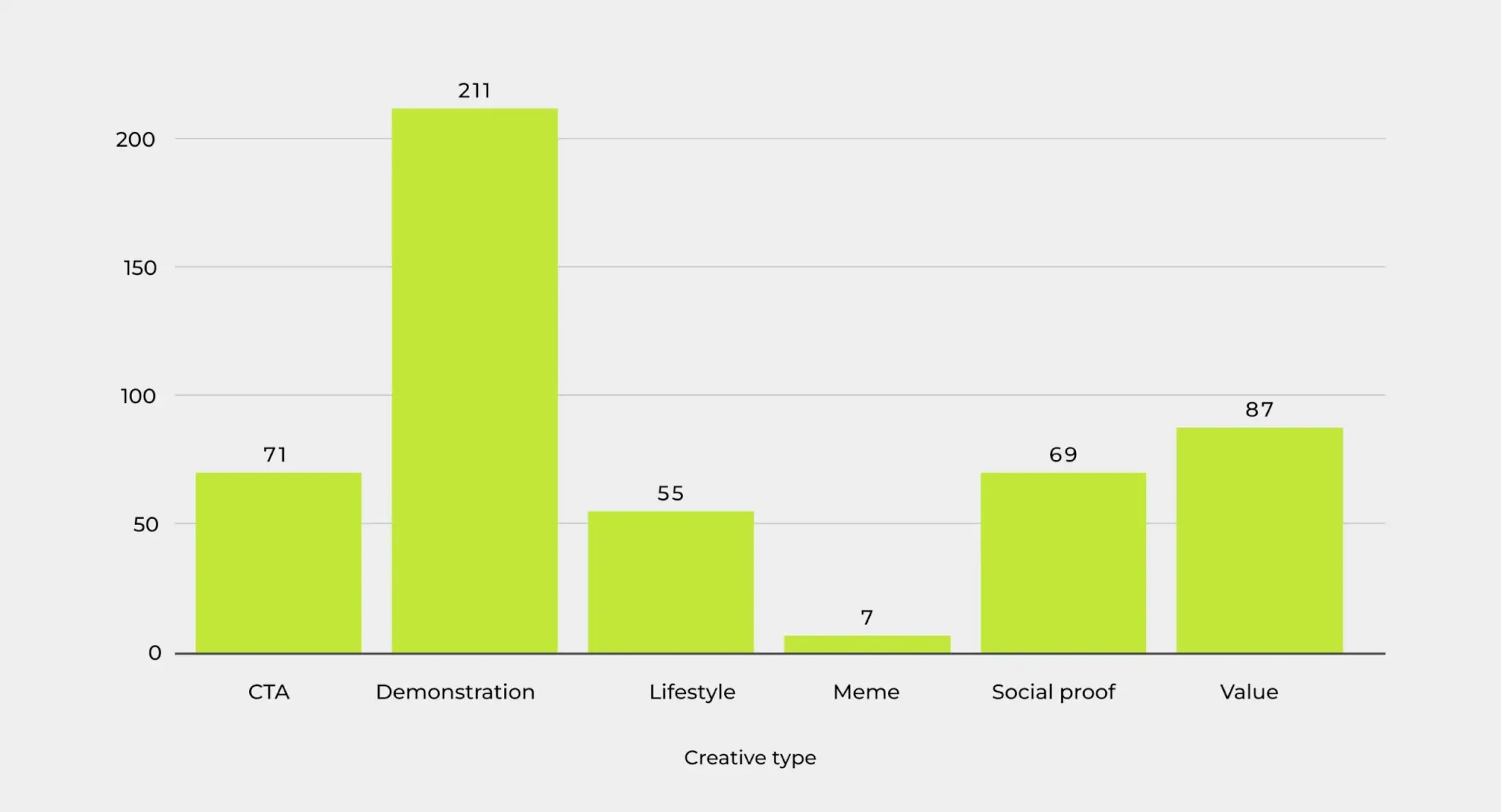

When it comes to creative styles, demonstration led clearly, 42.2% of all ads (211) focused on showing how the product works. These range from usage instructions to ingredient breakdowns.

For example, True Sea Moss often shows its product being mixed into smoothies, while Spacegoods uses unpacking visuals and ingredient highlights to communicate quality.

True Sea Moss UGC video ad

Spacegoods UGC ad

Value-driven creatives came next at 17.4% (87 ads), with brands like Bloom Nutrition showcasing key health benefits, product bundles, or limited-time offers. CTA-focused ads made up 14.2% (71 ads), often pushing urgency or direct purchase intent. Social proof ads, at 13.8% (69 ads), included reviews and testimonials, reinforcing trust through customer validation.

Lifestyle creatives made up 11% (55 ads), with brands like Live Conscious using aspirational visuals to reflect their brand identity. Meme-style content appeared in just 1.4% (7 ads), typically used by younger or more niche brands like Spacegoods to stand out with humor or edge.

The Spacegoods Story

One of the breakout stars of the new wave of supplement marketing, Spacegoods has taken a bold, high-conviction approach to brand building. With a product line that fuses functionality with fun, they’ve leaned into psychedelic-inspired visuals, strong DTC execution, and a clear founder-led voice to differentiate in a saturated market.

Founder Matt Kelly emphasized in his interview that success comes from building brand like a media company, doubling down on fast content testing, UGC-style creatives, and community-first messaging. (from 2:40)

Overall, the creative and format distribution reveals a clear focus on function, trust, and clarity, favoring formats that communicate quickly and styles that directly demonstrate product effectiveness or user satisfaction.

Top Supplement Ads - Landing Page, Ad Duration

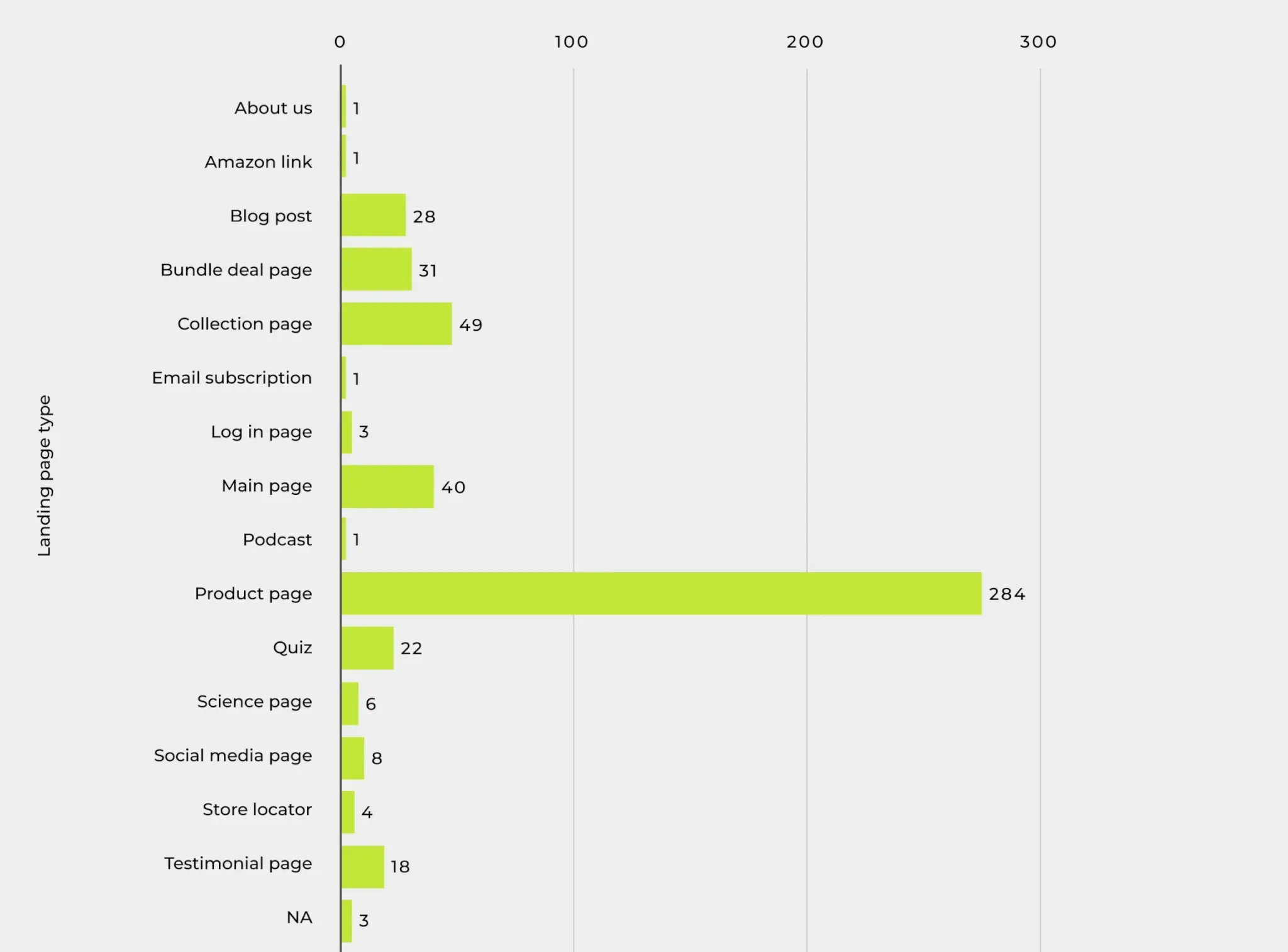

When it comes to supplement ad performance, where you send your traffic matters just as much as what you show. Our analysis reveals that Product Pages are the most frequently used destination, accounting for 56.8% of all landing pages. This highlights how many brands still opt for the most straightforward path to purchase.

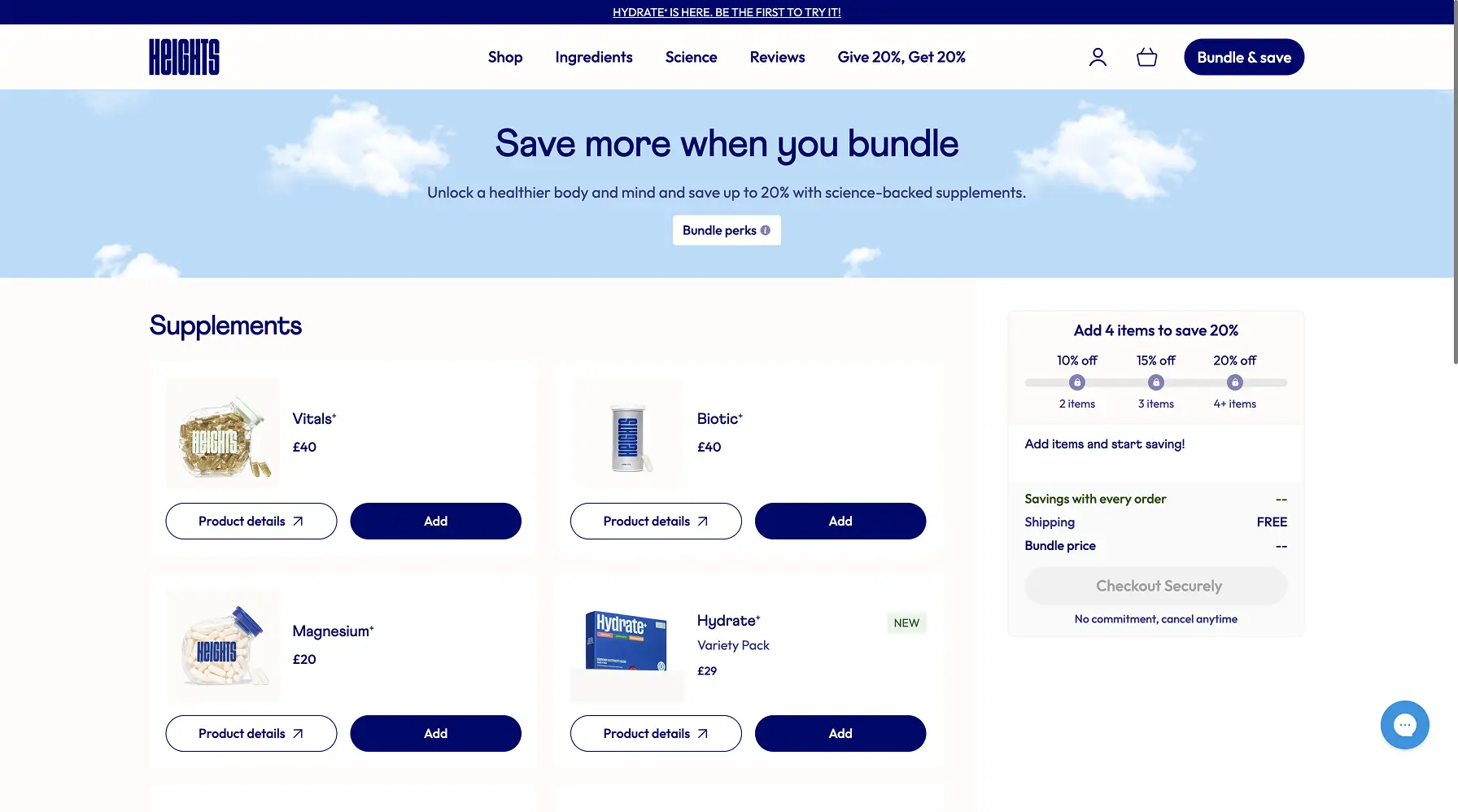

Brands like AG1, JSHealth, and Cymbiotika often use clean, high-converting product pages to keep user flow simple.

Cymbiotika product page

Meanwhile, Collection Pages (9.8%) and Main Pages (8%) follow, offering broader discovery experiences or more controlled funneling of attention. Email subscription and bundle offer pages also appear with moderate frequency, suggesting a growing interest in first-party data capture and AOV optimization strategies.

More advanced formats like quizzes (4.4%), science explainers, and testimonial-driven landers were used far less frequently, signaling underused opportunities to build trust or personalize user journeys. Tactics that high-performing DTC brands could lean into.

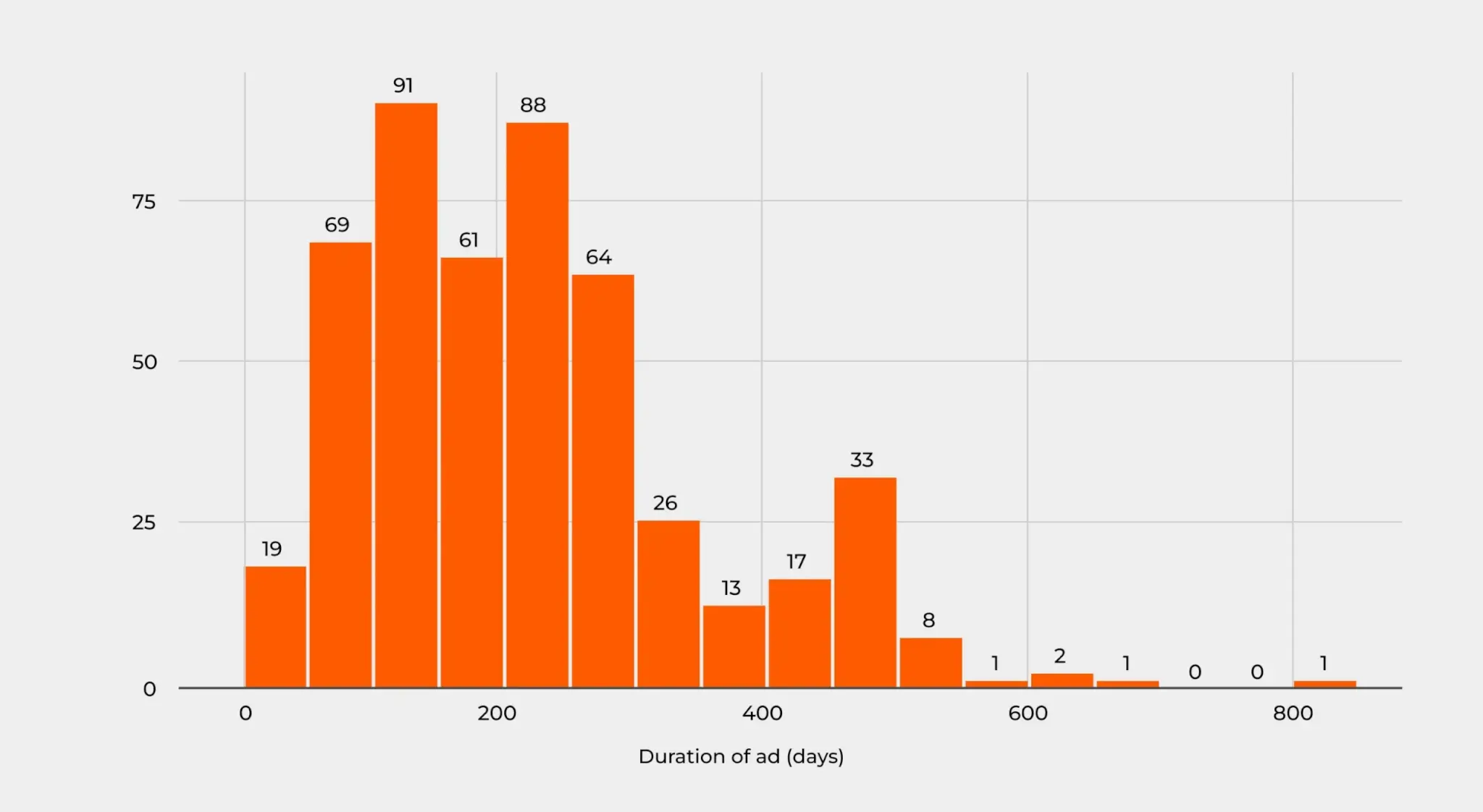

On the ad duration side, campaigns most often fall within the 100–300 day range, with a peak around 150–250 days. While shorter tests and seasonal bursts still exist, this indicates a trend toward longer-term evergreen campaigns, especially among brands with a clear product-market fit and scalable funnel.

Why Your Supplement Ads Are Getting Flagged (And What to Do)

In April, Meta quietly escalated enforcement of its Health & Wellness Policy, and the impact has been felt hard by supplement brands. Without warning, many accounts saw performance drop, conversion data vanish, and ads get restricted, even without policy violations.

But this isn’t about banned products. Meta’s AI systems are flagging supplement ads as “regulated health” content, even when they aren’t.

Why It Matters

For supplement brands relying on Meta to scale, this is more than an inconvenience, it breaks your growth engine. Brands launching new products or using niche ingredients are especially vulnerable.

How to Protect Your Brand

Audit Your Copy: Remove medical terms, claims, or comparisons to pharmaceuticals.

Use Clean Landing Pages: Create Meta-compliant versions with minimal health claims.

Track Redundantly: Set up Google Analytics 4, post-purchase surveys, and influencer links as backup.

Appeal Fast: If flagged, hit Meta Support immediately and explain your compliance.

Diversify Channels: Don’t rely on Meta alone, explore TikTok Shop, YouTube, SEO, and influencer-led funnels.

Brands that future-proof their compliance and build omnichannel strategies will win in this new landscape.

What Drives Ad Longevity in the Supplement Industry?

To uncover what truly makes a supplement ad campaign durable, we applied Cox proportional hazards regression to the dataset, an advanced statistical tool used to analyze the time until an event occurs, in this case, an ad going offline.

The model is highly predictive with a concordance of 0.85, meaning we can accurately distinguish long-running vs. short-running ads about 85% of the time. Global tests (Likelihood Ratio, Wald, Logrank) were all extremely significant (p < .001), showing that these variables matter a lot in explaining ad survival.

The overall model was statistically significant, Likelihood Ratio χ²(78) = 682.70, p < .001; Wald χ²(78) = 2702, p < .001; and Score (logrank) χ²(78) = 1572, p < .001, indicating that the predictors jointly explained significant variance in ad survival. The model demonstrated strong discriminatory ability, with a concordance index of .85 (SE = .008), suggesting excellent predictive accuracy in distinguishing longer- from shorter-running ads.

This is a critical matter of interest, because this shows that ad duration isn’t random. It’s systematically shaped by strategic choices, from ad format to landing page type. Brands that understand this can design campaigns not just for clicks, but for long-standing power.

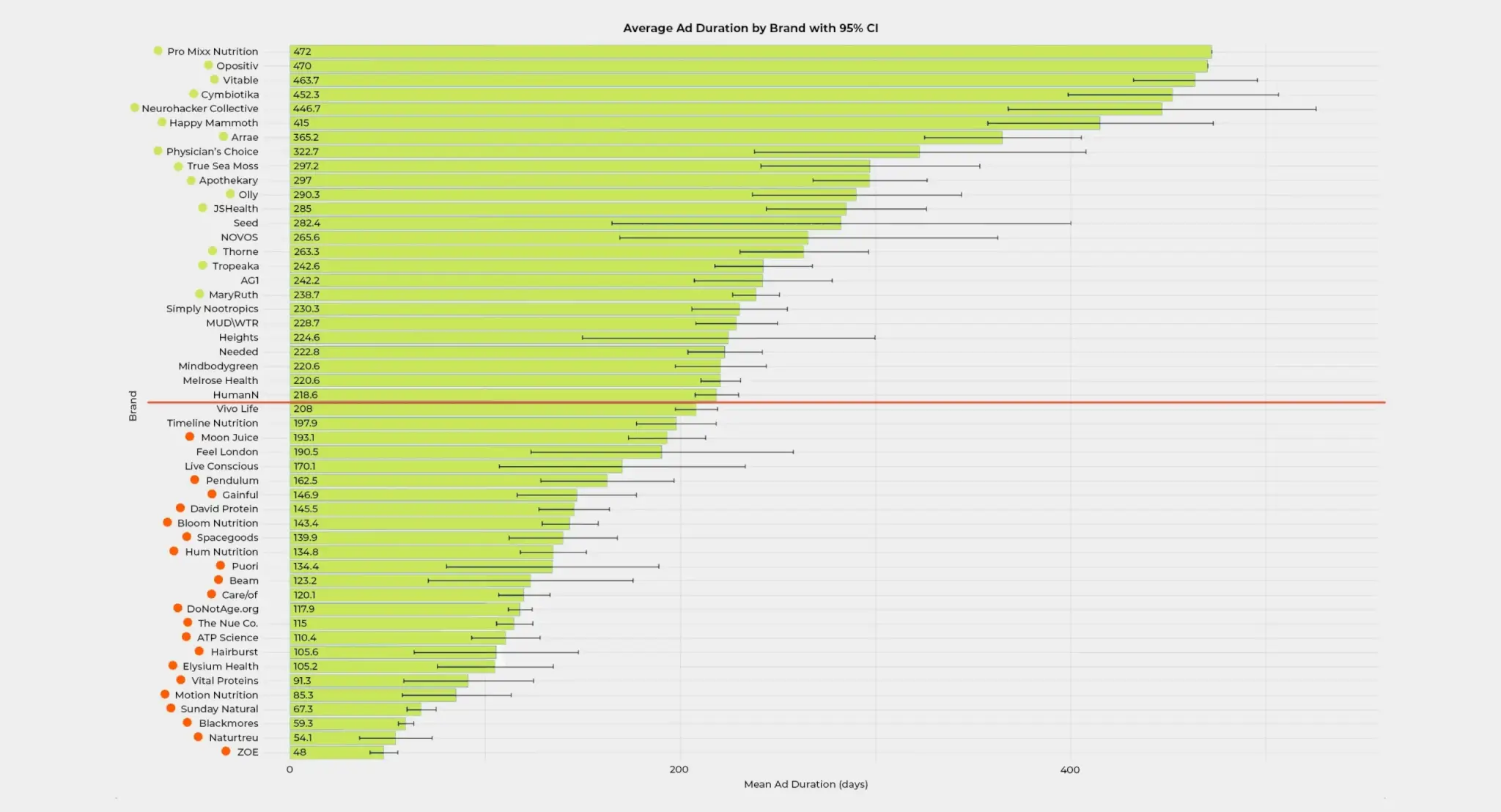

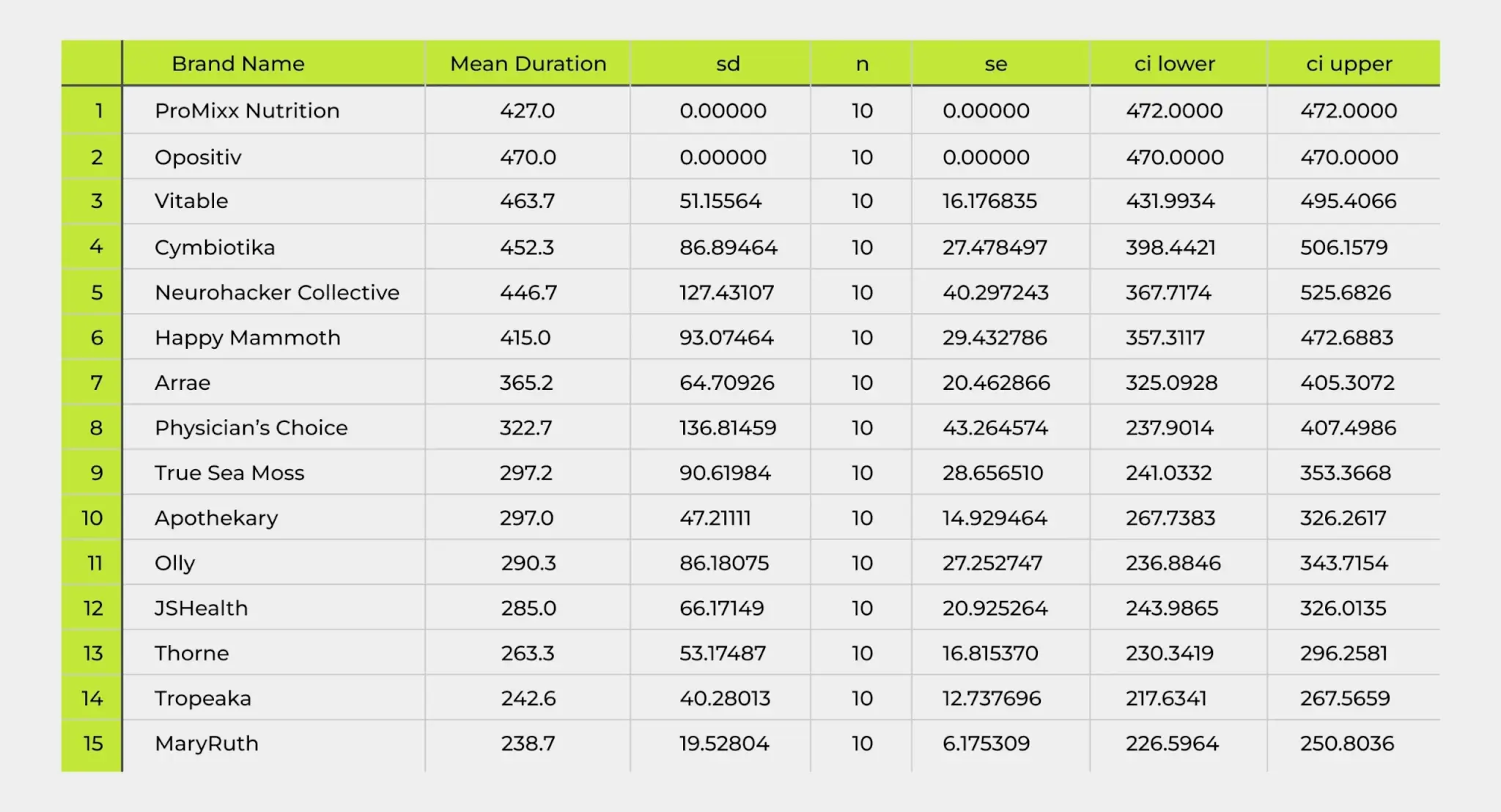

We evaluated every available variable and set AG1 as the benchmark, given its industry-leading scale and consistency across Meta platforms.

The model allowed us to calculate the hazard ratio for each brand, essentially, the risk of an ad ending on any given day compared to AG1. Brands with a hazard ratio below 1 run ads that tend to last longer, while those with ratios above 1 tend to rotate or kill ads sooner.

The most critical finding: 215 days emerged as the inflection point for ad duration across the dataset. Brands with average campaign durations below 215 days are more likely to suffer from short-lived campaigns due to underperforming creative, weak offers, or lack of strategic media planning.

Brands above this line, however, have clearly cracked the code for evergreen performance.

Note: These insights are based on the top-performing ads from each brand. When we refer to “underperforming,” it’s strictly in relation to other high-performing competitors within this elite group, not in the context of general ad performance.

To illustrate:

- Arrae demonstrated one of the strongest survival profiles, with a 67% lower risk of ad termination on any given day compared to AG1. Their campaigns are likely benefiting from strong positioning, consistent creative angles, and a narrow but well-optimized product offering. So definitely worth checking out their ads if you want a solid benchmark.

(If you subscribe to to our full library, you will find 500 from these ads categorized into brand folders)

- In contrast, ATP Science stood out for the wrong reasons, its ads were 34 times more likely to be terminated on any day versus AG1. This may point to more frequent testing without a clear winning formula or an over-reliance on short-term promotions.

- Brands with hazard ratios near 1, such as JSHealth and Seed, performed close to the benchmark, suggesting solid but not standout performance.

When we look at the chart, the orange-dotted brands are grouped below the main curve, these are the ones that didn’t perform as well. The green-dotted brands are the outliers that maintain longer-running, higher-yielding campaigns. This separation is not random; it directly correlates with choices around creative type, landing page, ad format, and market positioning, factors we explore in the following sections.

In short: ad longevity is not luck, it’s the result of deliberate creative and strategic decisions.

Brands With Significantly Higher Ad Duration Than Average

Some supplement brands manage to keep their ads running far longer than others. This extended lifespan may signal higher ad efficiency, these campaigns are likely delivering strong results in the form of better click-through rates (CTR), higher conversion rates, or simply better return on ad spend.

But ad longevity doesn’t always mean performance alone. These longer-running ads might also be part of a broader “always-on” or evergreen strategy, where the goal is to build consistent brand awareness and customer acquisition over time, not just quick wins tied to sales events or seasonal trends.

So What Makes These Long-lasting Ads Different?

We ran a statistical comparison between the long-running ads and the rest, and the results were clear: there are key differences in how these ads are built and delivered. Individual Pearson’s Chi-square tests revealed significant relationship between ad longevity and the format, creative type, and landing page used as well.

In plain terms: brands that keep their ads live longer tend to make different creative decisions than those who cycle through ads quickly.

Understanding these patterns gives us a better grasp of what makes supplement ads not just high-performing, but sustainable over time.

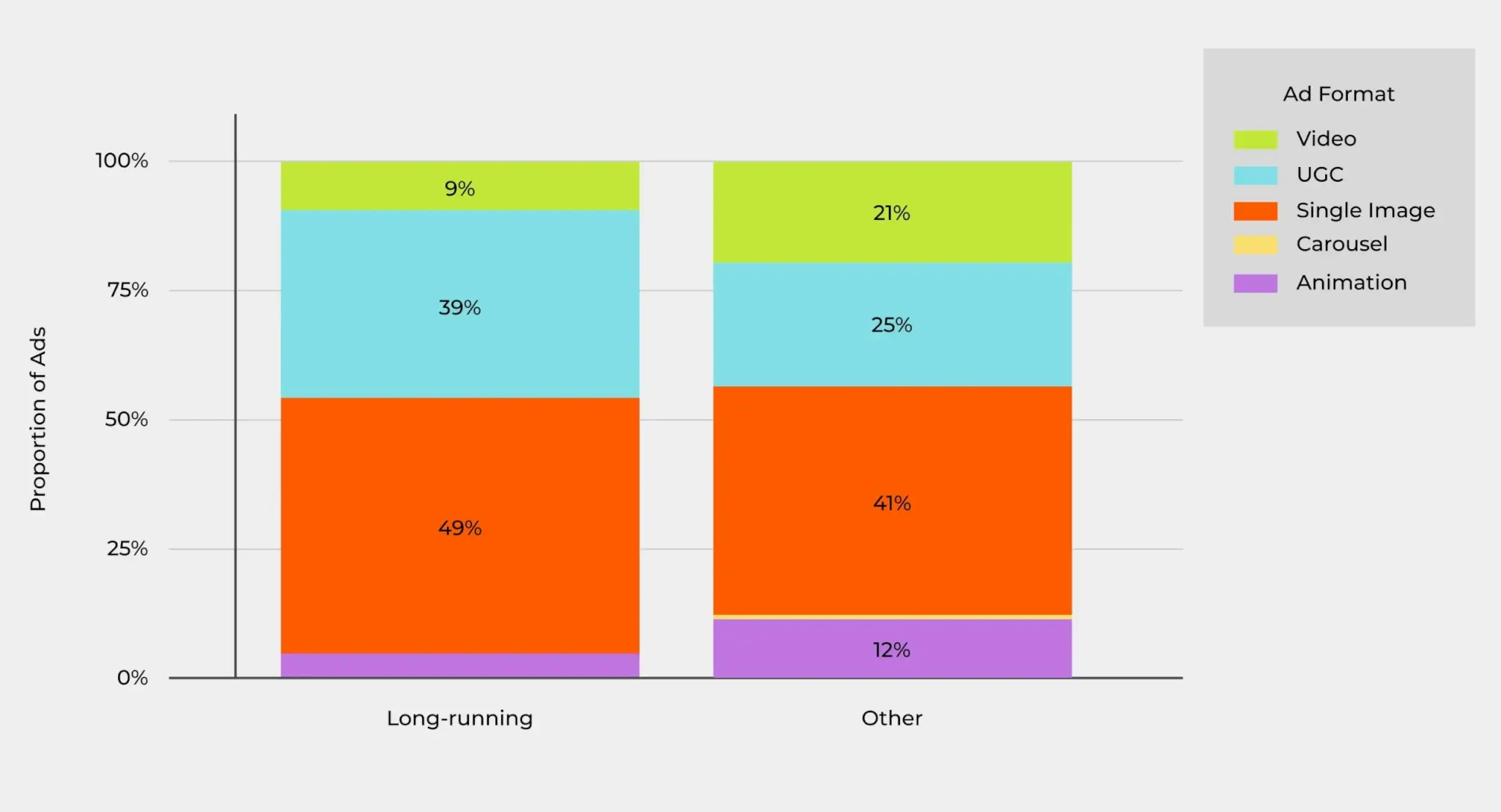

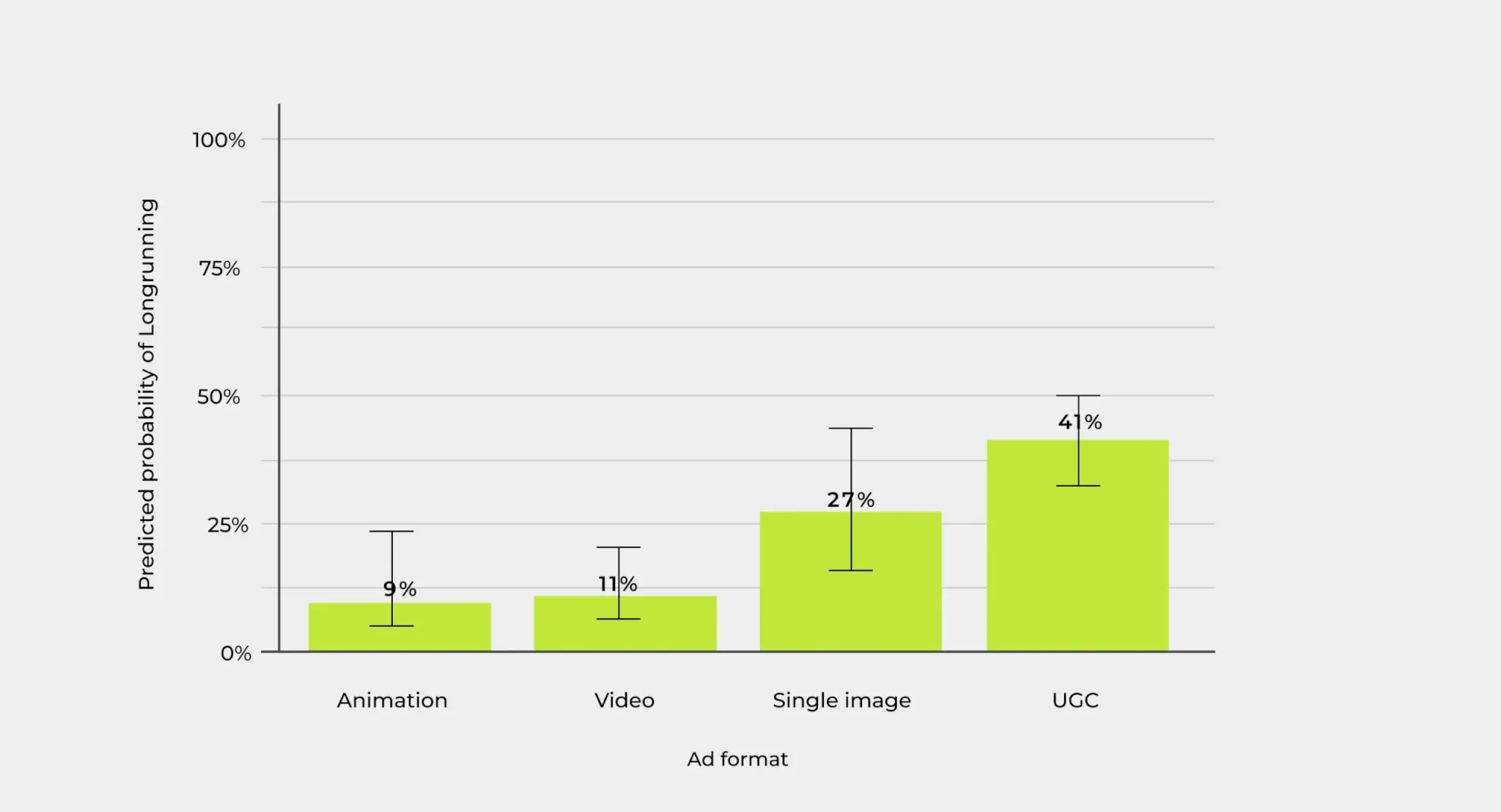

Ad Format Differences

When comparing the ad formats used by long-running supplement brands with those that run shorter campaigns, clear patterns emerge.

Single image ads are not only the most frequently used format across the board, they’re also highly effective. Long-running brands use them at a much higher rate, suggesting this classic format still delivers consistent, sustainable performance. Their simplicity, clarity, and fast load time likely contribute to better engagement and higher conversion rates over time.

User-Generated Content (UGC), while known for building trust and relatability, appears underutilized among brands with short-lived campaigns. However, it is far more common among long-running brands, indicating that authentic, peer-style content may support campaign longevity more than many marketers expect.

Cymbiotika longest running UGC ad – 699 days

Arrae longest running UGC ad – 496 days

Vitable longest running UGC ad – 494 days

Video ads, on the other hand, are more frequently used by brands with shorter campaigns. This could suggest that while videos may generate attention in the short term, they might not sustain interest or conversions over extended periods without strong storytelling or repeat value.

Physician’s Choice longest running video ad – 501 days

Promixx longest running video ad – 472 days

Animation and carousel formats remain relatively underused overall, but especially among high-performing long-term campaigns, which may reflect either production cost considerations or weaker direct-response performance.

This breakdown challenges some assumptions, particularly that flashy video content is always superior.

Instead, the data suggests a return to fundamentals: clear messaging, social proof, and static imagery may offer stronger long-term returns in the supplement space.

Format is key. Animation and video ads burn out fast (only ~ 10% chance of being long-running in both cases), while UGC ads stand out with a 41% probability of running much longer.

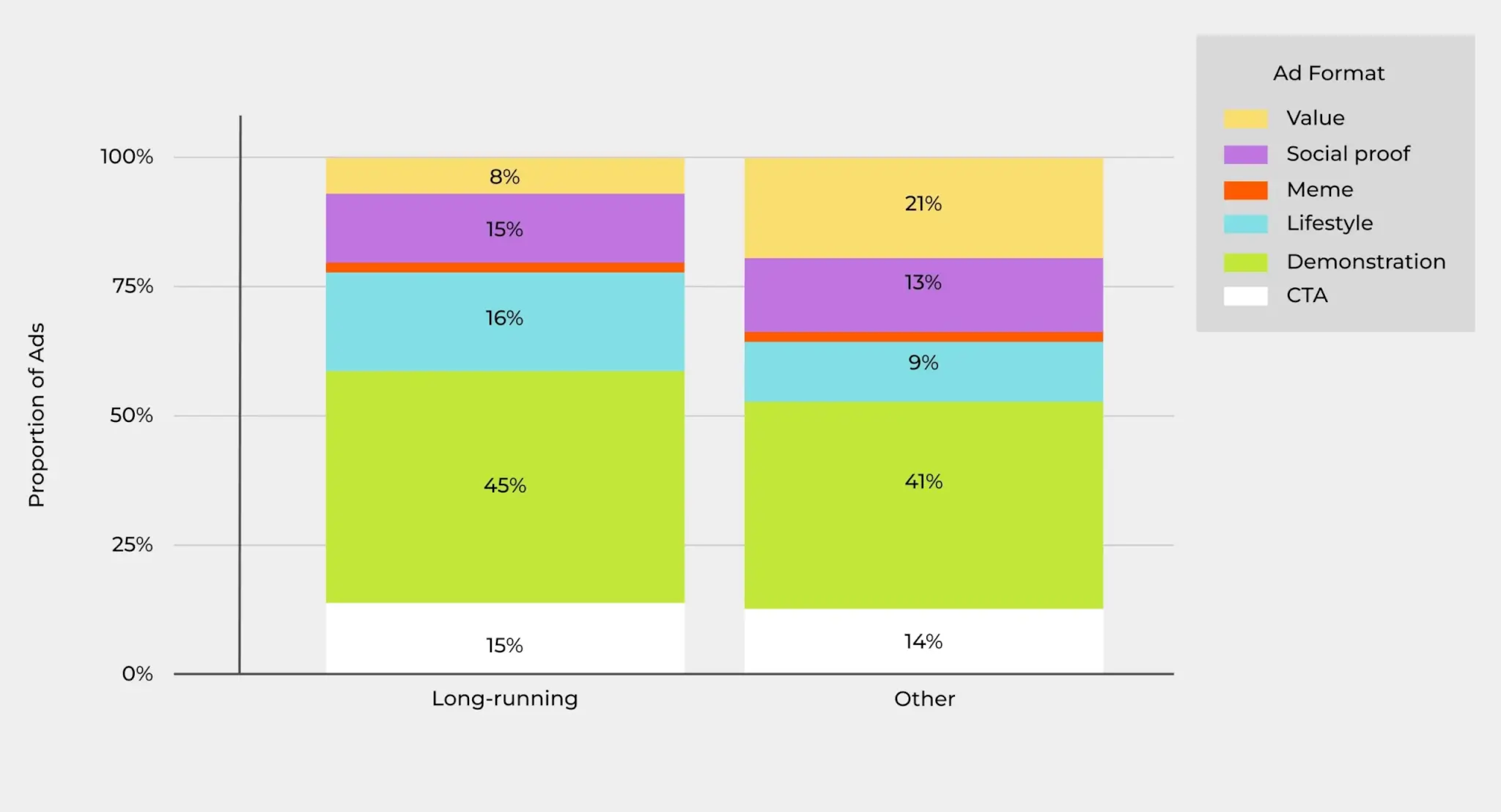

Creative Type Differences

Brands whose campaigns consistently stayed alive over time were more likely to rely on Demonstration creatives.

Nearly half of their ad mix showed the product in action, contextualizing its use and embedding it into real-life scenarios. By contrast, brands with shorter-lived campaigns leaned much more heavily on Value creatives: promising functional benefits or outcomes directly, without showing the journey or the context.

This pattern is telling. Value-based messaging is powerful in the short term; it pushes urgency, sparks immediate interest, and can accelerate clicks. But it also seems to exhaust its narrative quickly, leading to ad fatigue and shorter lifespans. Demonstration, on the other hand, does more than sell: it teaches, it shows, it visualizes. It builds familiarity and trust, giving campaigns a kind of narrative resilience that sustains them long after the first impression.

For marketers, the implication is clear:

If the goal is sustained performance, we need to resist the temptation of pure benefit-driven ads and instead design creatives that demonstrate the experience.

Storytelling in the form of action appears to extend not only engagement, but the very life of a campaign.

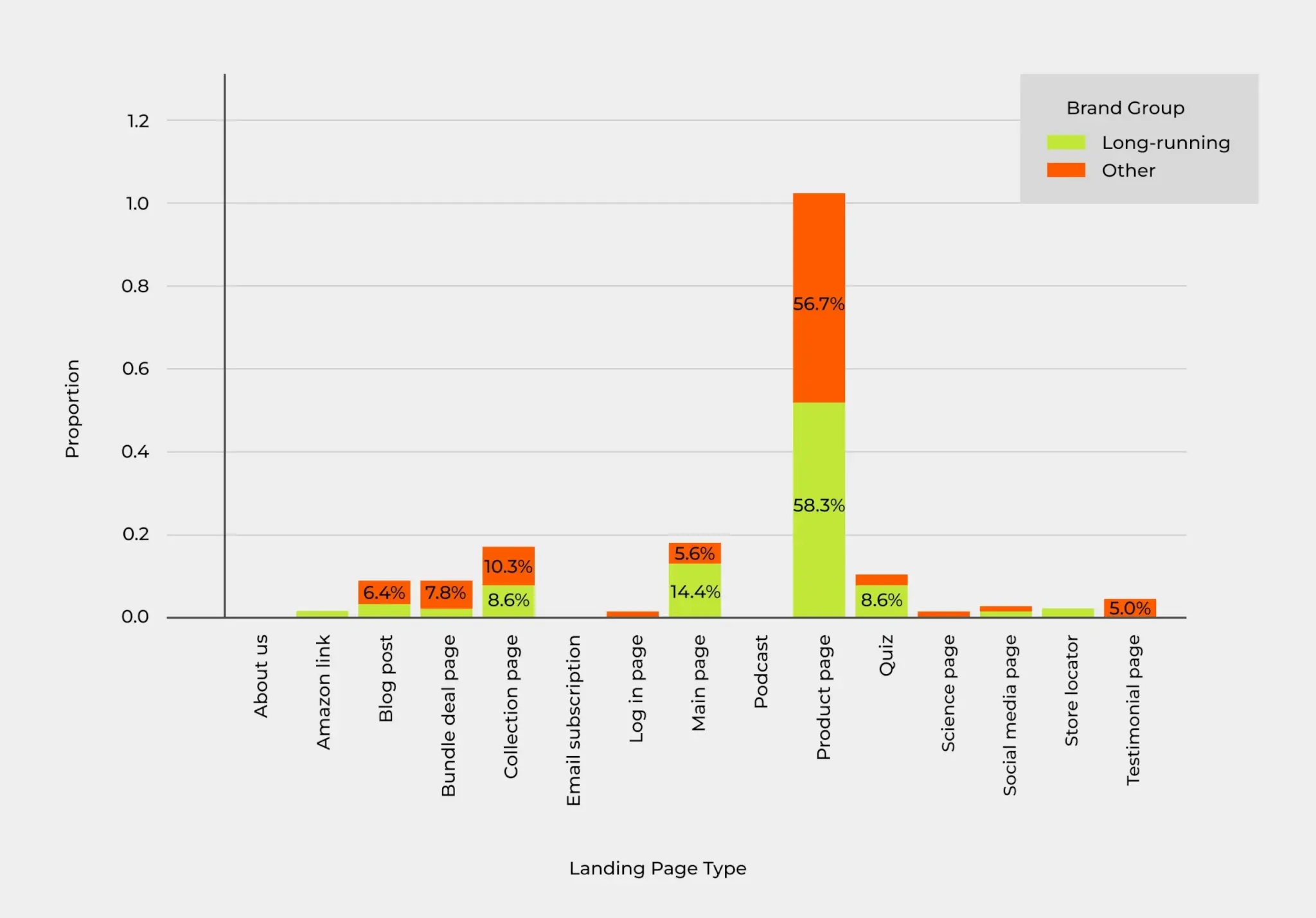

Landing Page Type Differences

In the following visualization, you’ll see that brands with long-running ads lean heavily on product pages (58%) and main pages (14%). These choices drive consistency and clear brand experience, which appears to sustain campaigns over time. Other brands in our sample, on the other hand, spread their bets wider: they rely also heavily on product pages (56%), but also allocate traffic toward testimonial pages (5%), collection pages (10%), and blogs (7%).

This tells us that long-lasting campaigns are built on focus and clarity. By keeping traffic on tightly controlled, conversion-optimized environments (like product or main pages), these brands reduce friction and extend campaign lifespans. Meanwhile, shorter-lived campaigns often experiment with broader storytelling (blogs) or social proof-heavy assets (testimonial pages). These can spike engagement but don’t seem to sustain ads in the long run.

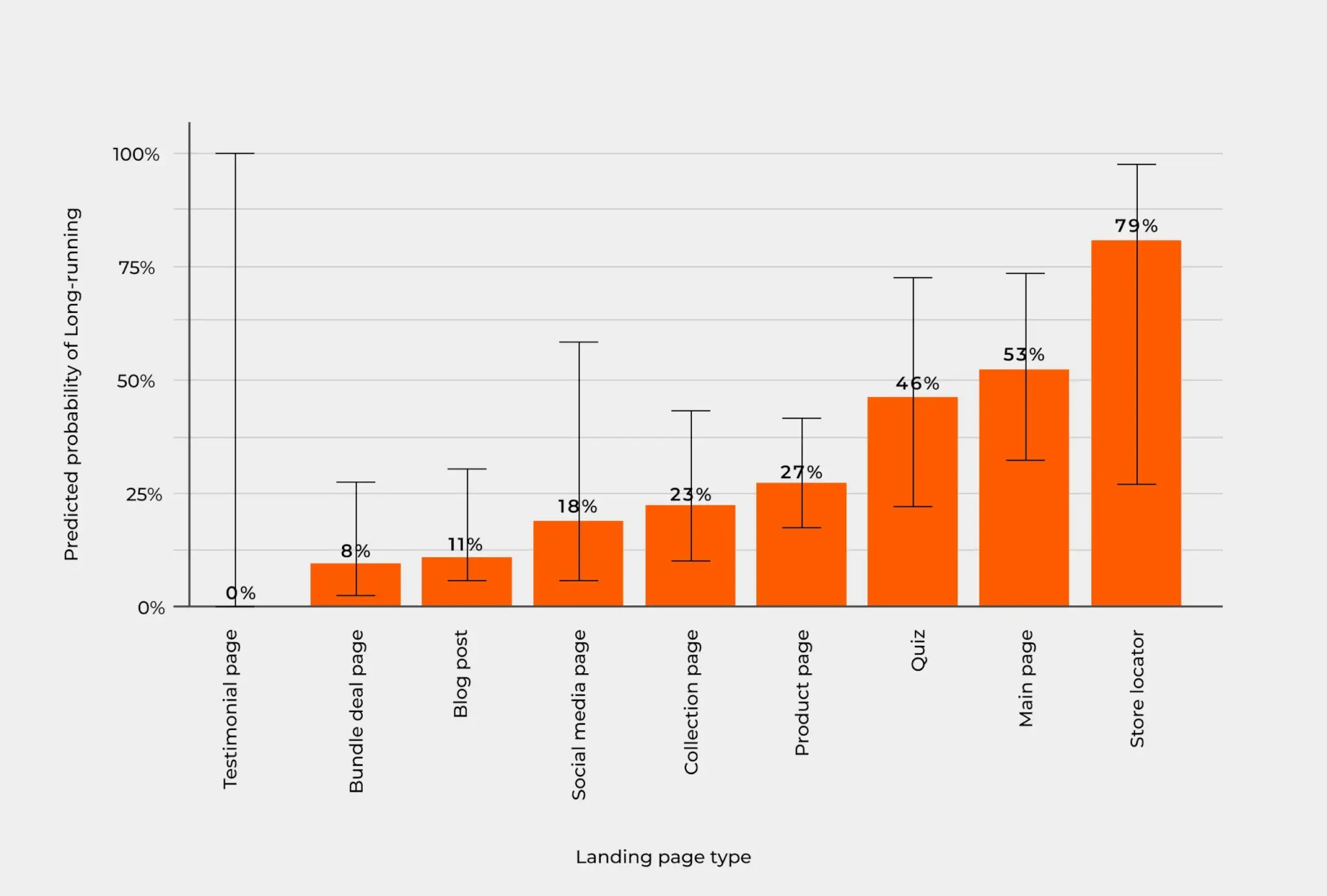

After identifying which brands run ads significantly longer (or shorter) than average, we wanted to go deeper: what factors actually predict whether a campaign will belong to one group or the other?

To answer this, we turned to logistic regression analysis. Unlike simple frequency comparisons, logistic regression allows us to isolate the effect of ad format, creative type, and landing page type while controlling for everything else. In other words: instead of asking “what’s popular?”, we asked “what truly increases or decreases the odds of long-term ad success?”.

Therefore, a binary logistic regression was conducted to predict whether an ad belonged to the long-running brand group (vs. other brands) based on ad format, creative type, and landing page type. The model was statistically significant (χ²(17) = 89.98, p = .001), indicating that the predictors reliably distinguished between long- and short-running ad groups. The explanatory power of the model was moderate (R² = 0.15).

Sending traffic to a bundle page or testimonial page almost guarantees short runs. But push to a main page, quiz or a store locator? Your ad has more than a 50-70% chance of sustaining.

Why Quiz Funnels Still Work – And Why Most Brands Ignore Them

Quizzes remain one of the most underutilized conversion tools in the supplement space, yet they consistently prove their value when implemented with strategy.

Unlike a standard product page, quiz funnels create a personalized path between a cold user and a purchase. By asking simple, targeted questions about goals, lifestyle, and preferences, quizzes tap into something every buyer craves: relevance.

When users are prompted to share what they’re struggling with – be it energy, sleep, gut health, or focus, they’re not just engaging. They’re self-qualifying, and more importantly, building trust in your product’s recommendation.

And the best part?

You don’t need a long or complex quiz to see results. Some of the best-performing brands in this study used short, 3–5 question quizzes that delivered clear outcomes and product matches without friction.

We’ve hand-selected 50 top supplement brands and their best-performing, longest-running ads, featuring Onnit, AG1, Supergut, Surreal, Feel London, Timeline, Thorne, David Protein, Spacegoods, Care/of and many more.

Want to see all the ads, including their copies, visuals, and videos? Drop your name and email below, and we’ll send you a private link to browse our exclusive winner ad library, curated by our performance team.

Top Supplement Ads Summary

Not all ads are created equal. Some campaigns burn out after a few weeks. Others keep driving clicks, sales, and brand awareness for more than a year.

When we compared top supplement ads with those that faded out earlier, the differences were clear:

Formats that last.

- Long-term campaigns lean on single images and UGC content. These formats may seem “basic”, but they’re proven to stay relevant longer than animation-heavy or flashy video ads, which often fatigue quickly.

- Animation ads were negatively associated with long-running campaigns.

- Video ads also showed a significant negative association.

Creatives that connect.

- Lifestyle and demonstration-style creatives dominate among long-running ads. Instead of just promising benefits, these ads show how the product fits into everyday life. That difference in storytelling makes campaigns feel fresh and relatable even months later.

- Other creative types (CTA, Social proof, Value) were not statistically significant.

Landing pages that convert.

- Here’s the game-changer: long-lasting ads don’t just send traffic to standard product pages. They often link to main pages, quizzes, or other tailored experiences that build brand consistency and trust over time.

- Bundle deal pages were significantly negatively associated with long-running ads

The big takeaway? Ad longevity isn’t just about creative quality. It’s about building a conversion ecosystem where format, story, and landing experience reinforce each other.

Brands like PRoMixx Nutrition, Opositiv, Vitable, Cymbiotika, Neurohacker Collective, and Happy Mammoth all cracked this code, keeping their campaigns alive for 400+ days.

If you want ads that stand the test of time, rethink the whole journey. Not just the first impression.

Methodology

Cox Regression (Survival Analysis)

Cox regression is a statistical method used in survival analysis, ideal when the question is:

How does one or more variables affect the timing of a specific event?

In our case, the “event” can be interpreted as the end of an ad campaign, but in other contexts, it might be things like product abandonment, program dropout, relapse, or even death.

Instead of predicting a number or a category, Cox regression uses two key pieces of information as the outcome:

- Duration: How long something “survived” (e.g. how many days an ad ran)

- Status: Did the event occur?

The model estimates what’s called a hazard ratio, which tells us how a certain factor increases or decreases the likelihood of the event happening at any given time.

This allows us to quantify the impact of things like ad format, creative type, or landing page strategy on how long high-performing ads tend to run.

Logistic Regression (Predictive Profiling)

Logistic regression is a statistical method we used to predict the likelihood of an ad falling into a high-performing category, based on various creative and strategic factors.

Unlike Cox regression, which looks at how long something lasts, logistic regression answers a different question:

What increases or decreases the chances of an ad being successful?

Pearson’s Chi-squared Test

Pearson’s Chi-square test is a statistical method used to determine whether there is a significant association between two categorical variables.

The test compares the observed frequencies in each category with the frequencies we would expect if there was no relationship. If the difference is large enough, the result is considered statistically significant, meaning the variables are likely related.

*Special thanks to Flóra, our senior creative copywriter and data analyst, who helped put together the statistical models and the main findings.