What This Article Will Give You

In the next sections, we’ll break down the biggest beauty trends from the Business of Fashion Beauty Report 2025 and add Evolut’s lens: (1) What they really mean, (2) Why they matter, (3) And how brands like yours can turn them into results.

A Turning Point for the Beauty Industry

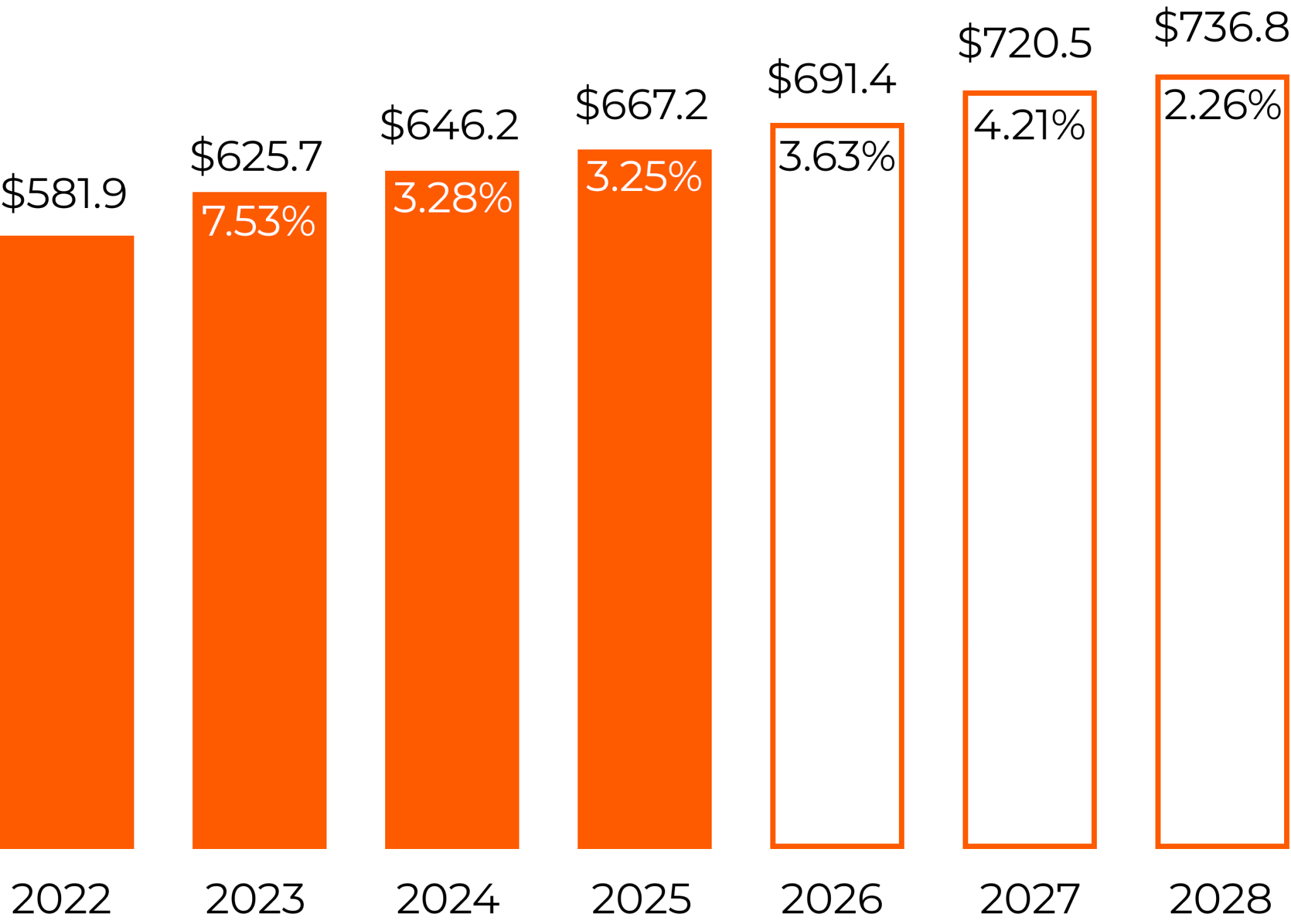

For years, the beauty industry could not do anything wrong. New products, bold packaging, viral trends, and almost everything sold. From 2022 to 2024, beauty grew fast, riding on hype, social media, and a never-ending wave of consumer curiosity.

The growth of the beauty industry since 2022, according to statistics from Oberlo.

But now, in 2025, beauty trends are changing. Growth is slowing. Audiences are pickier. There are more choices than ever, thanks to a wave of new indie brands. And the same playbook that worked just a year ago? It’s no longer enough.

Consumers Are More Selective Than Ever

Consumers haven’t stopped spending, but they have started thinking harder before they buy. They’re asking:

- Is this product really worth it?

- Does it actually work?

- Does this brand stand for something I care about?

That’s why 75% of beauty executives now say “value perception” is the number one thing shaping the market. 54% see uncertain consumer spending as the biggest risk to growth going forward. (Source: BoF x McKinsey Beauty Report 2025)

In short: it’s not about how much you shout, it’s about what you stand for.

The Beauty Category Is Getting Bigger and Broader

What people consider “beauty” has expanded. It’s no longer just makeup or skincare. Beauty supplements market is forecasted to grow at a CAGR of 10–12% globally through 2027.

In the U.S., 33% of beauty consumers now purchase ingestible beauty products regularly.

Now it includes:

- Wellness and supplements

- Personal care rituals

- Aesthetic treatments

- Emotional well-being

- Longevity & biohacking

To succeed in this new, expanded beauty space, brands must evolve from selling surface-level results to offering real value. That means:

Turning Data Into Decisions in the Age of Intelligent Beauty

February 18-20, 2026 – Hayes Mansion, Curio Collection by Hilton, Silicon Valley.

Join Evolut at the Silicon Valley summit.

Don’t miss the conversations shaping the next era of beauty & longevity.

1. The Fragmented Consumer

Old Labels Don’t Work Anymore

Once upon a time, beauty brands could group people by age, gender, or income and be done with it. But in 2025, that’s a fast track to irrelevance.

Today’s beauty buyer isn’t defined by demographics. Instead, it’s about mindset, values, and habits. One 26-year-old might shop like a minimalist wellness freak, while another is a glam maximalist skincare junkie. They might both buy beauty, but they’re buying for completely different reasons.

Same demographics, different values and style

To win, brands need to go deeper. That means building attitudinal segments – understanding how people think, what they care about, and how beauty fits into their lifestyle.

More Options, Less Loyalty

Beauty shoppers are overwhelmed. With thousands of new brands, products, and promises launching every year, attention is fractured and trust is hard to earn.

People now shop across price points, mix drugstore essentials with luxury, follow creators not brands, jump from Sephora to TikTok Shop, and experiment with a new brand the second it feels fresher, faster, or more aligned. Brand loyalty is fragile.

According to a 2024 McKinsey Beauty Consumer Report, 45% of Gen Z and Millennial beauty shoppers say they’re not loyal to any one brand and regularly switch between products based on trends, price, or creator recommendations.

Evolut’s Insight: Build Mini-Worlds, Not Mass Appeal

At Evolut, we believe the future of beauty belongs to brands that build micro-universes. Not just selling a product, but inviting people into a lifestyle that reflects their tastes, values, and goals.

Here’s how you can start:

✔ Define your core customer by attitude and aspiration, not just age or location

✔ Speak to them with visuals, copy, and community content that reflects their world

✔ Create offers and bundles that solve specific needs, not just general beauty categories

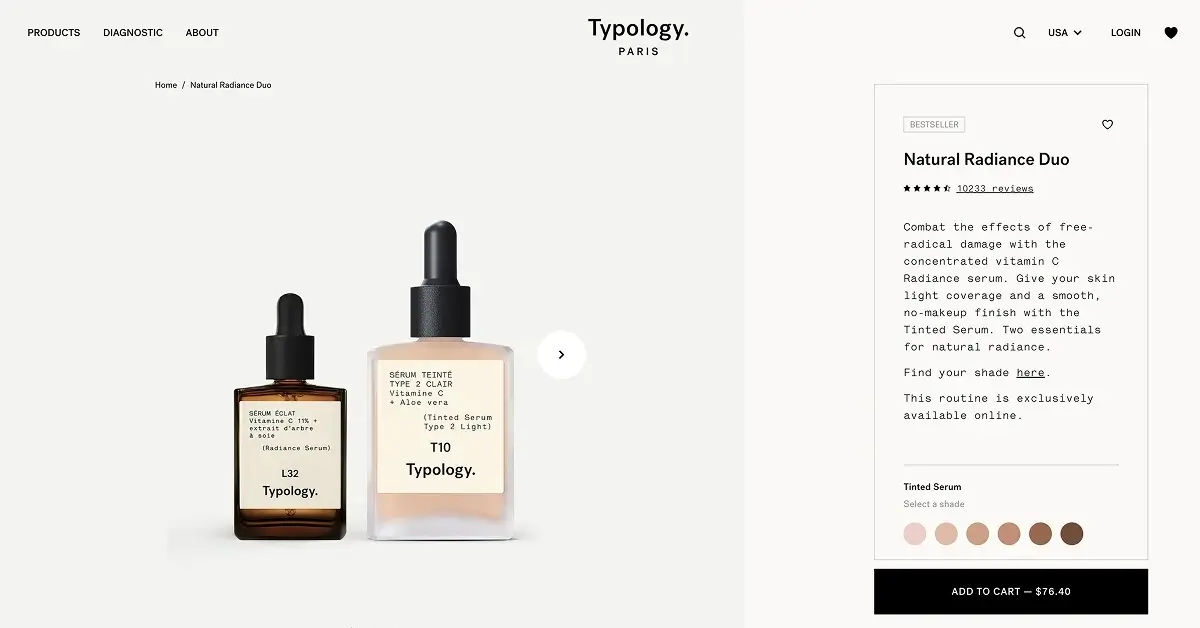

Typology “Radiance Routine” Bundle

2. Value Over Hype

Hype Is a Temporary High. Value Builds Brands.

We’ve entered the post-hype era. For years, beauty brands grew fast by launching shiny products, using viral packaging, and riding influencer waves. But in 2025, customers are waking up.

Now they ask:

- Is this just trending or is it actually good?

- Will this solve my problem?

- Why should I trust you over the 15 other brands offering the same thing?

Brands that don’t have real answers get filtered out. The ones that prove value early and consistently rise to the top.

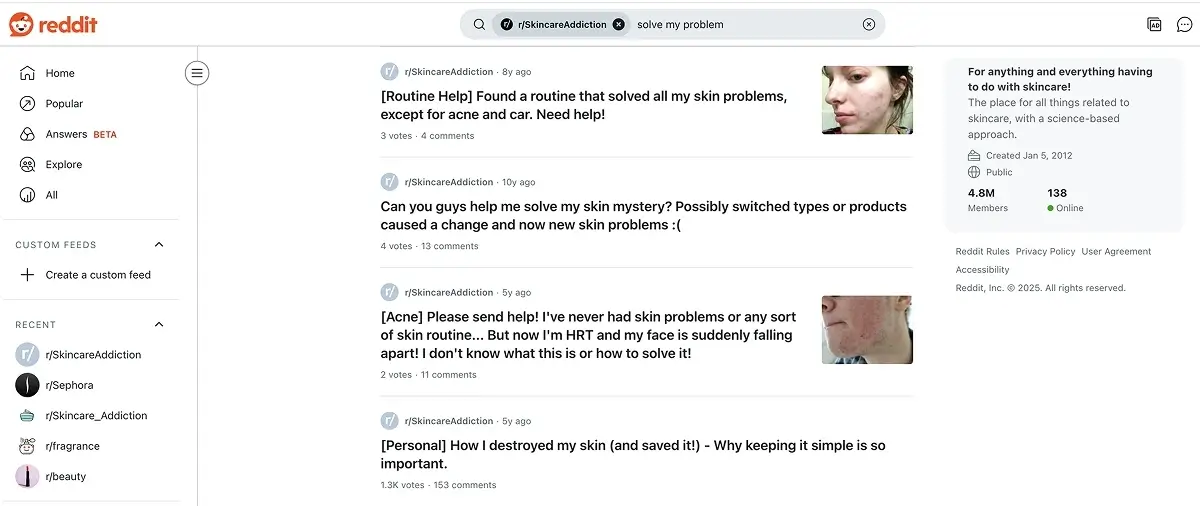

Nowadays, Reddit is leading the way for millions of skincare consumers with brutal honesty and fact-based discussions.

Product Performance Is Non-Negotiable

It’s not enough to be “clean,” “sustainable,” or “inclusive.”

PERSONAL NOTE

When I attended Cosmoprof Bologna this year, I interviewed 40 beauty brands about trends, consumer loyalty, and more. One of my key questions was about sustainability and ethical sourcing.

Almost all of the brands reported having ethical supply chains and sustainable packaging. So on their own, these USPs are no longer enough, consumers are used to them and now see them as a baseline expectation.

Consumers want performance. Results. Proof.

And they expect it across all price points, whether they’re buying a €10 lip balm or a €120 serum. Today’s beauty shopper isn’t loyal to a price tier; they’re loyal to what works.

Your formula needs to deliver. And your messaging must explain how and why with clarity and confidence.

R&D Is the New Influencer

Instead of blowing budgets on influencers with fake engagement, smart brands are reinvesting in product development. Because here’s the truth:

A product that actually works creates better word-of-mouth than any ad.

Some of the fastest-growing beauty brands in 2024–2025 are science-first or performance-backed brands. They lead with education, not hype. They let real results become their best campaign.

Treat your R&D like a marketing asset. Document it. Share it. Tell stories around it.

Timeline sets a strong example of how to showcase ingredients and research in a way that builds credibility and consumer confidence.

Let People Try You First

One of the smartest ways to prove value is to let customers experience your product before they fully commit. Think:

- Entry-level SKUs

- Travel-size kits

- Samples with smart targeting

- Subscription mini-trials

This creates what we call the “non-return effect”. Once they try the real quality, it’s hard to go back to what they used before.

Big brands like Saint Laurent and Augustinus Bader use this method to make premium products more accessible without diluting brand value.

A travel kit from AB and an entry level cream from YSL.

Don’t Just Sell - Educate

Today’s most successful beauty brands are not pushing only sales, they’re teaching their audience as well. They explain ingredients, rituals, and results. They give people reasons to care.

They use demonstration and value-driven content to communicate the brand and product USPs from multiple angles. In doing so, they also address and overcome preconceptions about the brand. How?

Consumers don’t want more noise. They want guidance. If you give it to them, you earn trust and long-term loyalty.

3. Beyond the Founder

Founders Don’t Sell Like They Used To

Not long ago, founder-led beauty brands were everything. A bold personality, a compelling backstory, and a few viral videos. That was enough to drive loyalty and sales.

Not anymore.

In 2025, being the face of your brand isn’t enough to build trust. Today’s consumers are asking harder questions:

- Does the founder’s background actually add value or is it just a marketing story?

- What are the brand’s real USPs if you remove the founder from the picture?

- Does this brand speak to me or just repeat the founder’s story?

The era of “personality-first” branding is fading. What matters now is the depth of the brand itself.

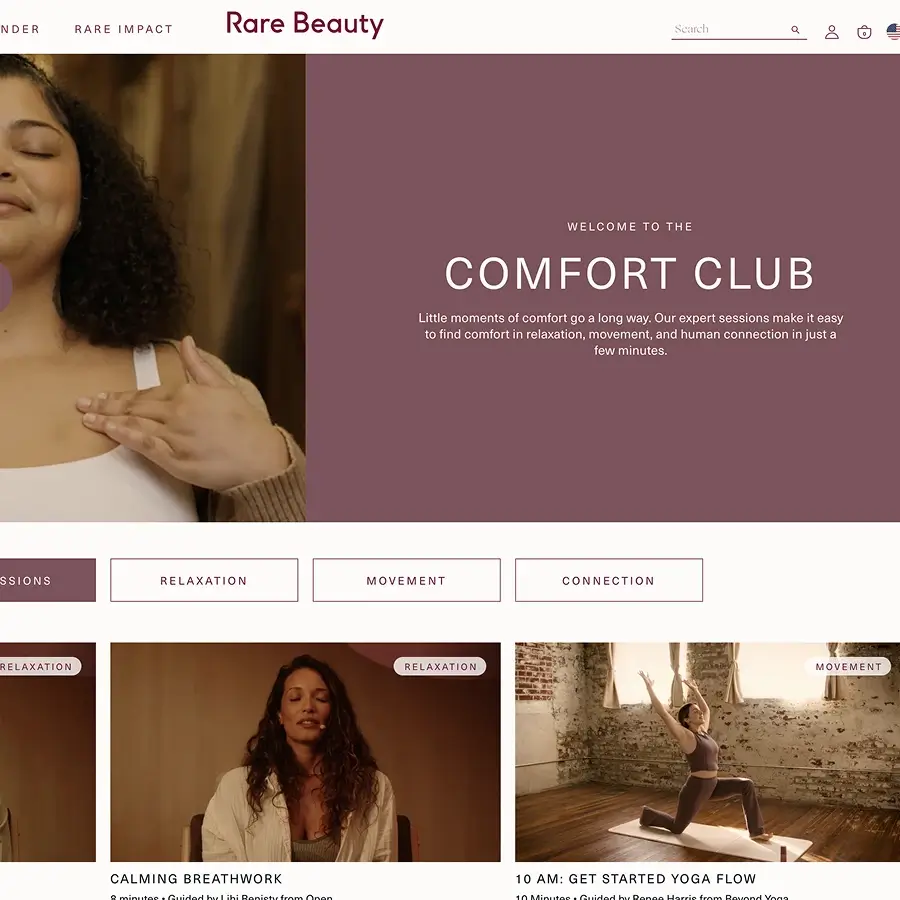

Community First, Ego Second

Consumers are shifting from “follow the founder” to “find the tribe.”

What wins now is a shared aesthetic, a belief system, and a culture people want to belong to.

Think about it:

- Glossier built a universe of beauty minimalists

- Rare Beauty created space for emotional wellness

- Fenty made everyone feel included

None of them rely on the founder’s daily presence anymore. The brand has grown beyond the individual and that’s what makes it strong.

Evolut’s Take: Build a Brand That Outlives Its Creator

At Evolut, we guide our clients to build founder-integrated brands, not founder-dependent ones. You don’t need to erase the founder, but you must elevate the brand beyond the face.

Your brand should be able to:

✔ Speak clearly without a face on camera

✔ Deliver consistent emotion through packaging, content, and UX

✔ Build loyalty around values, not vanity metrics

Here’s how to start:

- Clarify your core identity: Build your identity around rituals, values, and benefits, not just personal stories.

- Create a brand voice guide: So your tone stays consistent across platforms, teams, and campaigns, even when the founder isn’t the one speaking.

Let your community become your new co-founders: The founder reflects the audience’s journey, not just her own expertise. This builds relatability and trust, not ego-driven branding.

4. The Marketing Reset

Too Much Noise. Not Enough Meaning.

Let’s face it: beauty marketing is oversaturated. Too many ads. Too many influencers. Too many brands fighting for the same clicks.

What once worked – outspending or outposting your competitors – is now a recipe for ad fatigue and wasted budget. The ROI of empty reach is collapsing.

Attention is earned through meaning, not just media.

Influencer Fatigue Is Real

There was a time when one Instagram shoutout could sell out a product overnight. But that era is over.

In 2025, audiences are tuned in but skeptical. They’ve learned to recognize staged photos, scripted hashtags, and “authenticity” that’s clearly bought. And they’re not just ignoring those posts, they’re actively turned off by them.

A 2024 survey by CreatorIQ found that:

- 67% of Gen Z say they are “less likely to trust an influencer who promotes too many brands.”

- 59% say they prefer content that is educational or product-use based, rather than purely lifestyle-oriented.

And most striking: trust in macro influencers has dropped 30% since 2021, while micro and niche creators have gained traction as more credible sources.

Brands need to stop thinking in “influencers” and start thinking in collaborators.

Why Content Strategy Is Your New Power Move

Winning brands today don’t just make ads, they build content ecosystems.

They use:

- UGC to build social proof

- Behind-the-scenes to build transparency

- Founder insights to build authority

- Tutorial-style content to build trust and product confidence

This doesn’t just sell, it creates attachment. And in beauty, attachment leads to repeat purchases, community, and word-of-mouth.

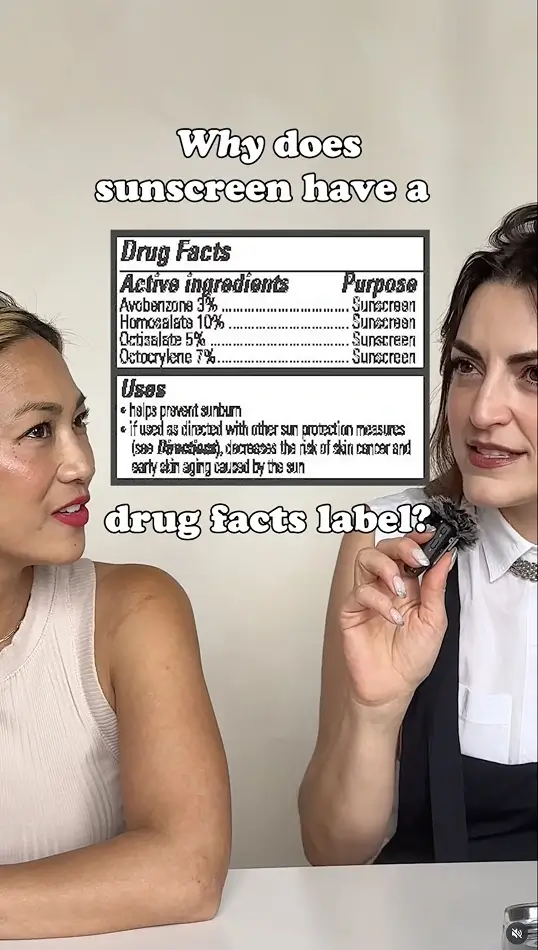

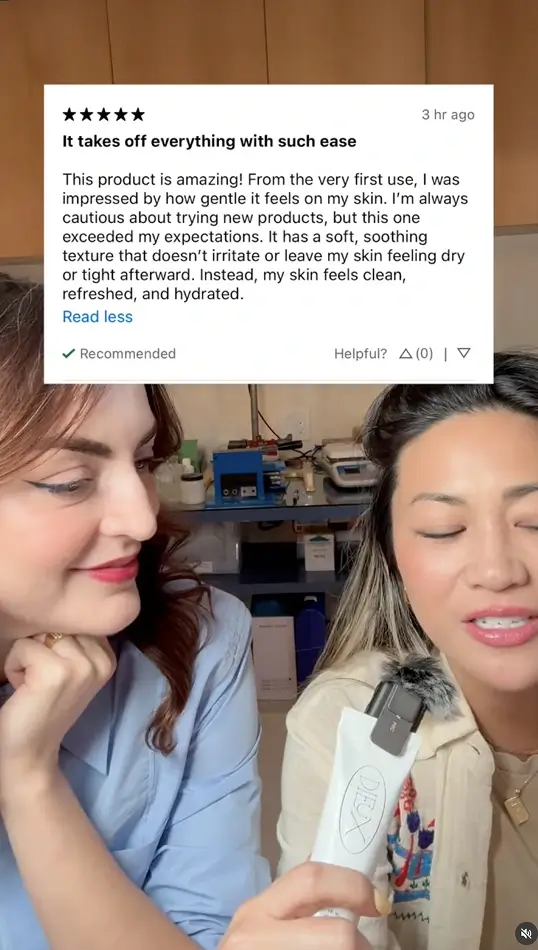

Like Dieux Skin, which earns repeat customers through ultra-honest communication and science-backed transparency. Their brand feels human, which keeps people coming back.

The founders of Dieux Skin openly share product and ingredient insights, and respond to reviews with refreshing honesty.

The Right Message, The Right Channel, The Right Time

Beauty buyers still shop in many places. But they discover, evaluate, and decide in different places than before. That’s why your message has to travel well.

Example:

- TikTok = curiosity & vibes

- Instagram = aesthetics & reviews

- Google = clarity & intent

- Email = conversion & retention

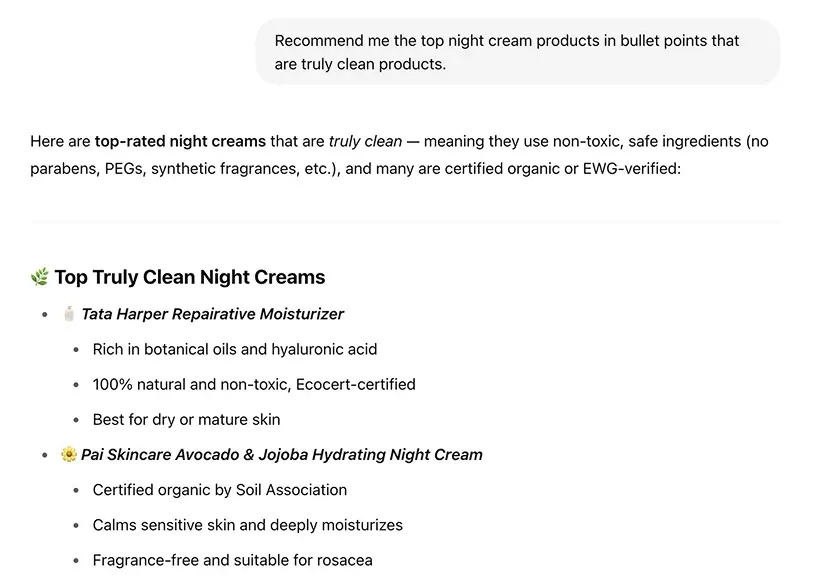

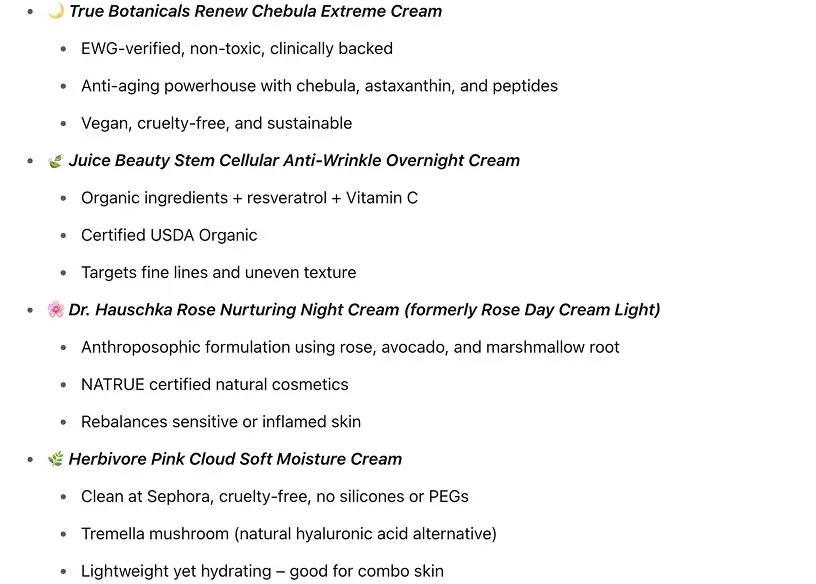

AI Search (e.g. ChatGPT, Perplexity, Gemini) = Trust & first impressions

A simple ChatGPT search for clean beauty products now replaces the need to compare websites one by one on Google.

AI is the newest battlefield. Consumers are asking AI tools to summarize product comparisons, recommend routines, and filter brand credibility before they even hit your site.

5. The Channel Shakeup

E-Commerce Isn’t Everything - But It’s Crucial

For a while, it looked like physical stores were out and online was everything after Covid. But in 2025, we’re seeing a hybrid reality.

Yes, digital matters more than ever. But here’s the twist:

Smart brands aren’t choosing one. They’re building multi-touch ecosystems and and make each one feel native to the platform and the user.

Marketplaces Are Winning on Convenience, But at a Cost

Consumers love marketplaces. They’re fast, familiar, and usually cheaper. But for brands, they can be dangerous territory.

Why?

- You lose control of the customer experience

- Discounting can kill your positioning

- Competing products sit next to yours, 24/7

The challenge: how to leverage marketplaces without becoming dependent on them.

Our advice: use them to acquire, but own the relationship elsewhere (like email or direct subscriptions).

The Rise of Agentic Commerce

AI is transforming the way consumers shop, especially online.

What’s next? Agentic commerce: AI tools that help consumers shop for themselves.

Think:

- Product finders that act like digital beauty advisors

- Smart bots that build carts based on your skincare goals

- Personalized offers triggered by behavior, not broad targeting

60% of beauty execs are exploring AI, but only 10% are using it meaningfully.

Start small, test AI in support roles (like product recommendations or personalized flows), and prioritize customer trust.

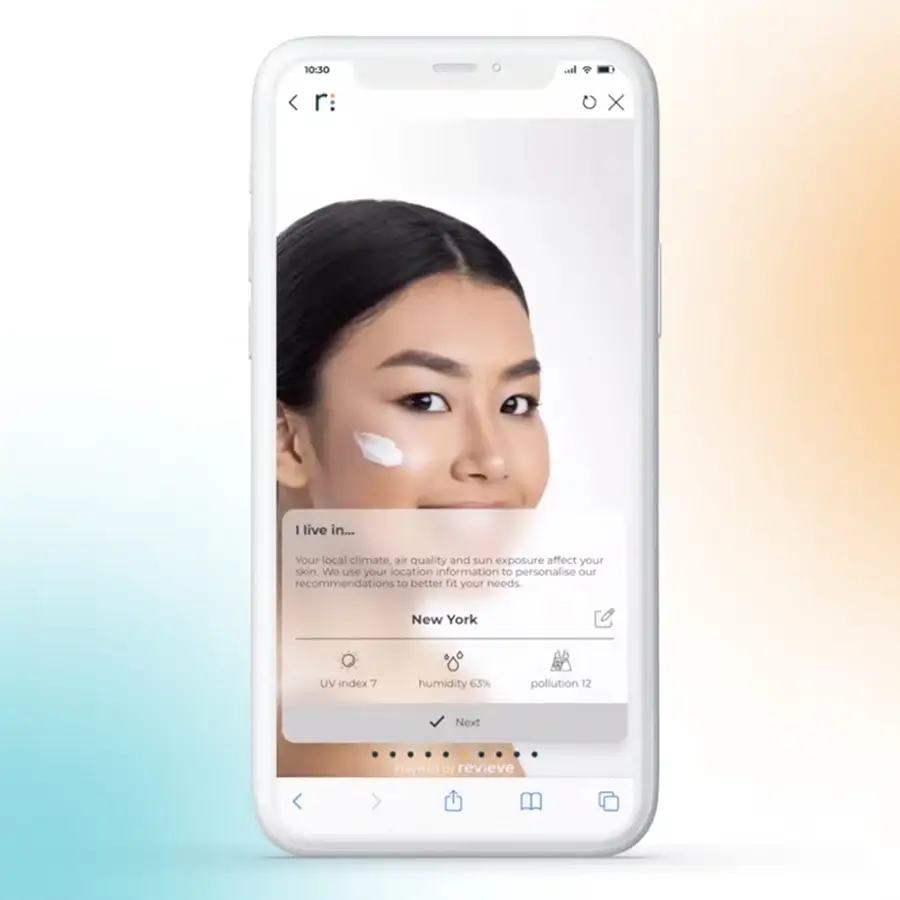

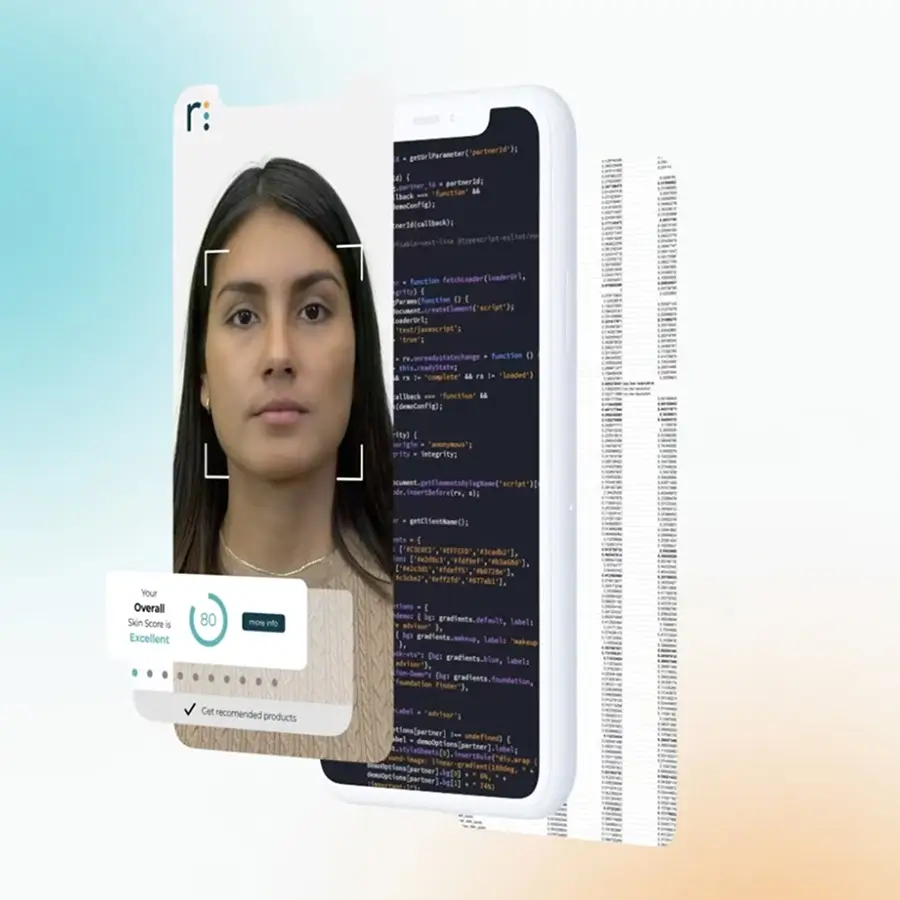

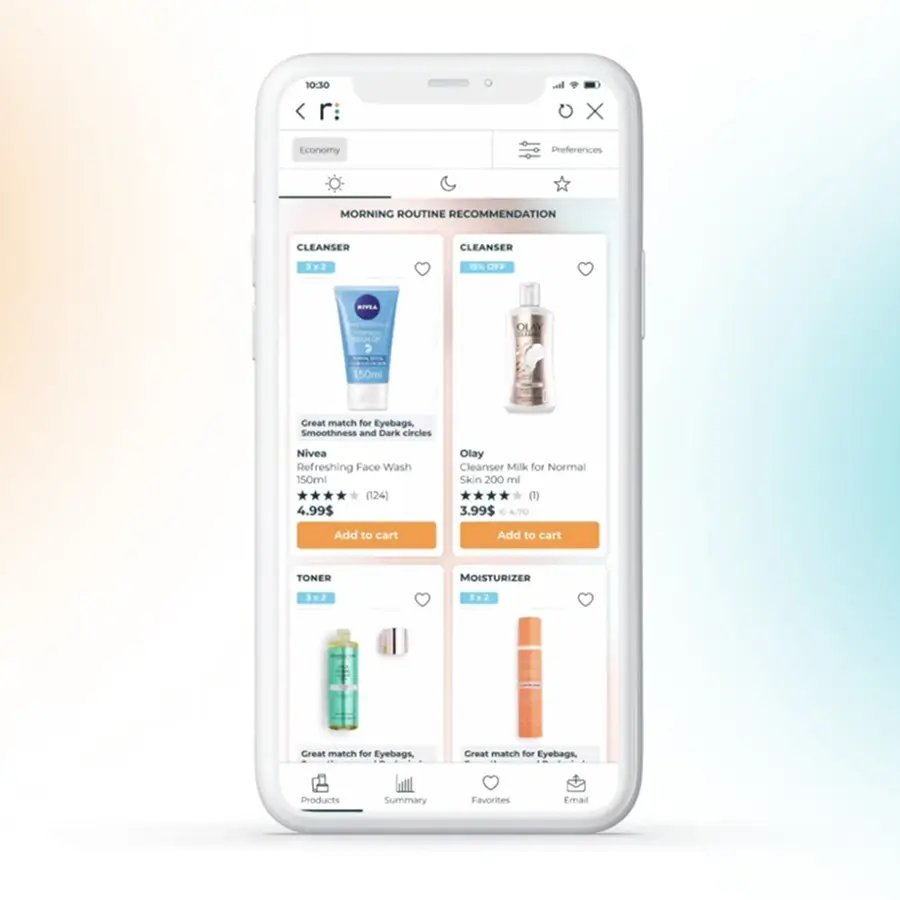

Revieve is a great digital beauty platform that transforms how consumers discover and shop for skincare. Powered by AI and computer vision, it acts like a virtual beauty advisor – analysing skin concerns, offering personalised product recommendations

6. Tech Meets Beauty

Beauty and Tech Are Finally Merging - For Real

For years, tech buzzwords floated around the beauty world – “personalization,” “smart skincare,” “AI-powered routines.” Most of it was hype. But in 2025? The shift is getting real.

Brands are starting to use tech not just for show, but to solve actual problems:

Let’s break down where the smartest brands are putting their energy and how you can use these tools without losing your brand’s human touch.

Hyper-Personalization Is the New Standard

No more one-size-fits-all. Beauty consumers expect experiences tailored to their:

- Skin type

- Tone

- Goals

- Mood

- Shopping habits

Use tools like Dynamic Yield or Klaviyo to personalize product recommendations, email flows, and homepage banners based on behavior. Even simple tweaks in copy can dramatically lift conversions.

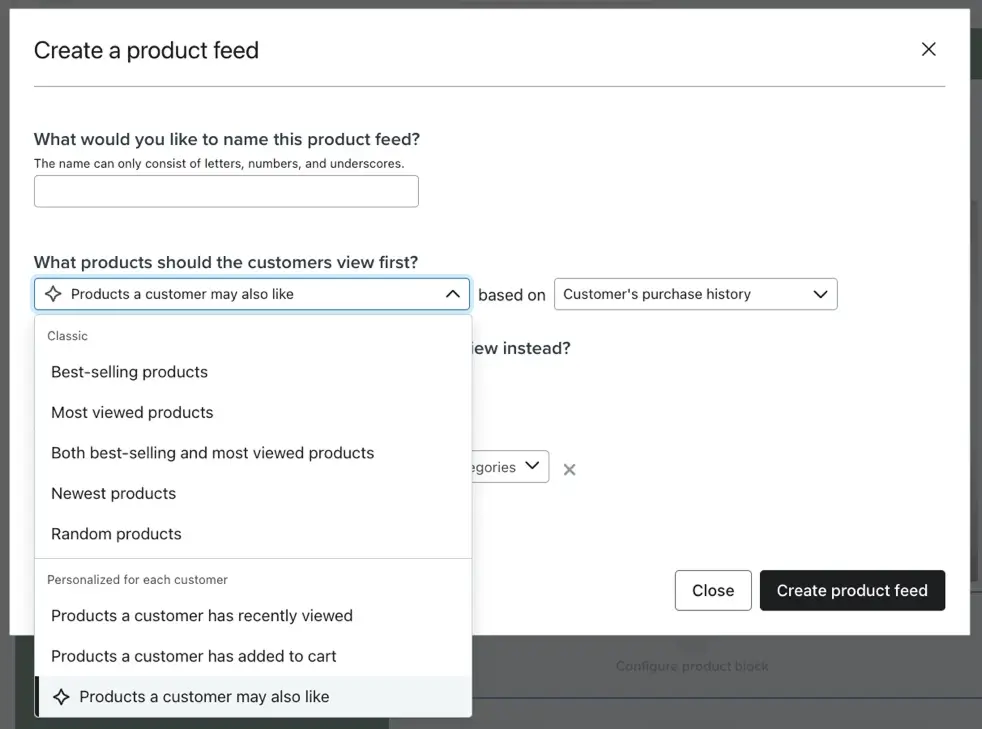

Klaviyo product feed interface showing personalised recommendation settings.

7. Global Forecast

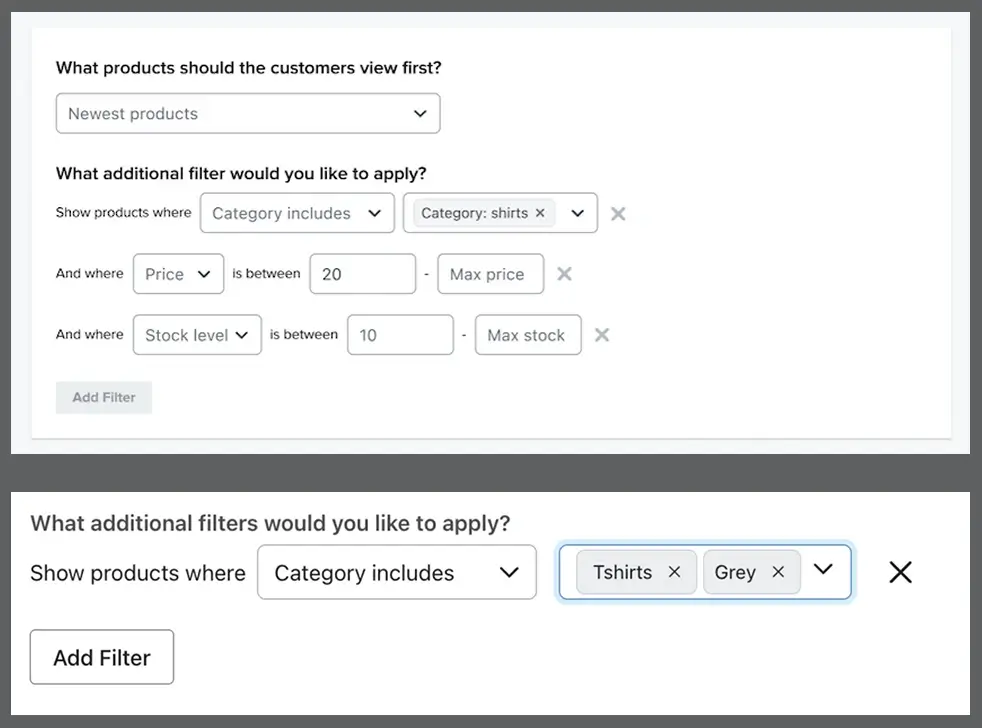

The Global Market Is Still Growing, But Not Everywhere, and Not Equally

The beauty industry may be facing pressure, but globally, it’s still on a path to growth. The catch? It’s uneven. Some regions are booming, while others are cooling off.

If you’re thinking about expansion, media buying, or even where to place partnerships, you need to know:

- Where consumer demand is rising

- What challenges each region faces

- And how to tailor your strategy to the local mood

Let’s break it down.

North America: Stable But Competitive

Growth forecast: ~6%

What’s driving it: High GDP, innovation, strong DTC scene

Watch out for: Political volatility, ad saturation

North America is still a top-tier market, especially for premium and wellness beauty. But it’s also one of the most crowded spaces. Brands need clear positioning, tight and niche messaging, and cross-channel execution to stand out.

What works:

- Value-backed storytelling

- TikTok-native product discovery

- Subscription and refill models

- Expert-led content (especially in skincare and wellness)

Europe: Slow and Steady

Growth forecast: ~3-5%

What’s driving it: Solid infrastructure, rising wellness category

Watch out for: Economic stagnation, price sensitivity

Europe is steady, not explosive. Think long-term brand building over fast wins. Sustainability and ingredient transparency matter more here than almost anywhere else.

What works:

- Region-specific campaigns

- Sustainability-first messaging

- Subtle, design-forward aesthetics

- Deep localization (language, retail, influencers)

China: Reset Mode

Growth forecast: ~3%

What’s driving it: Beauty culture, e-commerce leadership

Watch out for: Slower post-Covid recovery, geopolitical tension

China remains a massive opportunity, but brands need patience and hyper-local strategy. Western cool factor isn’t enough anymore. Success depends on how well you understand platforms like Douyin, Little Red Book, and Tmall.

What works:

- Tech-enhanced shopping

- Local KOL (influencer) partnerships

- Value-based pricing

- Science-backed skincare narratives

FYI: You need a local agency, your EU or US agency won’t be able to handle your chinese campaigns, since a local entity is required.

Latin America: Big Potential, Bigger Risks

Growth forecast: ~7-9%

What’s driving it: Emerging middle class, rising interest in self-care

Watch out for: Currency instability, infrastructure gaps

LATAM is hungry for new beauty experiences, but access is still uneven. The key is to keep things accessible while building emotional connection.

What works:

- Affordable luxury positioning

- Beauty education (especially in skin & haircare)

- Localized influencer marketing

- Lean, mobile-first e-commerce

Middle East & Africa: Luxury Meets Mass

Growth forecast: ~10-11%

What’s driving it: Rising wealth, retail sophistication, youth population

Watch out for: Cultural sensitivity is non-negotiable. Missteps around religion, modesty, or representation can result in immediate backlash.

These markets are young, digital, and image-driven and love both prestige and personal care. But brands must respect culture, religion, and regional preferences.

What works:

- Prestige positioning with heritage storytelling

- Premium retail experiences

- Arabic-language content & local voices

- Exclusive drops, limited editions, seasonal collections, and Ramadan/Eid-exclusive offerings

Success comes from local precision. Adapting shade ranges, seasonal timing (think: Ramadan campaigns), and respectful messaging that aligns with tradition but speaks to modern aspirations.

Emerging APAC & Australasia: Quiet Giants

Growth forecast: 6-7%

What’s driving it: GDP growth, digital adoption, tourism

Watch out for: Tourism dependency, talent gaps

Think Vietnam, Indonesia, the Philippines, and Australia. These markets are growing under the radar. Many are mobile-first, value-focused, and ready for beauty that feels accessible, global, and personal.

What works:

- Mobile UX optimization

- Fast, relatable video content

- Tiered pricing

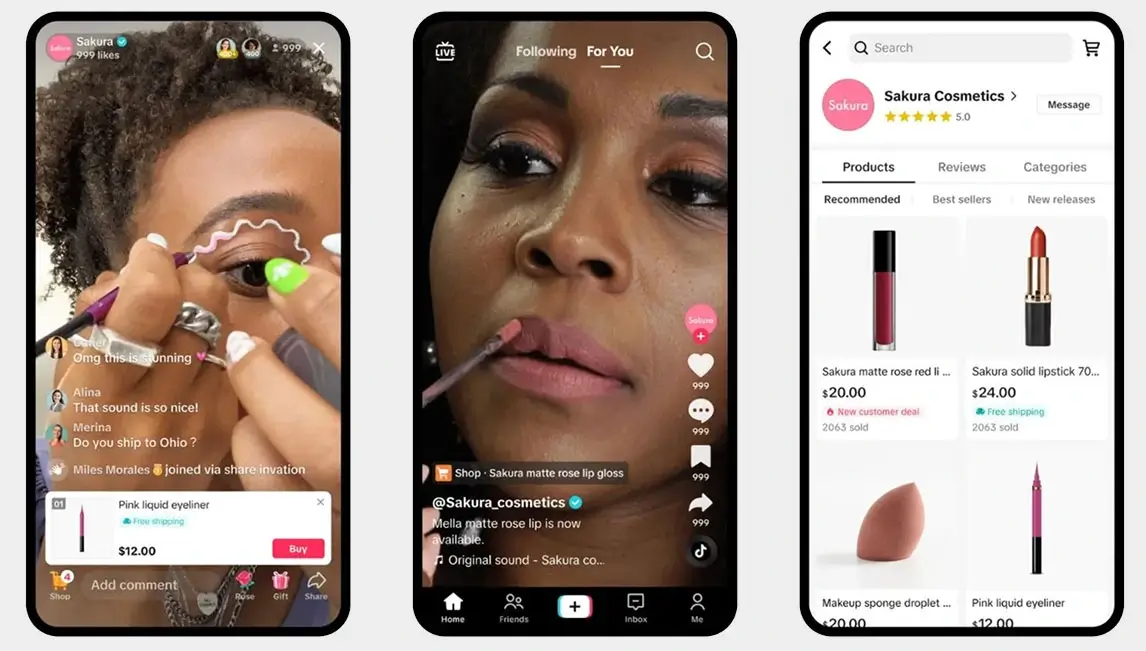

- Social commerce (especially TikTok Shop)

8. Conclusion: Winning in the New Beauty Era

The Rules Have Changed

The beauty industry is no longer about who can shout the loudest, spend the most, or launch the trendiest product.

Today, the brands that win are the ones that speak clearly, deliver real value, earn trust, build community, and stay consistent day after day, channel after channel.

Growth is still on the table. But it’s no longer about going viral overnight. It’s smarter. Slower. More intentional. And built to last.

Your Next Moves

At Evolut, we help beauty and lifestyle brands navigate exactly this kind of shift. If we were building your playbook from this report, here’s where we’d start:

- Refine your brand core

- Create a value-focused content system based on our own method

- Build an omnichannel strategy

- Tap into attitudinal targeting

- Use tech where it enhances trust, personalization, or clarity

- Prepare for localized expansion

- Think community-first, not campaign-first