/This guest article is written by Dr. Dominik Thor, President, Geneva College of Longevity Science./

The meaning of beauty and wellness to consumers is undergoing a profound transformation, as the rise of longevity science means the quest for health longevity is now permeating the worlds of skincare, cosmetic innovation, spa-wellness and hospitality. If you think about it, this shift is nothing less than a rewrite of the playbook.

At the heart of this transformation lies a new paradigm: people are shifting away from the outdated notion of “anti-ageing” and toward a proactive optimisation of their healthspan. This perspective acknowledges ageing as a natural biological process – yet not one that inevitably equates to decline. Instead, it emphasises the possibility of preserving vitality, capability, and wellbeing through scientific discoveries.

When properly embedded into business strategy (plus product development and experience design!), longevity science offers a roadmap for differentiated value in an extremely crowded marketplace. How brands can stand out and meet consumer expectations.

1. From Anti-Ageing to Pro-Longevity: The Paradigm Shift

Historically, the beauty industry has leaned heavily on marketing narratives grounded in “anti-ageing”. Their creams promised to erase wrinkles, serums “lifted” sagging skin – together they claimed to turn back time. You could say ageing was something to be beaten back or hidden. But in recent years, the consumer mindset has shifted.

Today’s consumers are more informed and more sceptical. They want products and experiences that help them live better for longer, not simply look younger.

That’s where longevity science enters the equation. By linking interventions to mechanisms of ageing, biomarkers, cellular repair, regenerative biology, and metabolic health, longevity science reframes beauty and wellness away from just surface-level aesthetics. It says: your skin, your body, your cognitive performance and your aesthetic presence are linked to deeper biological processes – and you can alter them.

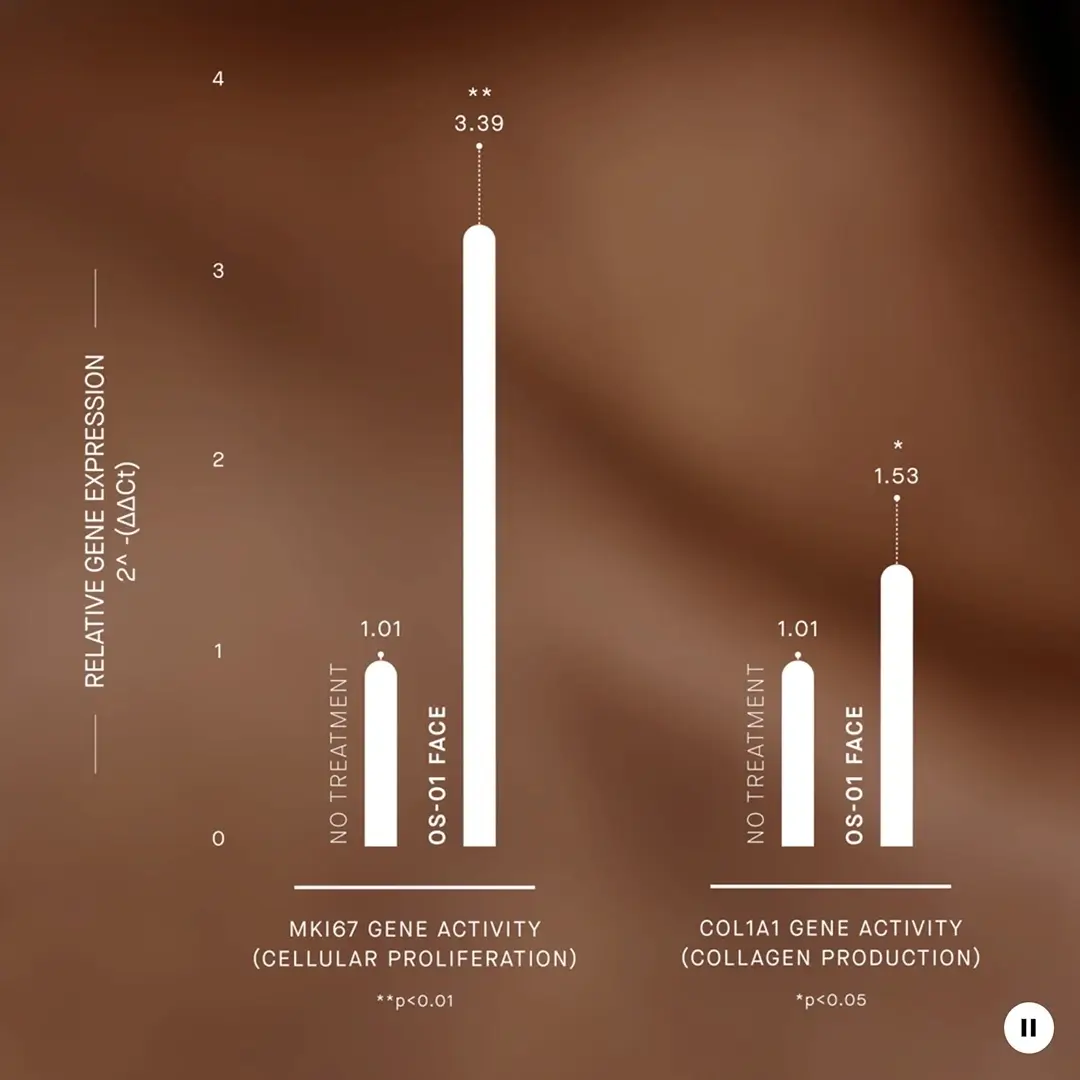

For example, rather than claiming a cream will “erase 10 years,” a longevity-science informed skincare brand might say: “This formulation supports mitochondrial resilience, helps to clear senescent cells and preserves the skin’s epigentic profile over decades.”

ONE SKIN is a standout example of a beauty brand successfully grounded in longevity science.

That subtle repositioning is profound. The consumer is not just buying a simplified “look younger” promise but buying into a future of sustained vitality and a brand that uses scientific concepts, which creates deeper trust, higher engagement.

2. Why Beauty & Wellness Is Being Transformed by Longevity Science

There are several converging forces driving the infusion of longevity science into the beauty & wellness space:

a) Consumer demand for healthspan optimisation

Recent data show (Global Longevity Survey, 2024) that more consumers than ever believe they can actively influence how they age, not just how long they live, but how well.

This is reflected in global survey results, where respondents identified diet and nutrition (58%), physical fitness (52.2%), and mental stimulation (39.6%) as their top three strategies for supporting longevity. A strong majority (63.6%) also expressed a desire to begin improving their wellbeing immediately.

With this growing confidence and proactive mindset, consumers are becoming far less tolerant of products that make exaggerated claims without credible evidence.

b) Advances in biology and measurement

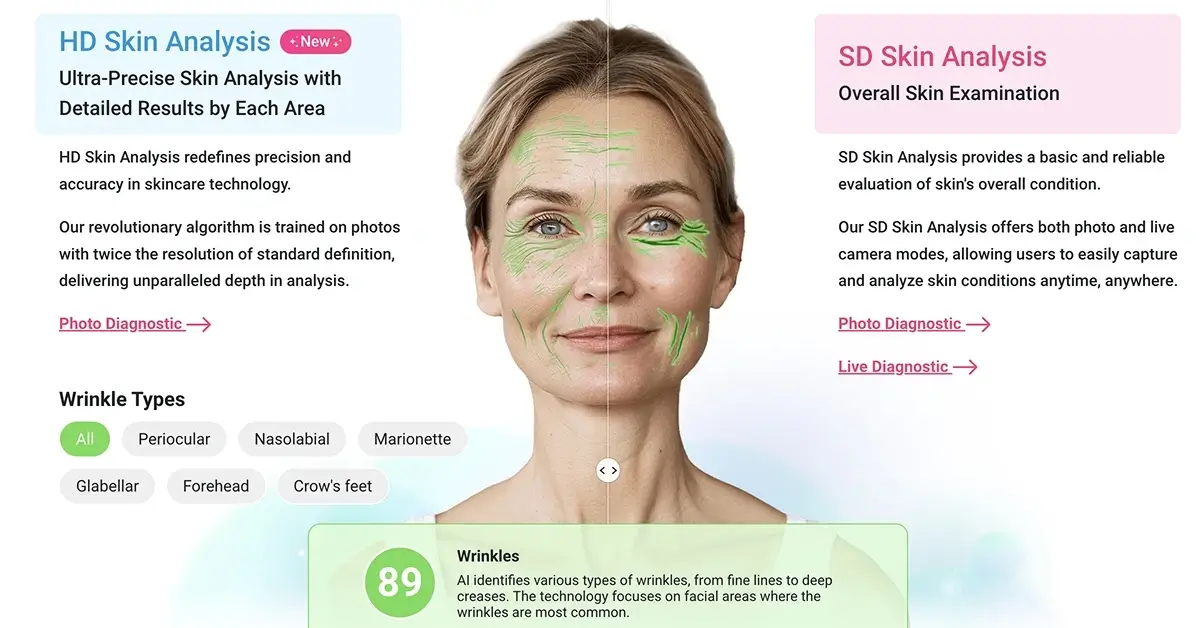

Longevity science has matured: we now have measurable biomarkers of biological age, a unified framework describing ageing as an interconnected network of hallmarks, the ability to visualise microbiome–skin interactions, and emerging tools to influence cellular and intercellular communication through exosomes and other vesicles.

Together, these advances enable wellness and beauty companies to speak and act with far greater scientific credibility.

c) Market opportunity

The crossover between aesthetics, wellness and longevity is massive. The 2025 edition of the INNOCOS Beauty & Longevity Summit Geneva is explicitly positioned “where science-beauty-wellness converge.”

Organisations that leverage longevity science can tap into the boom in what is being called the “longevity economy” – merging healthcare, lifestyle and aesthetics.

d) Business innovation and experiential economy

Wellness and beauty are shifting from products to experiences – diagnostics, personalised solutions, platforms, continuum of care.

Longevity science fits perfectly into that evolution: it provides the framework for diagnostics, personalisation, longitudinal journeys, subscription models, integrated wellness ecosystems.

In short: longevity science is not simply a new buzzword, it is a strategic inflection point for the industry.

3. Rewriting the Playbook: Four Business Innovation Tracks

Let’s explore four key ways that longevity science allows innovation in how beauty & wellness businesses operate.

Track 1 – Diagnostics and Personalised Journeys

- Traditionally, skincare or spa treatments were somewhat generic: you choose your skin-type, you get your treatment. Now, longevity science allows brands and clinics to incorporate diagnostics (e.g., epigenetic age, skin microbiome mapping, exposome assessment) and then prescribe tailored protocols. This becomes a journey rather than a one-time purchase.

- For a beauty brand or wellness clinic, this means new revenue models: diagnostics → baseline → protocol → follow-up → optimisation. The consumer becomes engaged in a sustained journey of healthspan enhancement, not just a cosmetic purchase.

- A business that embeds such diagnostics builds higher customer lifetime value, deeper loyalty, and stronger differentiation.

Track 2 – Evidence-Anchored Product & Service Innovation

- Linking formulations and treatments to underlying biology, not just marketing claims.

- When longevity science is applied, brands move from “reduces wrinkle appearance” to “supports the expression of skin repair genes, mitigates senescent cell burden, enhances mitochondrial function in dermal fibroblasts.” That kind of framing enhances credibility and willingness to pay goes up when brands can show mechanistic rationale, biomarker data, and personalised metrics.

- It also opens paths to partnerships with biotech, academic labs, and longevity medicine clinics.

Track 3 – Wellness Ecosystem & Longevity Clinics

- From spa or salon to longevity-embedded health-wellness centres.

- Beauty and wellness brands are increasingly integrating with medical wellness, longevity clinics, diagnostics centres and longevity-focused hospitality. Think spa destinations that include biometric testing, skin age metrics, healthspan coaching, regenerative treatments, personalised nutrition, microbiome optimisation.

Track 4 – Building Trust in Longevity Science

- Because longevity science is technical and still emerging, brands must educate and engage consumers, transforming complex biology into compelling narratives.

- The beauty & wellness industries are shifting from simplistic messages (e.g., “just buy this cream”) to education platforms: how skin ages, how lifestyle intersects, how exposome and epigenetics influence appearance. Brands that embed longevity science into their storytelling, consumer education, advisor training, and platform-content will fare better in credibility and differentiation.

Estée Lauder has built an in-house longevity expert team to guide its science-driven innovation.

4. Strategic Steps

Which steps should beauty brands, wellness entrepreneurs, and clinic operators prioritise if they want to integrate longevity science into their offering?

Beauty is no longer about “fighting age” but about extending the healthy, vital years. That is the mindset pivot enabled by longevity science. Successful brands will embed this into mission, product design, value proposition and consumer experience.

If you claim your treatment or product supports longevity, you must back it with data: biomarkers, longitudinal tracking, digital tools, metrics. The era of unsubstantiated claims is fading. Longevity science demands evidence.

Rather than a single serum or treatment, think in terms of journey: diagnostic – intervention – monitoring – optimisation. Think subscription models, coaching, digital engagement, diagnostics, in-clinic treatments, at-home protocols.

Brands that align with academic research, biotech, medical clinics, longevity institutes (such as GCLS) will benefit from trust, co-innovation, and early-mover advantage. Longevity science thrives in collaborative ecosystems.

MEET GCLS

The Geneva College of Longevity Science (GCLS) is a Swiss higher-education institution and global partner for organizations shaping the future of health and longevity.

As the first college dedicated entirely to longevity science, GCLS provides world-class executive education, clinical upskilling, and industry-oriented certifications.

Its flagship program, the Executive Master of Science in Longevity (EMSc Longevity), is a flexible, fully online curriculum that covers geroscience, biological age diagnostics, preventive medicine, and healthspan optimization GCLS.

Beyond the master’s program, GCLS offers specialized certifications including the Certified Longevity Physician continuing medical education (CME) course for medical professionals, as well as training for nutrition specialists, physiotherapists, and fitness coaches

Consumers today understand that their biology, lifestyle and environment are unique. Platforms that deliver personalised protocols based on individual biology set new standards. Longevity science provides the tools to personalise at scale.

As the intersection of biotechnology, wellness and beauty deepens, regulation will follow. Ethical frameworks, transparency in claims, sustainability of interventions and treatments will matter more. Longevity science must be responsibly embedded.

Finally, brands must step into the role of educator. Teach the consumer about biology, empower advisors with knowledge, create content and community around longevity lifestyle. This deepens engagement and trust.

5. Risks, Challenges and the Role of Credibility

As longevity science moves from the lab into consumer markets, brands face a set of challenges that require careful positioning, scientific integrity, and responsible communication. For direct-to-consumer (DTC) brands, credibility is everything – without it, even the strongest innovation story collapses.

Scientific Translational Gap: From Research to Consumer Reality

The promise of longevity science is powerful, but the path from discovery to a consumer-ready product is not straightforward. Much of the excitement surrounding longevity comes from basic research – cellular pathways, animal studies, and early-stage human findings. Exciting as they may be, many of these discoveries do not (yet!) translate into clinically validated interventions suitable for the consumer market.

For DTC brands, this means:

- Avoiding overclaims based on preliminary or preclinical research.

- Ensuring that any biological mechanism referenced (e.g., NAD+, senolytics, mitochondrial support) is backed by human data – or clearly framed as emerging science.

- Prioritising ingredients, tools, and diagnostics that have a proven track record in humans rather than chasing every new “longevity molecule” making headlines.

The brands that win in longevity will be those that bridge this translational gap honestly, without promising outcomes that science cannot currently deliver.

Consumer Fatigue and Scepticism: A Credibility Crossover Point

Longevity messaging enters an industry where consumers have already heard decades of exaggerated promises – from “anti-aging creams” to miracle supplements and detox protocols. As a result, modern consumers approach longevity-branded products with a high level of scepticism. For DTC brands, the challenge is to shift the narrative from hype to measurable benefit.

Consumers increasingly want:

- Clear, evidence-based explanations (not buzzwords).

- Trackable outcomes – such as improvements in skin barrier function, sleep metrics, glucose stability, or biological age markers.

- Transparent data and third-party testing.

Positioning products around healthspan, resilience, and functional wellbeing resonates far more than outdated language about reversing aging or providing “eternal youth.”

Regulation and Ethics: A Rising Bar for Longevity Claims

Longevity-labelled products live at the intersection of wellness, skincare, nutrition, and consumer health – areas with increasing regulatory scrutiny.

For DTC brands, this means navigating:

- Strict rules around structure-function claims in supplements and cosmetics.

- Requirements for substantiating advertised effects.

- Responsible handling of consumer health data if diagnostic tools or bio-tracking are included.

- Ethical communication – avoiding fear-based marketing, unrealistic expectations, or medical-sounding promises without clinical backing.

As longevity science expands, regulators will pay closer attention. Brands that build compliance and ethics into their foundations will have a long-term advantage.

Europe’s Strict Framework for Longevity

In Europe, the European Food Safety Authority (EFSA) regulates supplements and all associated health claims, while the European Medicines Agency (EMA) oversees medicinal products.

The EU’s Health Claims Regulation is far more stringent than U.S. rules: every permitted claim must be supported by a rigorously evaluated scientific dossier and appear on EFSA’s approved list.

As a result, statements such as “supports mitochondrial health” or “enhances cellular function” are typically prohibited unless explicitly authorised.

Cost and Accessibility: Making Longevity Mainstream

While many longevity innovations today are premium or clinic-based, the next breakthrough will be making longevity accessible through scalable DTC models.

This includes:

- Affordable, mass-market formulations using validated longevity-supportive ingredients.

- At-home diagnostics and digital tools that provide value without requiring clinical pricing.

- Tiered product ecosystems that allow consumers to engage at different price points.

- Transparent communication about what a product can and cannot achieve.

Accessibility will define the next generation of longevity brands. The winners will democratize longevity for everyday consumers.

6. The Big Picture

What could our world look like when longevity science is fully welcomed by the beauty & wellness industry?

- A consumer arrives at a spa not simply for a “luxury facial” but for a “skin longevity assessment” that includes exposome tracking, microbiome mapping, epigenetic skin age analysis, followed by a tailored treatment protocol, followed by digital tracking and coaching.

- A beauty brand’s value proposition shifts from looking backward in time to looking forward: “Future-proof your skin – powered by real longevity science.”

Wellness resorts evolve into “longevity retreats”: integrated diagnostics, personalised fitness, meditation, nutrition, skin and hair health, sleep optimisation, hormone evaluation, digital tracking. They partner with beauty brands, longevity clinics and data platforms.

- The KPIs shift from “tightens skin by X% after 4 weeks” to “reduces biological skin age, improves resilience of dermal matrix, extends healthspan of skin and body.”

- Brands now compete on the strength of their longevity science—validated mechanisms, measurable outcomes, personalised protocols, and connected digital ecosystems—rather than on packaging aesthetics or scent profiles.

Consumers become Longevity-Consumers: they expect brands to help them live better for longer, not just look younger now. Their lifetime value increases as they engage in longer-term journeys.

7. Implications for Industry Stakeholders

What do these changes mean for the different stakeholders in the beauty & wellness ecosystem?

Brand owners / product developers:

Businesses must invest in science partnerships, diagnostics, and personalisation. Position your brand around healthspan and longevity rather than mere appearance. Build ecosystems.

Clinics / spas / wellness resorts:

You must evolve into longevity-integrated centres. Offer diagnostics, collaboration with longevity medicine, personalised journeys. Partner with beauty brands, nutritionists, coaches, technologists. Offer measurable outcomes.

Investors / ecosystem builders:

Beauty & wellness is converging with biotech, diagnostics, digital health and longevity medicine. The products are more complex, stakes are higher, margins larger and the regulatory environment more difficult to navigate.

Educators / institutions:

Training of practitioners, therapists, spa directors must include longevity science, biomarker literacy, diagnostics, personalisation frameworks. Institutions such as GCLS are at the forefront of educating this new generation of longevity-informed wellness professionals.

Final Thoughts: Why Now, and What’s Next?

Why is this moment so pivotal for longevity science and beauty & wellness? Because we are witnessing the convergence of three trends:

- A maturing science of ageing, biomarkers, cellular repair and personalised health.

- A consumer mindset shift from “age-defeat” to “age-embrace & optimise”.

- A business model evolution from product sales to journey-centric, data-driven, personalised ecosystems.

Put together, longevity science is rewriting the beauty & wellness playbook with new rules, new metrics, new value propositions, and new consumer relationships.