The beauty industry, currently valued at over $530 billion globally, is experiencing significant shifts driven by changing consumer behaviors, technological advancements, and growing environmental and ethical consciousness. Amidst this evolving landscape, smaller, uprising brands are emerging as game-changers, leading the way in innovation and capturing the attention of the beauty market.

In this article, we’ll dive into the main trends shaping the beauty market’s future, focusing on the smaller brands that exemplify these trends, and discuss the impact on consumers, businesses, and the overall industry.

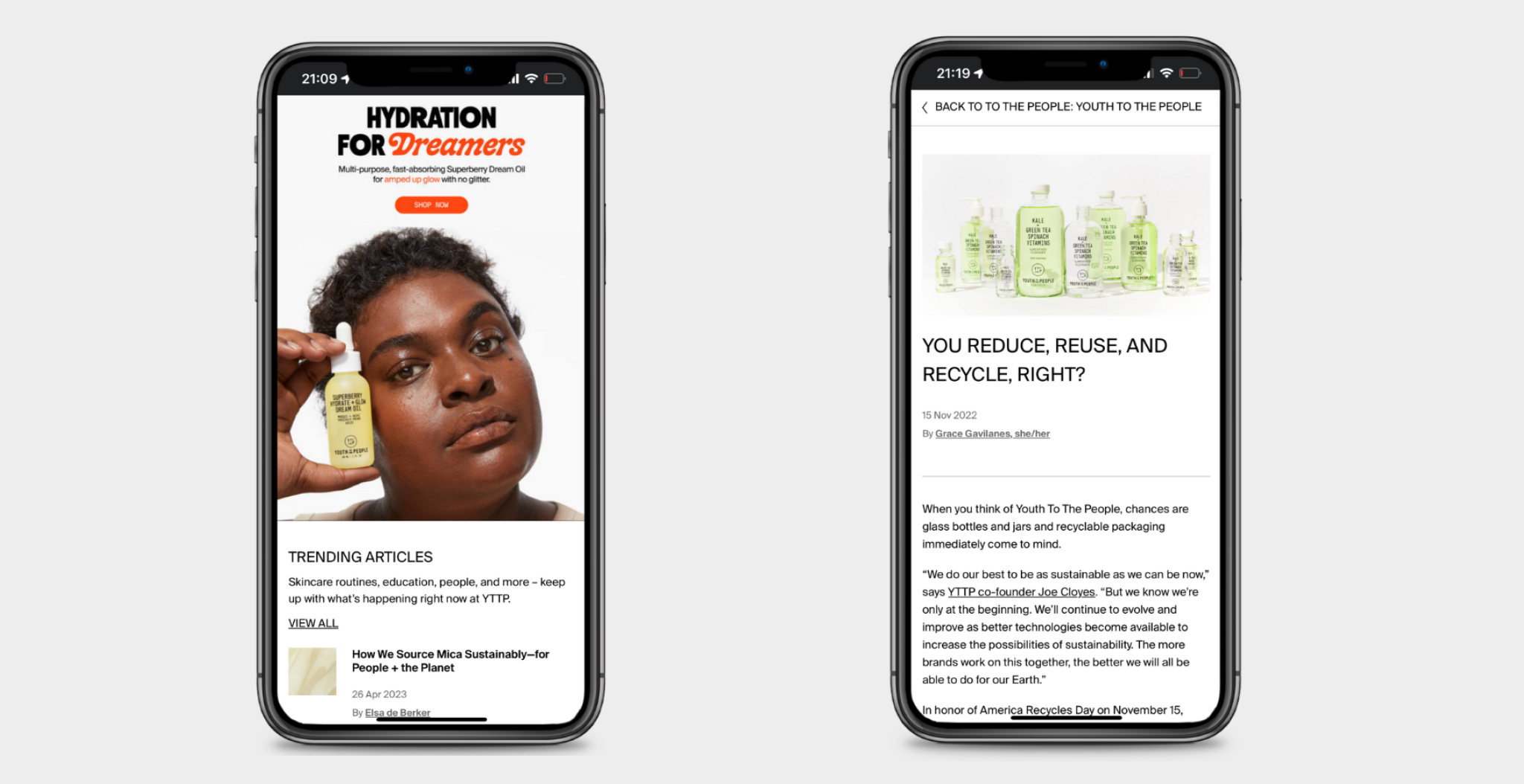

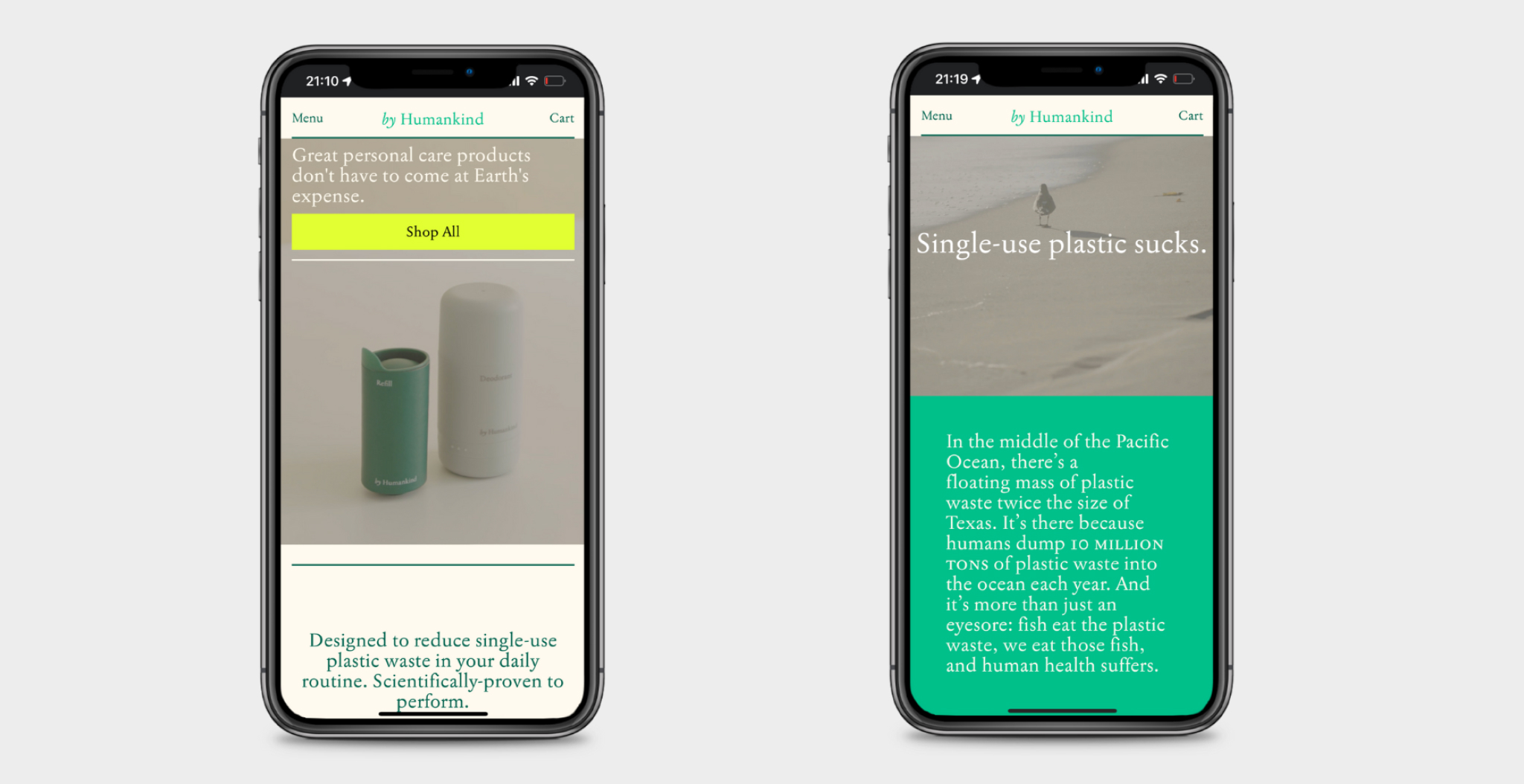

Sustainability and Ethical Beauty

Environmental concerns are pushing the beauty market towards more sustainable and ethical practices. Smaller, niche brands are pioneering this movement. For example, Youth to the People combines superfood ingredients with eco-friendly packaging made from recyclable glass. By Humankind is another brand that has gained traction, offering personal care products with minimal plastic packaging, and refillable systems to reduce waste.

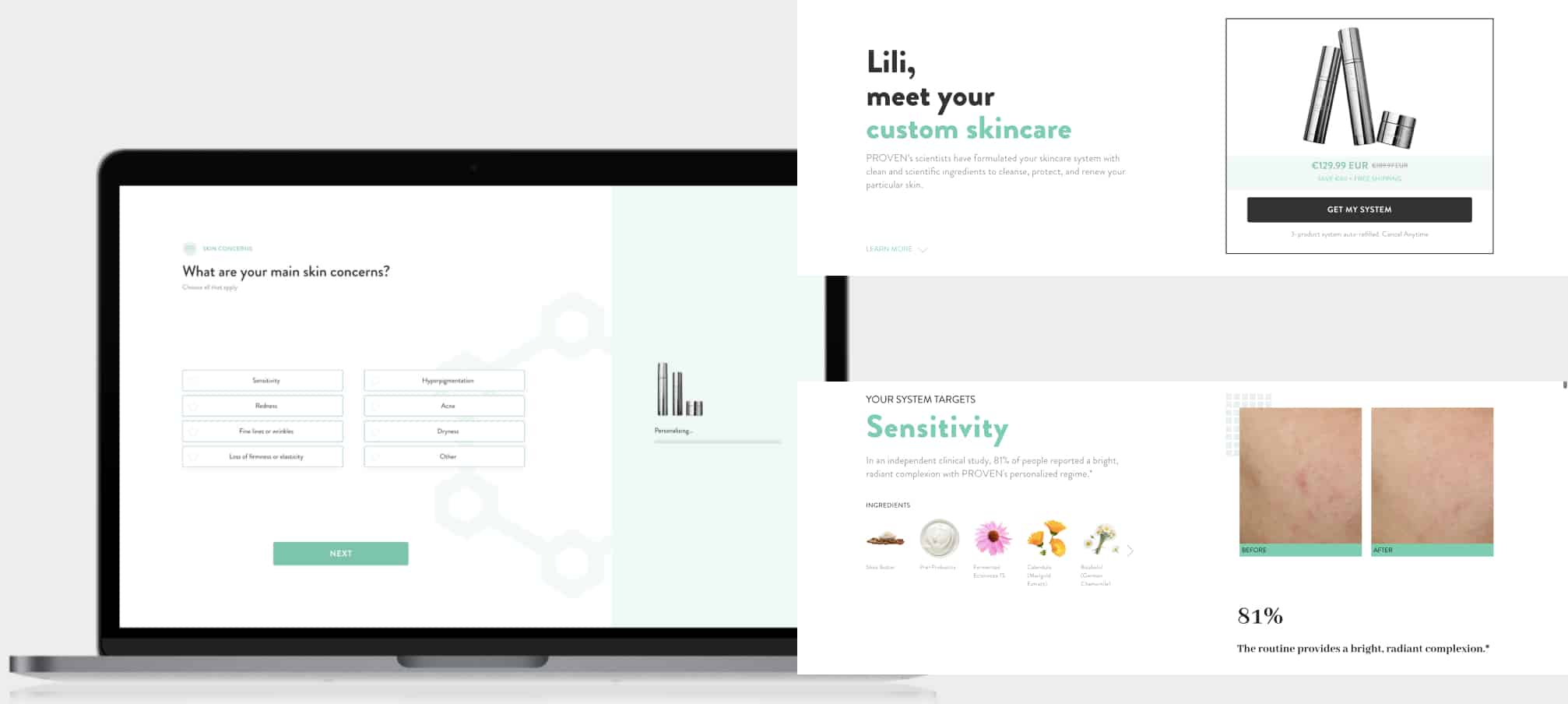

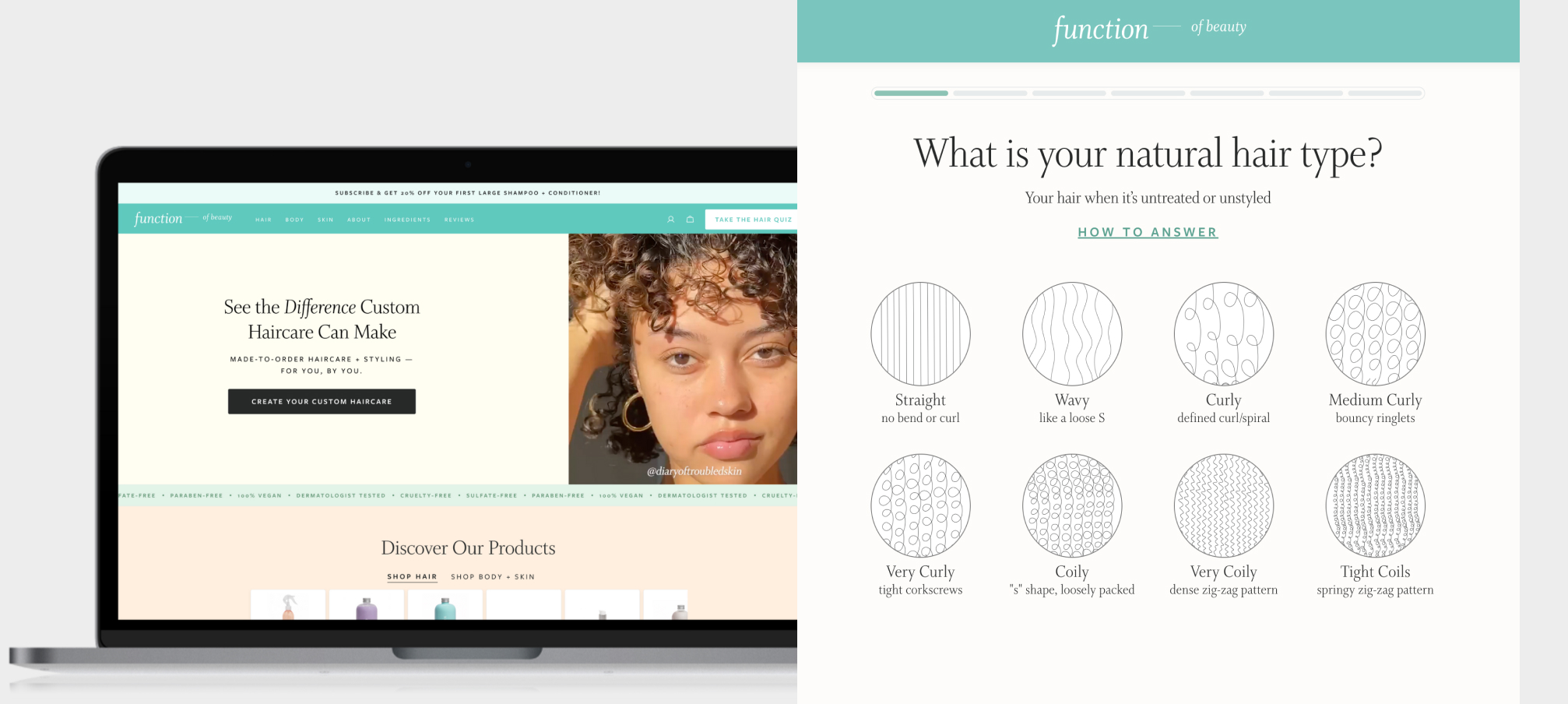

Technological Advancements in the beauty market

Technological innovations such as AI, mobile AR, and personalized skincare tech are transforming the industry, and emerging brands are capitalizing on these advancements. Companies like Proven Skincare use AI algorithms to analyze an individual’s skin type and create customized skincare products. Similarly, Function of Beauty employs technology to tailor haircare products to consumers’ specific needs, with a quiz that takes hair type, goals, and preferences into account.

Inclusivity

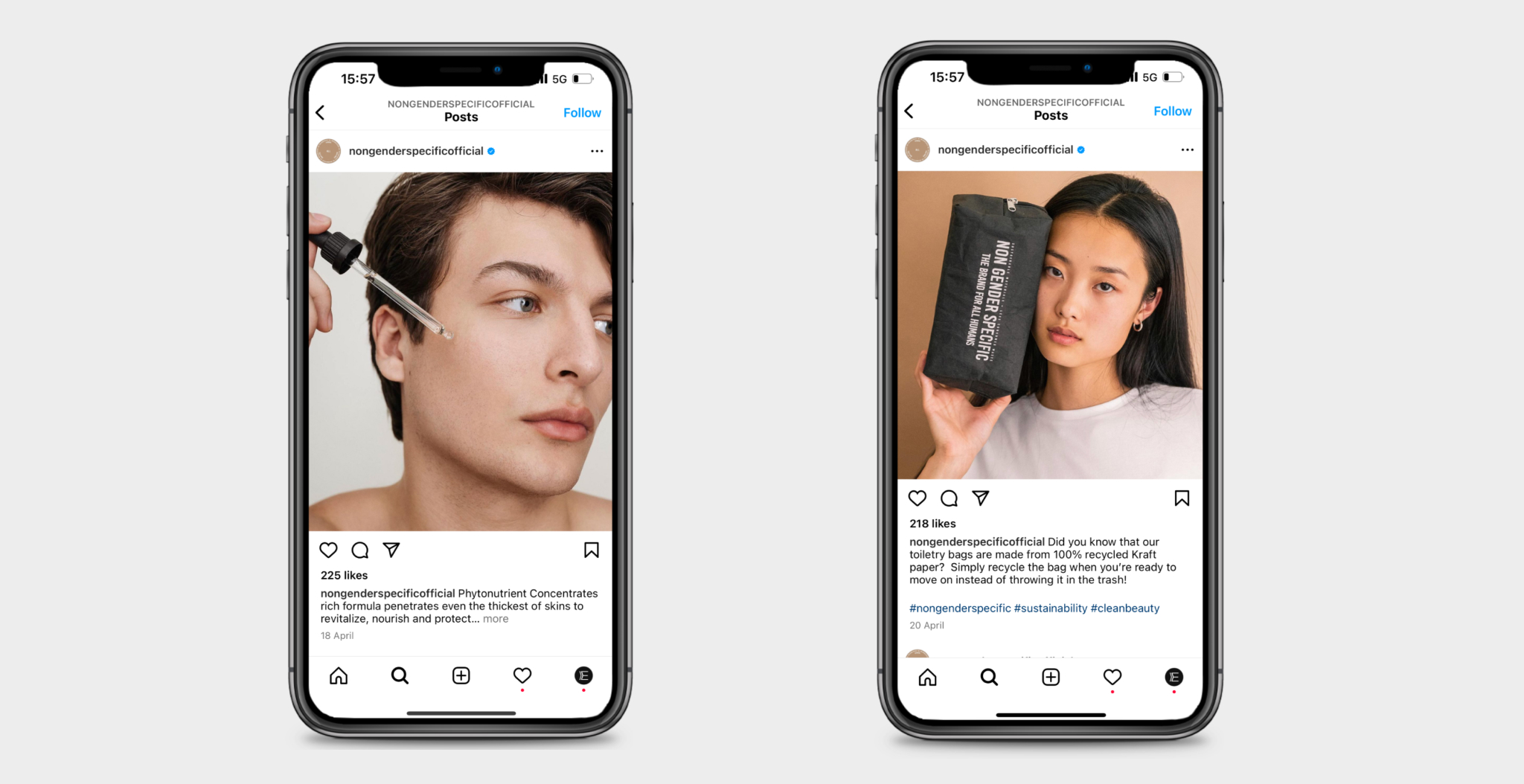

The trend of inclusivity in the beauty market is creating opportunities for new entrants offering diverse products for all skin types, colors, and genders. Uoma Beauty is an example of a brand that has garnered attention for its extensive foundation range, catering to various skin tones. Another uprising brand, Non Gender Specific, promotes inclusivity through its gender-neutral skincare line that appeals to a wide range of consumers.

Natural and Organic Beauty

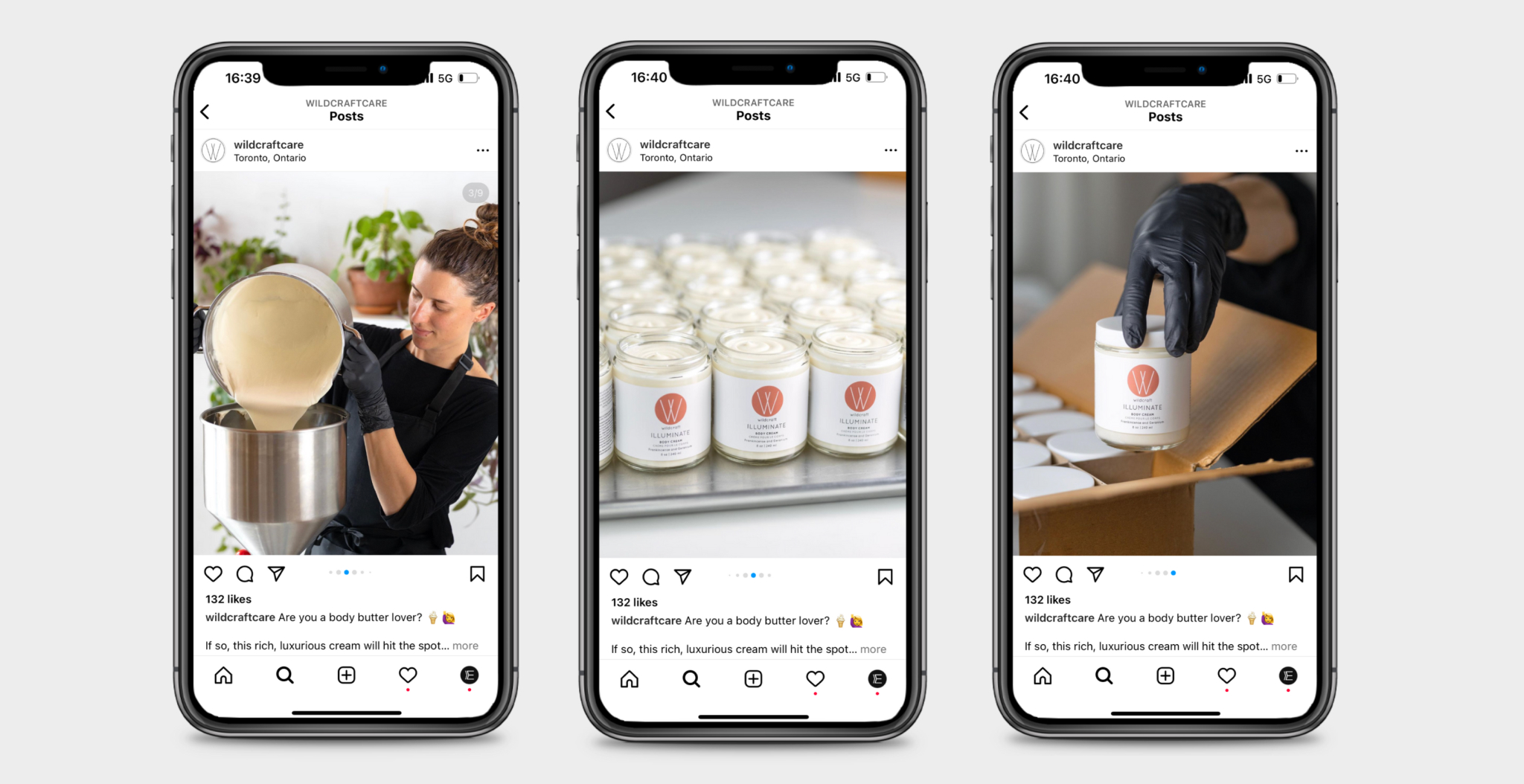

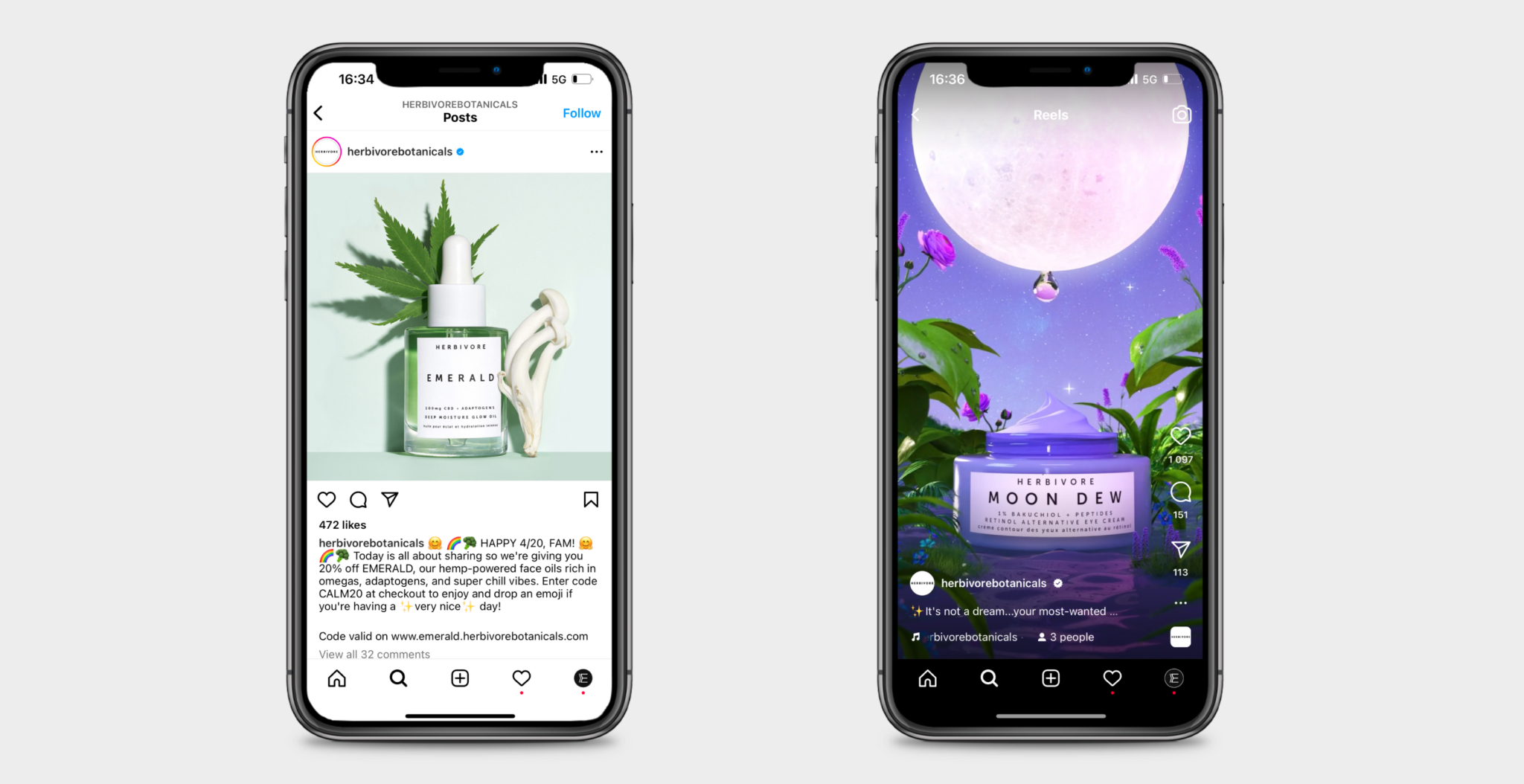

As demand for natural and organic beauty products rises, smaller brands are meeting this need with innovative solutions. Wildcraft, a Canadian brand, formulates its products using locally-sourced, all-natural ingredients, emphasizing simplicity and efficacy. Another example, Herbivore Botanicals, focuses on creating products with minimal, plant-based ingredients, which are ethically-sourced and cruelty-free.

Direct-to-Consumer Brands and E-commerce

The digital age, especially during product launches, has opened up new avenues for beauty brands to reach and engage with consumers. E-commerce has significantly transformed the way beauty products are introduced and marketed, leading to the rise of direct-to-consumer (DTC) brands. By circumventing traditional retail channels and focusing on direct product launch strategies online, these companies sell products straight to consumers. As a result, they’ve managed to flourish amidst the evolving consumer shopping behavior.

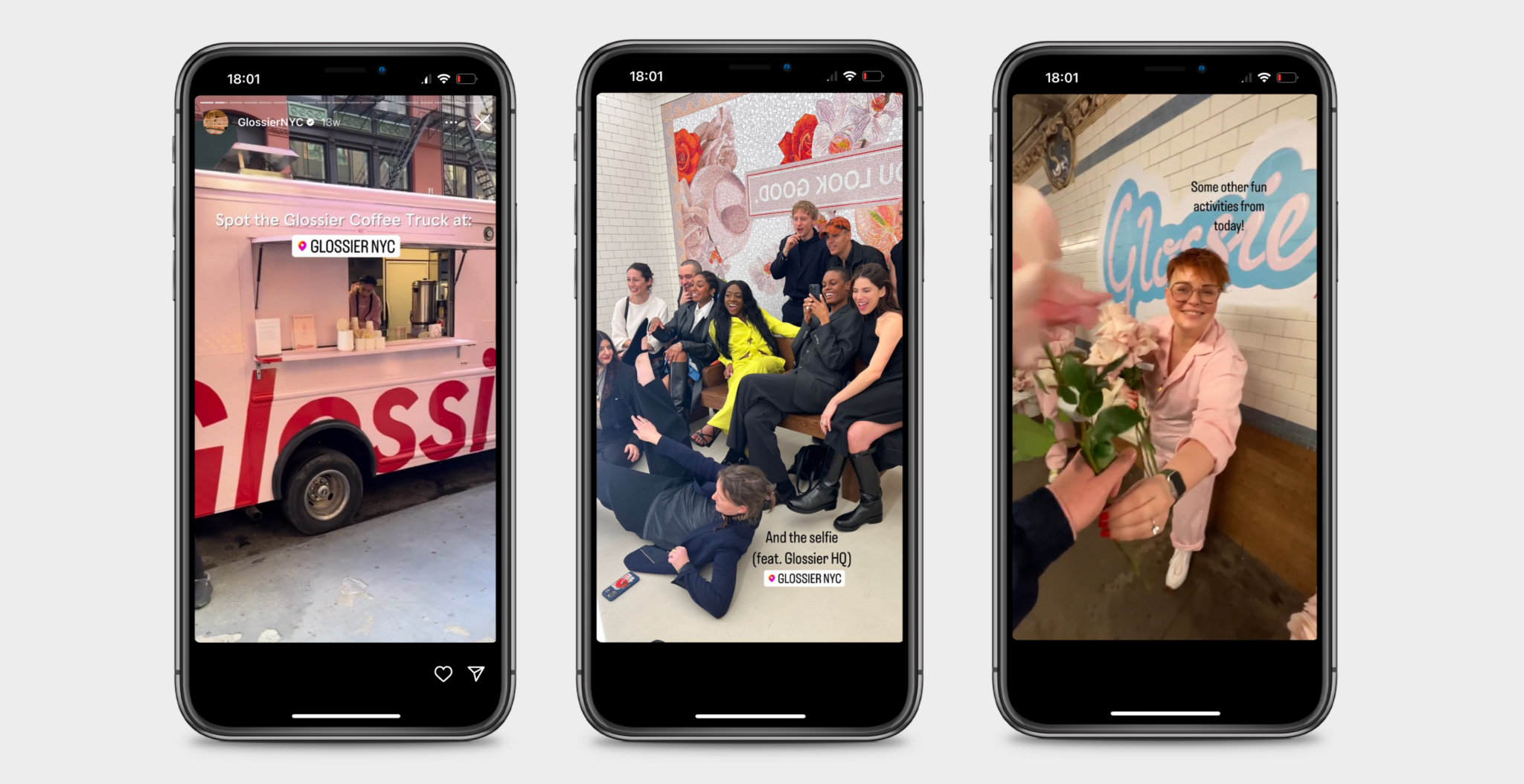

Successful DTC brands on the beauty market, like Glossier, have leveraged social media and e-commerce to create a dedicated customer base. Glossier’s strategy centers around building a community and engaging with it directly. Through their user-friendly website and strong social media presence, Glossier not only sells products but also fosters a lifestyle and a sense of belonging among its followers. They regularly post content that resonates with their audience – from skincare tips to behind-the-scenes glimpses – turning their social media channels into a space for dialogue and engagement. This community-driven approach has helped Glossier to cultivate brand loyalty and build a strong online presence.

Glossier Community

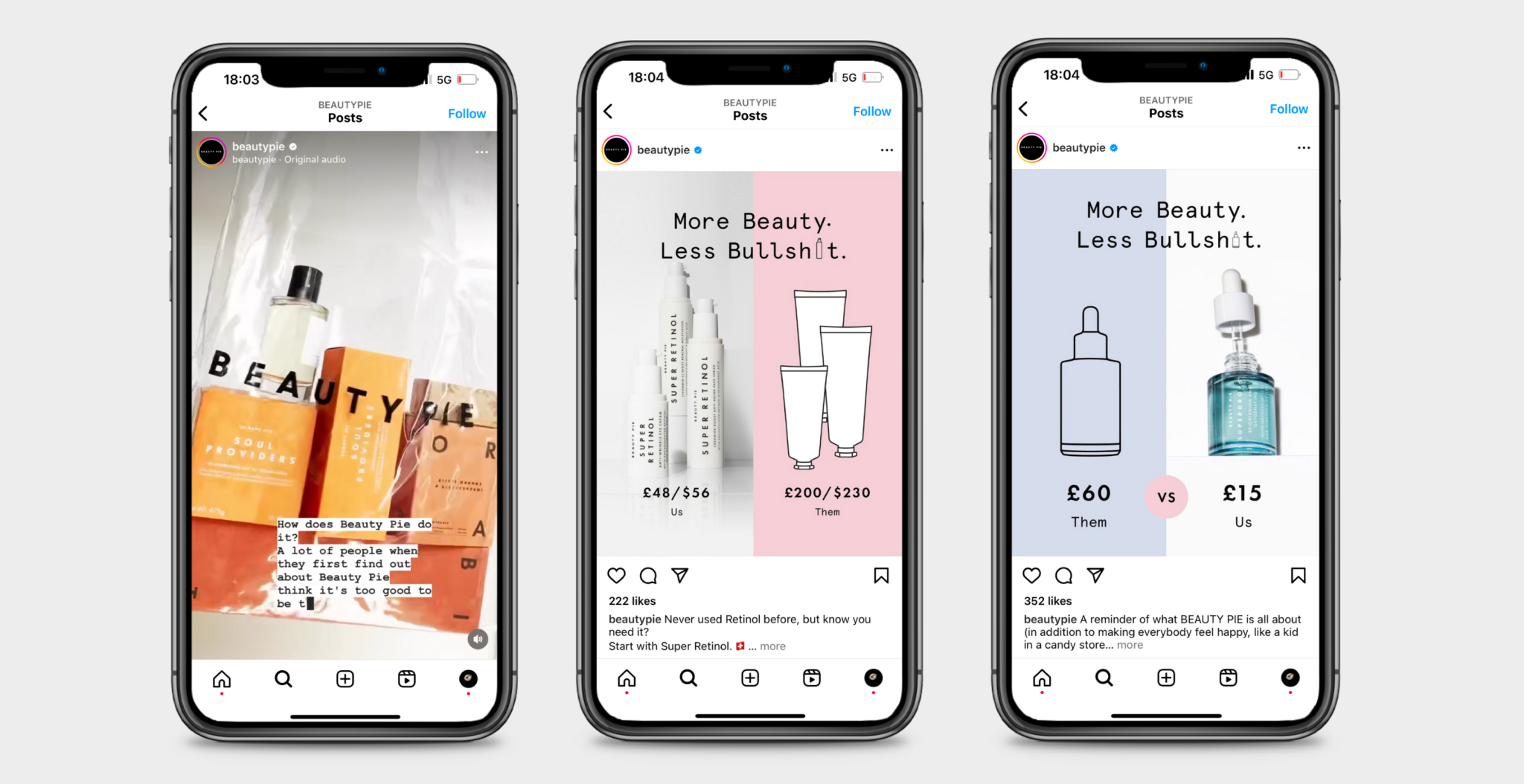

Beauty Pie, another emerging DTC brand, has disrupted the beauty market with its innovative subscription-based model. By offering premium beauty products at factory prices, Beauty Pie provides consumers access to high-quality skincare, makeup, and hair care products without the traditional retail markups. Within the competitive beauty market, the brand’s transparent approach to pricing unveils the true cost of beauty items, challenging the established norms and offering consumers unparalleled value for their money.

Beauty Pie

For brands looking to succeed in the DTC space, several strategies could be beneficial:

#1 Building a Strong Online Presence

This includes a user-friendly, visually appealing website, and active social media profiles that reflect the brand’s identity and values. Regularly updating these platforms with relevant, engaging content can help to attract and retain a loyal customer base.

#2 Personalized Marketing

Personalization can improve customer engagement and conversion rates. This can involve personalized emails, product recommendations, or content tailored to individual consumer preferences and behaviors.

#3 Transparent Communication

Consumers appreciate transparency about product ingredients, pricing, and the brand’s ethical practices. Clear, open communication can help to build trust and loyalty among consumers.

#4 Superior Customer Experience

This is crucial in the competitive DTC space. From seamless online shopping experiences to efficient customer service, brands should strive to exceed customer expectations at every touchpoint.

#5 Leveraging Customer Feedback

DTC brands in the beauty market have direct communication with their consumers, providing valuable insights and feedback. Brands should leverage this information to improve their beauty products and services, and to show consumers that their opinions are valued.

In conclusion, the future of the beauty industry will be characterized by sustainability, technological innovation, inclusivity, natural beauty, and a shift towards direct-to-consumer e-commerce. Emerging brands are at the forefront of these trends, driving change and offering new opportunities for both consumers and businesses. As the beauty industry continues to evolve, it remains an exciting space for innovation and transformation. Read our wellness case study how we helped a beauty & wellness brand from €0 to €71k revenue within 5 months window.