The New Epicenter of Beauty

The Middle East has long been known for its love of luxury and aesthetics, but in 2025, it’s proving to be one of the most dynamic, trend-setting beauty markets in the world. From Dubai’s beauty-savvy Gen Z consumers to Saudi Arabia’s rapidly evolving retail sector, this region is actively shaping global trends.

This report was developed by Evolut based on exclusive on-the-ground insights from Beautyworld Middle East 2025, held in Dubai between October 27–29. We conducted in-depth interviews with over 30 European and U.S.-based skincare and wellness brands, discussing:

- Emerging beauty trends specific to the Middle East

- Expansion strategies

- Distributor search challenges

- Consumer behavior shifts

- Cultural nuances

- And what success really looks like in this market

The brands interviewed ranged from legacy French dermocosmetic houses like Matis Paris, to innovative clean beauty pioneers like Labrains (Latvia) and NES Skin (Portugal), and color cosmetic players like Astra Make-up (Italy). Together, they painted a picture of a market that is highly demanding, deeply knowledgeable, and increasingly influential on the global stage.

As Hannes A. Hebel from Klapp Cosmetics (Germany) put it:

“We came because the Middle East is no longer just a beauty buyer, it’s a beauty trend maker.”

In addition to brand interviews, this report is enriched with insights from panel discussions and expert talks presented during the event, including:

- The Future of Personal Care in the Middle East

- What Retail Buyers Expect in 2026

- The Woman CEO Panel

Panel discussions at Beautyworld Middle East including Iryna Kremin (right), the founder of INNOCOS

Through this multifaceted research, we uncovered a set of clear patterns, urgent opportunities, and cultural dynamics that all brands – whether indie or institutional – must understand before entering or scaling in this fast-growing region.

Let’s begin with what makes the Middle Eastern beauty market so uniquely powerful in 2025.

2. The Middle East Beauty Market in 2025

The Middle East in 2025 is far from just being a promising beauty market, it’s a strategic powerhouse for both established and emerging brands. Valued at over $36 billion USD in 2023, and projected to grow at 8-10% CAGR through 2027, the region has become a magnet for global beauty brands looking to expand into high-growth, high-spend markets. But what makes it truly unique is how consumer sophistication, cultural values, and retail innovation come together to create a market like no other.

High Spend Meets High Standards

Middle Eastern beauty consumers are among the world’s top spenders per capita on beauty and personal care products. According to Euromonitor, UAE consumers spend up to 2.5x more than the global average on beauty, while Saudi Arabia’s beauty market alone is expected to reach $7.6 billion by 2026.

But this isn’t blind luxury consumption. As Līga Brūniņa from Labrains (Latvia) noted:

“They’re beauty-savvy and ask tough questions, they want proof, not promises.”

After our chat, it was clear that Līga’s brand had one of the sharpest USPs and standout packaging of the whole event.

Shoppers are highly educated, often researching ingredients, comparing international formulations, and expecting visible results quickly. As one Spanish skincare brand said to me:

“The Middle Eastern customer knows what peptides are, they don’t just want to be sold a nice jar.”

The UAE as the Gateway - But Saudi Is the Scale

Most international brands begin their expansion journey mostly in the UAE, particularly Dubai, due to its ease of doing business, regional retail hubs, economic free zones, and large expatriate population. The city is seen as both a trend incubator and a testing ground.

However, many brands now see Saudi Arabia as the market with long-term volume potential. With Vision 2030 reforms accelerating consumer spending and a rapidly growing beauty retail scene, Saudi is becoming the priority for brands looking to scale.

As Natalia Garcia from Feetcalm (Spain) said:

“The UAE opens the door, but Saudi Arabia opens the scale.”

Other fast-growing target countries mentioned in interviews included Qatar, Kuwait, and Iraq – each with their own regulatory dynamics and consumer behaviors. This means you’ll need separate permits for each market, which can take anywhere from a few months to up to 1–2 years, depending on the case.

PRO TIP:

One message was clear across interviews with distributors and established brands:

If your brand isn’t ready, don’t launch in the Middle East. This is a region for scaling, not testing.

If your brand isn’t yet established in your home market or lacks operational readiness, think twice before expanding here. Market entry is expensive, and competition is fierce. As one distributor put it:

“This region rewards quality and commitment, not experimentation.”

The UAE has some of the highest CPMs (cost-per-thousand impressions) in the world, making paid media acquisition costly from day one. And don’t expect influencer partnerships to be a bargain either – top regional creators charge global rates, often with local exclusivity clauses. Add to that complex regulatory frameworks and logistics costs, and it’s clear: you need a well-capitalized, strategic approach, ideally with a trusted distributor or experienced local partner.

This was the advice I heard repeatedly from industry insiders during my trip and it’s one worth taking seriously. – Zsolt

3. Emerging Beauty Trends in the Middle East for 2026

The Glow Obsession

The top priority for Middle Eastern consumers: radiant skin that glows from real skin health, not just highlighter. Local consumers are fixated on that luminous, hydrated finish that suggests inner vitality. Unlike the Western shift back toward matte skin, here, a radiant finish is the ultimate goal, and brands are innovating to meet that demand.

“Glow boosters, light-reflective tints, even luminous body creams – everything has to deliver that instant fresh effect,” said Tanille from Beauty in the City (USA).

This explains the rise of hybrid products that enhance skin tone while treating it, such as brightening serums with shimmer particles, primers with skincare benefits, and body illuminators with nourishing oils.

“For Middle Eastern consumers, skincare is a ritual, they appreciate products that create a sensory moment, not just results.” — Laurent Maudet, Terraké (France)

Performance Is the New Luxury

Across the board, consumers in the Middle East are seeking fast-acting, clinically credible skincare and they don’t settle for vague promises. Brands reported that their customers expect to see and feel improvements quickly, especially in texture, firmness, and clarity.

“They don’t just want a beautiful jar, they want visible transformation,” said Līga Brūniņa from Labrains (Latvia).

Products like peptide-rich ampoules, firming serums, and intensive hydration masks are winning in this results-focused climate. Brands that position themselves as dermocosmetic or medspa-grade, particularly those with German, French, or Spanish roots, are resonating strongly with Middle Eastern consumers.

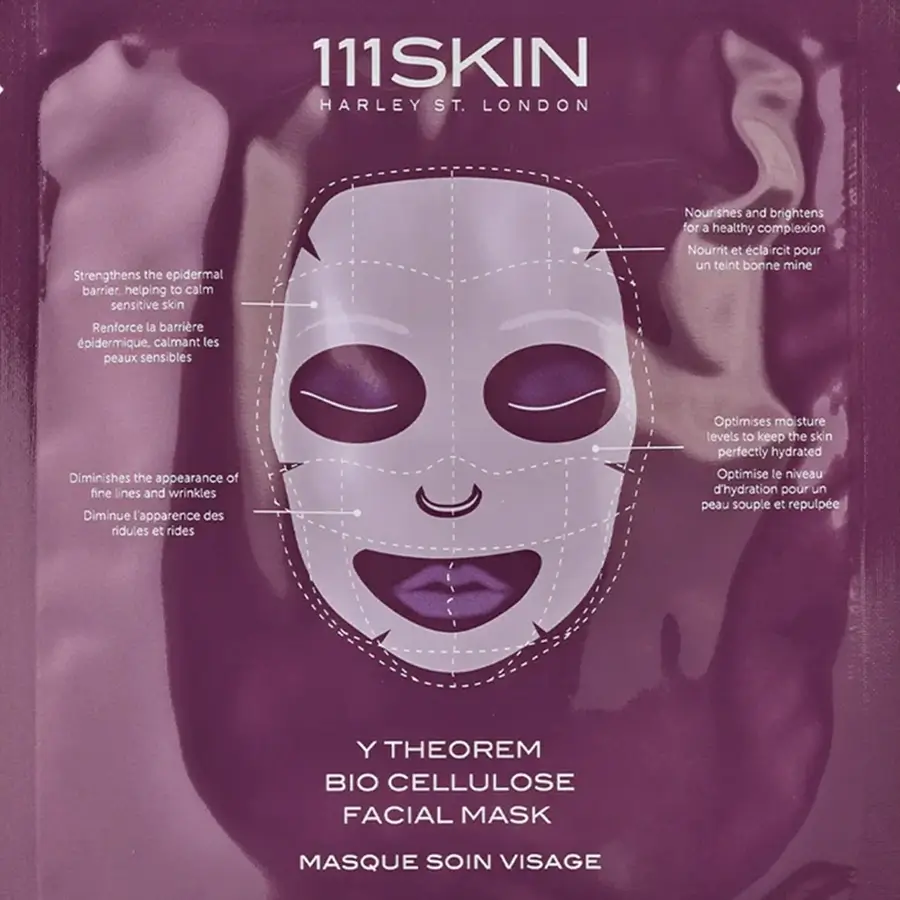

The well-known 111SKIN beauty mask brand, based in the UK, has been present in Middle Eastern markets for years with great success.

One standout innovation highlighted at the show was the use of spongilla spicules, microscopic siliceous needles derived from freshwater sponges, often used in advanced skin rejuvenation protocols.

These spicules mimic micro-needling by creating microchannels in the skin to stimulate collagen renewal and boost ingredient absorption.

“We’re using spongilla spicules… from freshwater sponge to stimulate skin regeneration without invasive procedures. Middle Eastern clients are fascinated by the idea of results without downtime.” — Esther Mendez, Anesi Lab

From Anti-Aging to Age Strategy

Rather than chasing wrinkle-free skin, many consumers – especially Millennials – are now focused on maintaining skin vitality over time. There’s a major move toward skin longevity, where protection, nourishment, and strength are prioritized over correction.

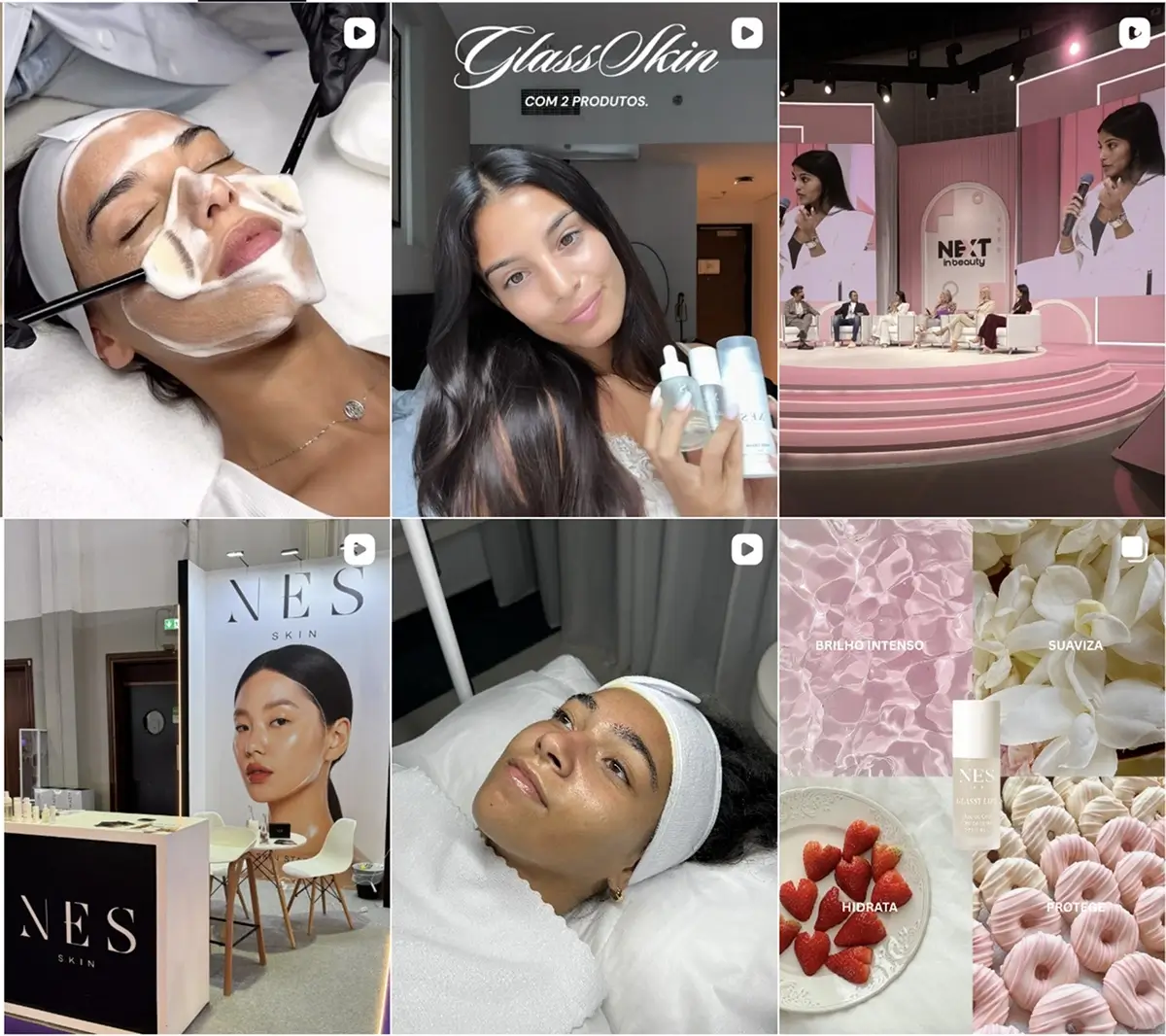

As NES Skin (Portugal) explained:

“Customers in their 20s and 30s are already investing in skin health. They’re not waiting for signs of aging to show.”

NES Skin Instagram posts

Trending categories include microbiome-balancing skincare, multi-layer antioxidant systems, and SPF formulas with added skin benefits. The new luxury is preventative care that works under the radar but delivers for the long run.

Clean Beauty Gets an Upgrade

Sustainability and ingredient transparency have become default expectations in many global markets and the Middle East is no exception. But here, “clean” needs to feel elevated. Minimalist packaging won’t resonate unless the experience feels indulgent.

“Consumers want clean formulas, yes, but they still expect the feel of luxury,” shared the distributor of Matis Paris (France).

The most successful clean brands are pairing plant-powered ingredients with clinical efficacy, while also adapting to local preferences for halal-certified, vegan, and ethically sourced products. Premium textures and sophisticated scents remain essential for conversion.

“We’re not just another clean brand, we bring lab-level precision to natural ingredients, and that’s exactly what Middle Eastern consumers respond to.” — Azer Bozoglu, Azerum

Azerum booth at the expo

The Merge of Makeup and Skincare

Beauty buyers in the region are showing a clear preference for products that do more than one job. Skincare-infused cosmetics, like hydrating foundations, lip balms with peptides, or SPF complexion tints are now in high demand.

“We see strong demand for color products that do more – hydrating foundations, anti-aging concealers, balms that soothe and enhance.” — Salem Ghezaili Le Rouge Français (France)

Hybrid beauty is especially appealing to younger generations, who want lighter, glow-enhancing coverage that fits into their skin-first routines.

Body Care Steps Into the Spotlight

One unexpected shift? Body care is experiencing a full-fledged premiumization. While once a secondary category, consumers are now treating body skin with the same seriousness as facial skin, especially in categories like foot care, firming body creams, and brightening scrubs.

“We saw more interest in our firming and shaping body range… It’s clear that body skincare has become part of the luxury routine here.” — Anna Cisek, Dives Med (Germany)

Driven by climate (and more skin exposure in social spaces like spas and gyms), this shift is helping niche categories like foot masks and targeted body exfoliators gain luxury status.

Korean Beauty’s Ongoing Influence

Even as European brands dominate the luxury perception, K-beauty continues to shape expectations, especially in skincare textures and delivery systems. Sheet masks, serum ampoules, and cooling gel cleansers remain popular thanks to their climate-appropriate and sensorial qualities.

At the same time, ingredients like niacinamide, CICA, and ginseng are now widely recognized by consumers, especially among Gen Z users who follow global beauty creators online.

“Middle Eastern customers love textures — light, silky textures. That’s why the Korean trend was working so well here, because of the way the products feel, how easy they absorb.” — Jose Cuesta , Anubis (Spain)

This has led several European brands to rethink packaging, texture, and format to align with this rising cross-cultural demand.

Arab Identity in the Global Beauty Narrative

As Western, Korean, and Japanese beauty continue to dominate global trends, a new voice is rising – A-beauty, or Arab beauty.

During one of the panel discussions at Beautyworld Middle East, industry leaders emphasized the emergence of a distinct Middle Eastern beauty identity rooted in cultural heritage, traditional ingredients, and modern self-expression.

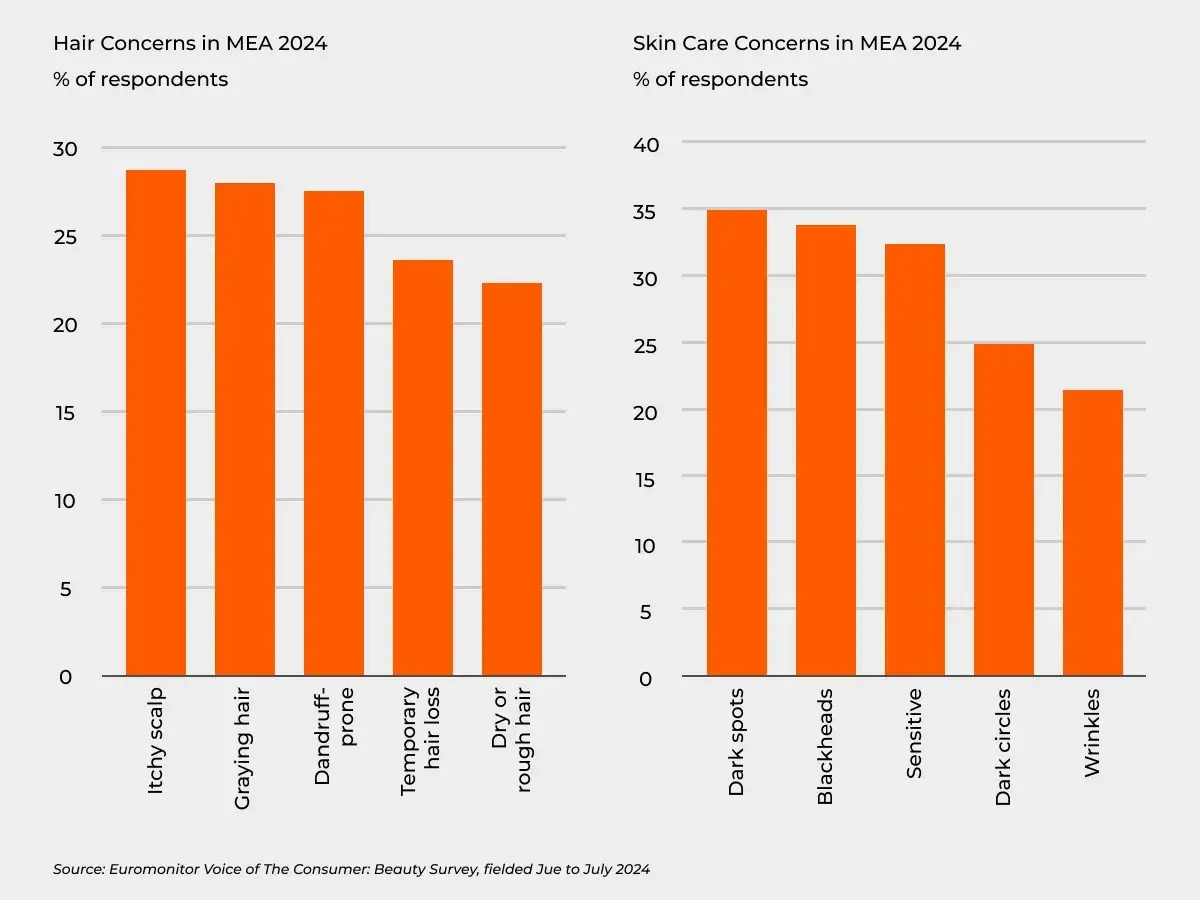

From the revival of oud-inspired fragrances to increased interest in local ingredients like date extract, black seed, luban, camel milk, and desert herbs, Arab consumers are increasingly seeking products that reflect their own skin tones, climate, and cultural rituals, not just imported ideals.

4. The Middle East Expansion Playbook

How Global Beauty Brands Are Breaking Into the Region

If the Middle East is one of the fastest-growing beauty markets in the world, it’s also one of the most complex. While its consumer appetite for beauty is unmatched, scaling here requires more than just a good product , it demands smart partnerships, market-specific adaptation, and a deep understanding of local infrastructure and regulation.

At Beautyworld Middle East 2025, we spoke with 30+ brands about how they entered the market, what worked, what didn’t, and what they’d advise others to do differently.

The result is a clear roadmap that emerging brands can learn from.

The Most Common Entry Path: Local Distributor First

Nearly every brand that had successfully expanded into the region started with a distribution partner, rather than going direct-to-consumer or launching their own retail presence.

“Without a local distributor, you’re invisible and the process is slow. You need someone who knows the market, speaks the language, and already has retailer connections.” — Irina Laaser, Dalton Cosmetics (Germany)

Most distributors in the region expect exclusivity, and they often specialize by category (e.g., professional spa, retail skincare, cosmeceuticals). But brand after brand stressed the importance of vetting the right partner, someone who believes in your product, not just someone who promises shelf space.

“We spoke to seven distributors before signing with one. The wrong partner can block you from growing – choose wisely.”

— Urszula Dolzynska, Miraculum (Poland)

EXPERT OPINION

“First, you have to define your go-to market strategy: customers you want to work with, your distribution channel, either it’s through a chain of retailers, online, through clinics and salons or some private concept stores and find right partners for each type of a model.

Second, you have to do a thorough market research and check the real numbers of your target audience according to the local data, since your investments could be huge so you need to score the expected ROI.

Third, local market is different from a European one and you have to prepare an adaptive strategy, once we had a client who even changed the name of their brand since it sounded more familiar to those ones who speak Arabic.”

Julia Agnès Diakova, Founder & CEO

Julia International Business Solutions

What Distributors Are Looking For

Distributors aren’t just looking for any brand, they’re looking for brands with a story, clinical proof, and scalability. Multiple partners reported that what excites them most are:

- Brands with unique positioning (e.g., vegan dermocosmetics, halal-certified actives, waterless formulas)

- A clear founder story

- Professional marketing assets & proof of traction in other markets

- Flexible logistics models (e.g., ready for UAE or KSA warehouses)

“We get hundreds of emails a month from brands. What makes us answer? Authenticity, vision, and readiness.” — Dubai-based beauty distributor (panel session)

Distributors in the Middle East are scanning for purpose-driven brands that will resonate with the region’s highly engaged, emotionally attuned consumer base. It’s not enough to look good on the shelf, the story behind the brand has to feel real, human, and culturally respectful.

“People here are emotionally connected to their beauty rituals. If your story feels flat or manufactured, they won’t buy in.” — Arnaud Mansard, Laboratoires Mansard (France)

Retail Isn’t Dying — But You Need E-Com Too

Brick-and-mortar remains powerful, especially in premium spaces like Sephora Middle East, Faces, and niche concept stores. Many brands used these retailers for credibility and initial discovery, but reported that long-term growth came from DTC and e-retailers like Amazon.ae, Namshi, and local e-com boutiques.

Product displays at Sephora in Dubai Mall

However, DTC isn’t cheap. Paid social campaigns in the UAE often have some of the world’s highest CPMs, and local influencer marketing can be expensive and competitive.

“You won’t win here with a $10/day Instagram campaign – the market is premium and expects premium content.” — Glorimar Primera-Riedweg, Onérique (France)

Localization Isn’t Optional — It’s a Trust Signal

One of the biggest mistakes brands make is copy-pasting their Western identity into the Middle East. Brands that won the trust of consumers and retailers alike were those that:

- Localized claims, language, and education

- Offered Arabic-language materials (sometimes labels) and adjusted visuals for cultural alignment

Modified formulations to meet halal or climate needs (e.g., SPF levels, non-alcoholic, lighter textures)

“We spent over a year preparing — registrations, partnerships, logistics — before our first order even shipped.” — Antoinette Tampé, Monjour (France)

Regulatory, Operational, and Logistical Realities

Getting a product approved for sale in the UAE or Saudi Arabia requires MOH (Ministry of Health) registration, which can take 3 to 6 months depending on the complexity of the formula and category.

Products must also meet strict labeling, claims, and documentation standards, which can be a barrier for indie brands not used to this level of regulation. Warehousing, import taxes, and last-mile delivery costs also add significant pressure on margins.

“It’s not hard, it’s just slow and expensive. Budget for it.” — Natalia Kobzar, Pharmély Cosmetics (Poland)

You Must Be Present to Be Relevant

While many markets can be built online, in the Middle East, face-to-face presence still carries enormous weight, especially when it comes to building relationships with distributors, retailers, and consumers.

“It was only after we visited multiple times, met our partners, and showed we were serious that things moved forward.” — Metta Murdaya, Juara Skincare (USA)

“You can’t do Middle East from a distance. Be here, speak the language of the market, and show that you care.” — Anna Cisek, Dives Med (Germany)

Trade shows like Beautyworld Middle East aren’t just sales events, they’re relationship accelerators. Brands that show up, engage, and follow up with consistency are the ones that get remembered.

The Middle East Isn’t Following Beauty Trends — It’s Setting Them

The biggest lesson from Beautyworld Middle East 2025? This region isn’t catching up to global beauty, it’s actively shaping what the future looks like.

From Dubai to Riyadh, beauty consumers are informed, experimental, and emotionally invested. They want results, but they also want meaning. They’re loyal, but only to brands that earn their trust through quality, transparency, and cultural respect. They don’t just buy products, they invest in stories, science, and self-expression.

For international brands, success here doesn’t come from volume alone. It comes from strategic presence, smart partnerships, and a genuine willingness to localize without losing your core.

At Evolut, we believe the Middle East will only continue to grow in global influence, not just as a consumer market, but as a creative, commercial, and cultural force in the beauty industry.