In 2025, longevity is no longer a niche idea, it’s moving to the center of beauty, wellness, and everyday lifestyle. From advanced diagnostics and biotech actives to holistic, identity-driven brands, the industry is transforming.

At the INNOCOS Beauty & Longevity Summit in Geneva, leading brand founders, scientists, and executives (many formerly from L’Oréal, Kenvue, Henkel, Shiseido and others) shared their views on what’s coming next.

To craft this report, I conducted over 15 in-depth interviews and captured keynote talks, transcribing and analyzing them to bring you the most insightful takeaways from the event.

This Evolut trend report dives deeper – beyond the headlines – to explore how longevity is shaping:

- what consumers demand,

- how brands are adapting,

- what science is enabling, and

- where the greatest opportunities lie for those bold enough to act.

1. The Consumer Landscape: What Longevity Means Today

From Anti‑Aging to Pro‑Vitality

For many years, “anti‑aging” was the narrative: fight wrinkles, mask or reverse signs, hide time. But according to the consensus at the summit and related industry research, that narrative is shifting. Consumers aren’t simply asking to look younger, they’re asking to feel better, longer. They want healthspan, not just lifespan.

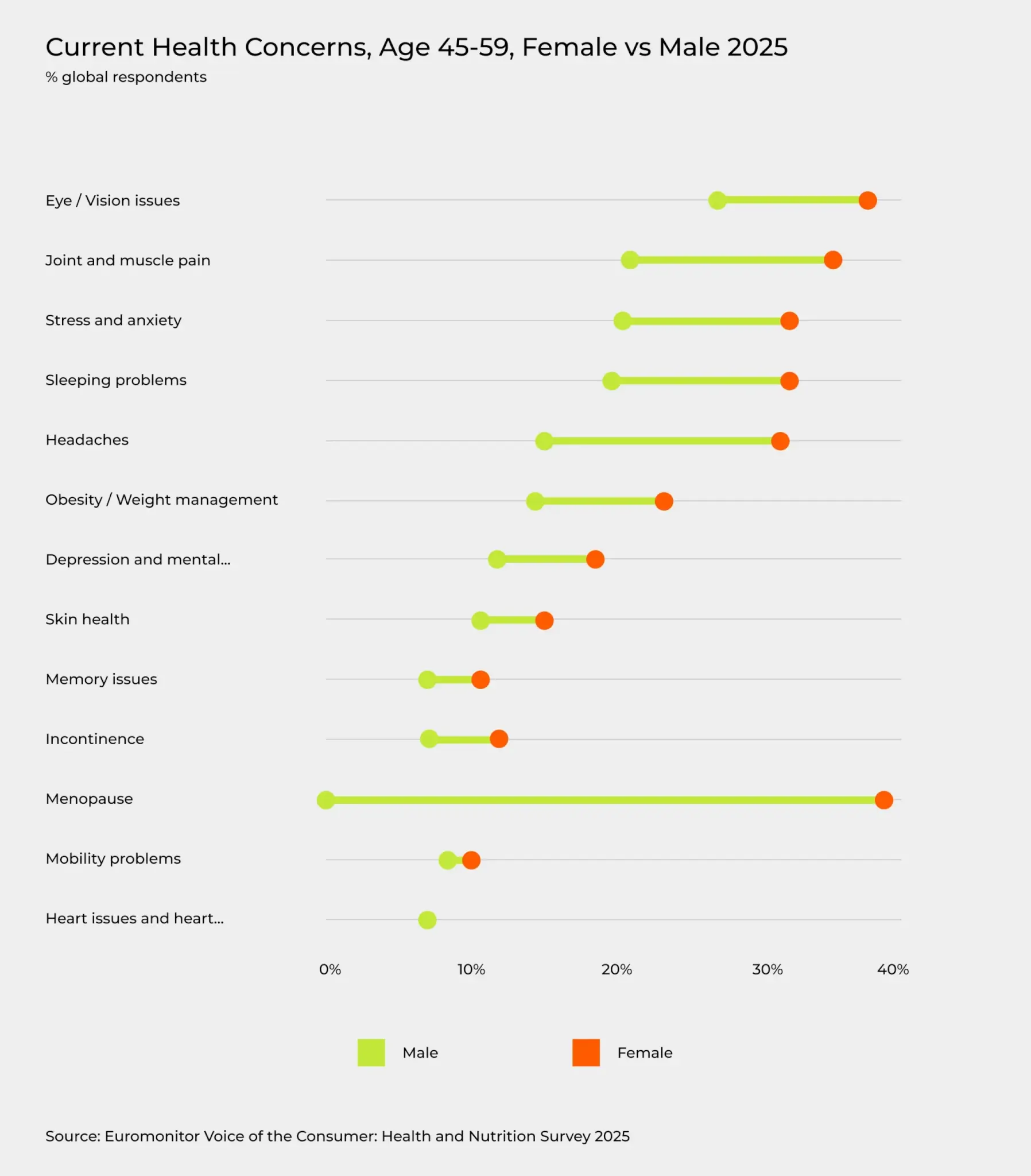

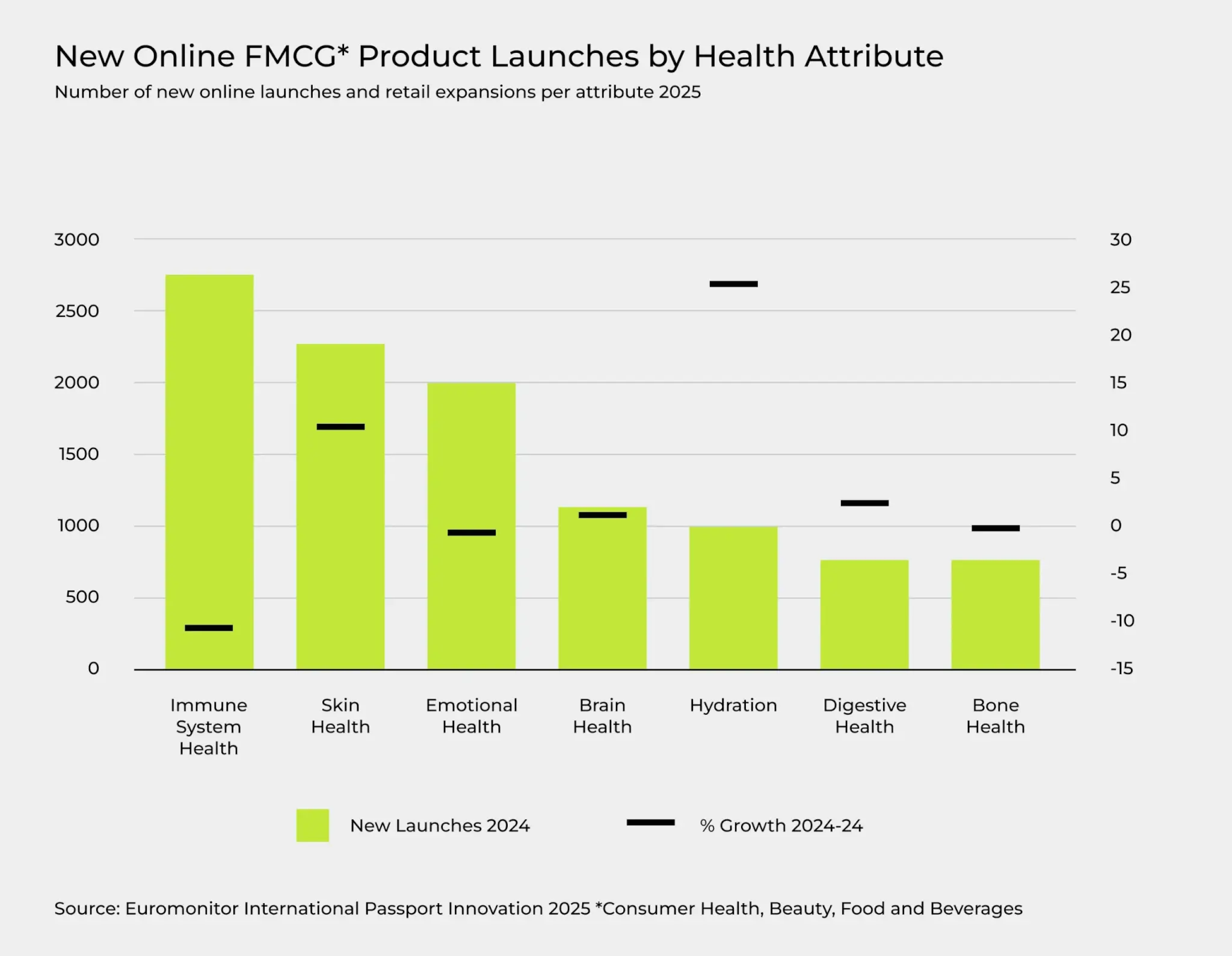

“Consumers are aware they are living longer, and are wanting to do that in the best way they can.” — Emilie Hood, Euromonitor, Vogue Business

It’s no longer about “erasing years” as much as maximizing quality of years. This change is not just semantic, it changes everything from product design to marketing messaging.

A More Educated, Demanding Consumer

Today’s wellness and beauty buyer is bio‑curious, data‑driven, and skeptical. They want proof: real clinical evidence, measurable biomarkers, trustworthy claims, and transparency.

- They compare ingredient label claims.

- They follow scientific publications or summaries.

- They expect innovation to be backed by science, not just marketing spin.

“In an era of AI, where you can fake anything, it’s really hard to fake a whole company with people…Science is essential, but people want proof and stories first.” — Sophie Chabloz, Co-Founder of Avea Life

Panel discussion about skin health of Sophie Chabloz (Avea Life), Dominik Thor (Geneva College of Longevity Science) and Iryna Kremin (INNOCOS)

Inside vs Outside: Beauty from Within

Beauty is increasingly understood as holistic. Skin health, mental wellness, sleep, hormonal balance, gut microbiome – all are part of the conversation. Brands wanting to lead are expanding their portfolios or forming alliances that bridge supplements, diagnostics, skincare, and lifestyle.

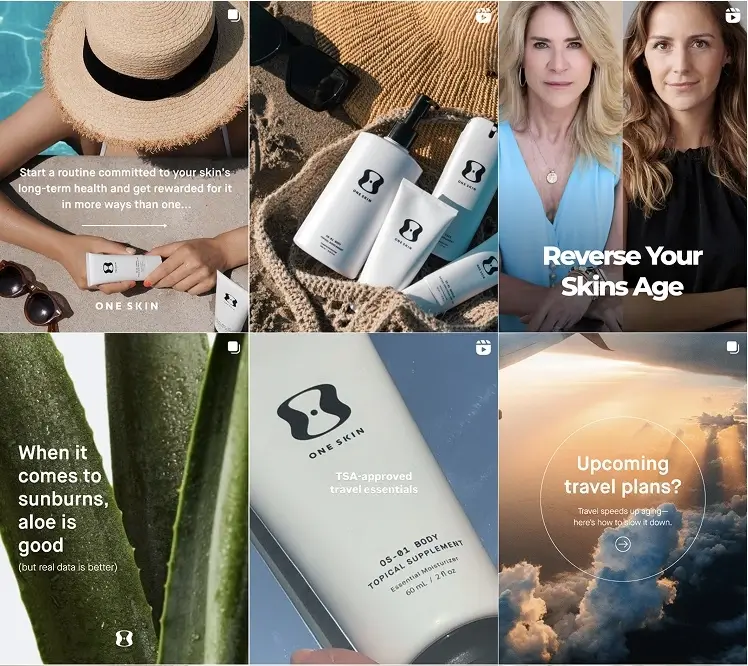

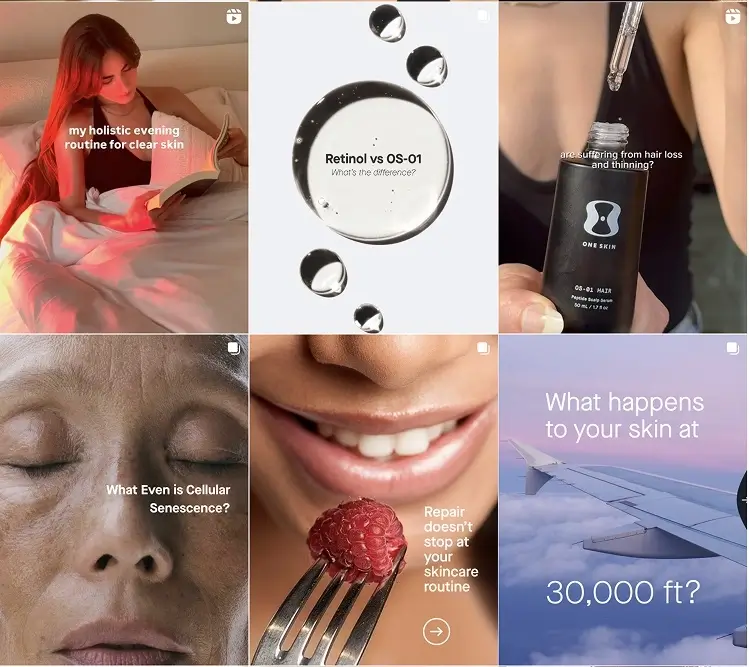

A good example is OneSkin, which built its brand around the OS-01 peptide and now positions itself at the intersection of beauty and longevity. By combining biotech research, consumer diagnostics, and lifestyle education, the brand reflects this shift toward holistic, inside-out longevity.

2. Science & Technology: Enabling Longevity

Biomarkers & Diagnostics: The New Foundations

Diagnostic tools are moving from clinics to homes, from optional to essential. Measuring biological age, mitochondrial health, oxidative stress, or microbiome composition are no longer sci‑fi: they are becoming central to personalized beauty‑wellness routines.

“When you think about longevity, there are three levels: people, body, and cell. What makes you age faster is imbalance… Biomarkers are essential because they tell us where that imbalance starts, so we can act before it becomes visible.” — Pascal Houdayer, CEO of Laboratoires Boiron

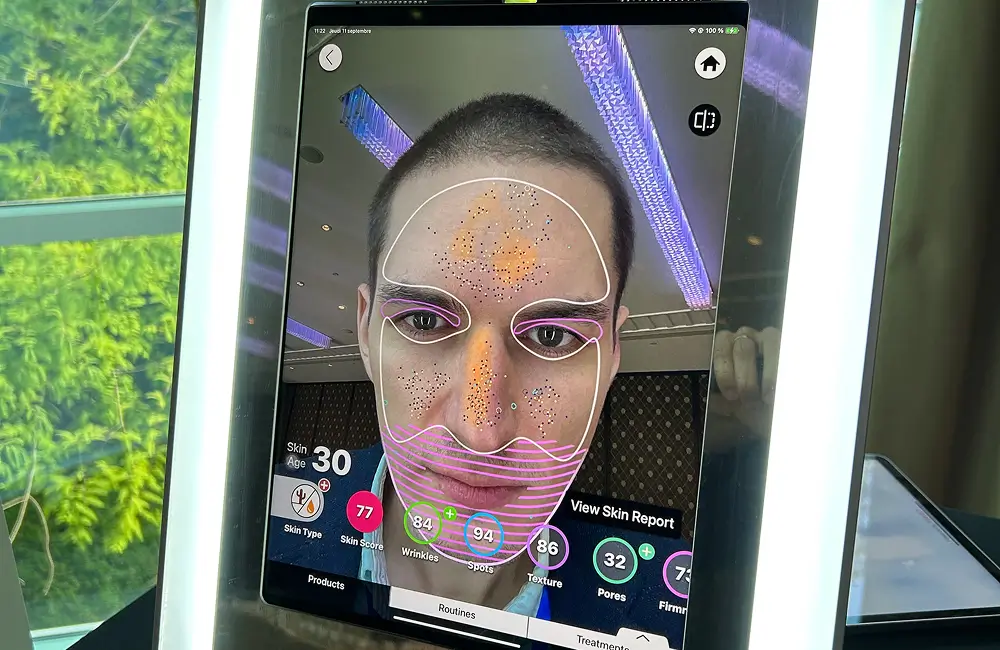

Companies are developing skin diagnostics (via apps, devices) that not only analyze visible skin condition (texture, hydration, fine lines) but also infer unseen damage or risk. These diagnostics then feed into recommendations – topicals, supplements, treatments – that are tailored to the individual.

Biotech, Peptides, and Cellular Health

Emerging actives are targeting aging at the cellular level: peptides, exosomes, postbiotics, mitophagy inducers, and molecules like NAD+ boosters. These are no longer niche, they are being integrated into more mainstream formulas.

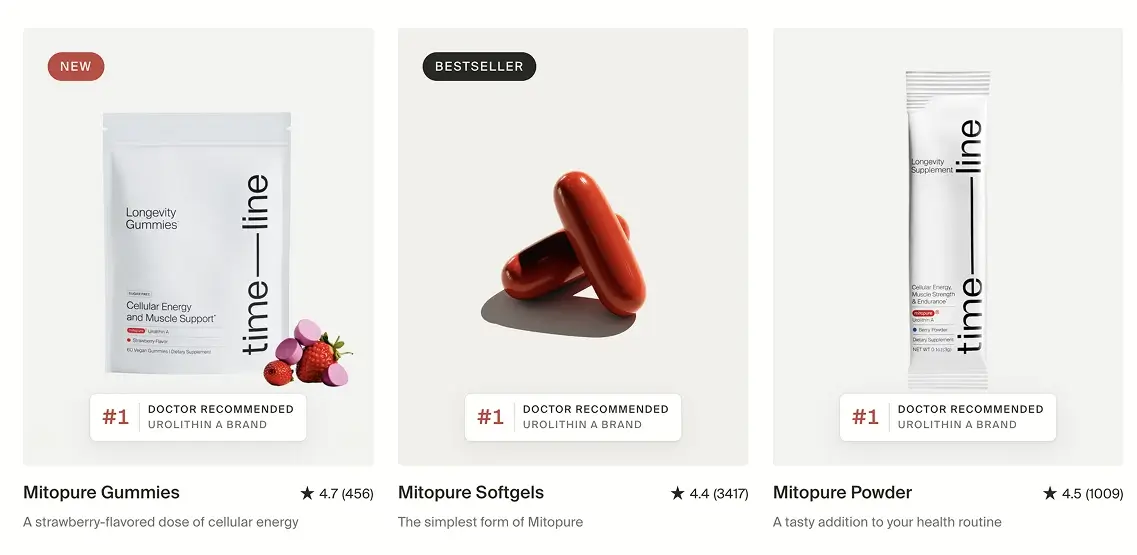

One example: research into postbiotics such as urolithin A, which promote mitophagy – a cellular “clean‑up” process preserving mitochondrial health. As many cannot produce sufficient urolithin A naturally via diet, supplementation or formulations bridging topical plus ingestible delivery are becoming a significant trend.

Urolithin A

It is a natural compound that your body can make when you eat foods like pomegranates, walnuts, or berries. But not everyone can produce it, because it depends on having the right gut bacteria. Scientists have found that Urolithin A helps your cells “clean up” damaged mitochondria (the parts of cells that make energy), which keeps your cells healthier for longer.

Timeline Nutrition has spent over a decade studying Urolithin A, leading pioneering clinical trials that proved its ability to activate mitophagy, the cellular process of recycling damaged mitochondria.

Products powered by Mitopure

Their research showed that supplementing with Urolithin A can improve muscle function, energy production, and overall cellular health, even in people who can’t naturally produce it.

AI, Personalization & Predictive Modeling

AI plays three interlocking roles:

- Diagnostic & Predictive: Analyzing user data – skin images, lifestyle, biomarkers – to forecast future needs before visible issues emerge.

- Personalization: Recommending specific actives, routines, or behaviors tailored to individuals.

- Scaling Expertise: Allowing brands to deliver near‑custom care at scale (via apps, digital platforms, subscription models).

Perfect Corp is one such example: guided skin diagnostics (hydration, fine lines, etc.), then matching personalized product and treatment suggestions in real time.

“Skin AI as an integral component of broader health monitoring systems, providing early warning for internal conditions and contributing to preventative health strategies.” — Wayne Liu, President, Perfect Corp

3. What Brands Are Doing: Strategy, Portfolio, Positioning

Integration Across Categories

Top brands are no longer siloed into skincare, supplements, or wellness. They’re merging:

- Skincare with ingestible (nutricosmetics) or postbiotics.

- Diagnostics / testing with product lines.

- Behavior / lifestyle interventions (sleep, stress, diet) as part of their offering.

This integration responds to consumer desire for holistic solutions.

High‑Efficacy Actives, Sustainable Processes

Consumers want both potency and ethics. Active ingredients need rigorous validation.

At the same time, sustainability is no longer optional: eco‑friendly sourcing, clean/ethical ingredients, sustainable packaging, and carbon/impact transparency are table stakes.

Trust Through Transparency & Storytelling

Storytelling that works is rooted in science. Brands that can explain why an ingredient, diagnostic, or behavior matters tend to win trust.

Some tactics:

- Publish or reference clinical/biomarker data.

- Use expert voices (dermatologists, scientists).

- Create educational content rather than just promotional.

Be honest about limitations: what the product can’t do is sometimes as valuable as what it can.

“Storytelling will always have more impact than facts alone, but it must be rooted in truth. In longevity and beauty, people are looking for authenticity — a balance where science provides credibility and storytelling creates connection.” — Arif Isikgun, Ai Beauty Consultancy

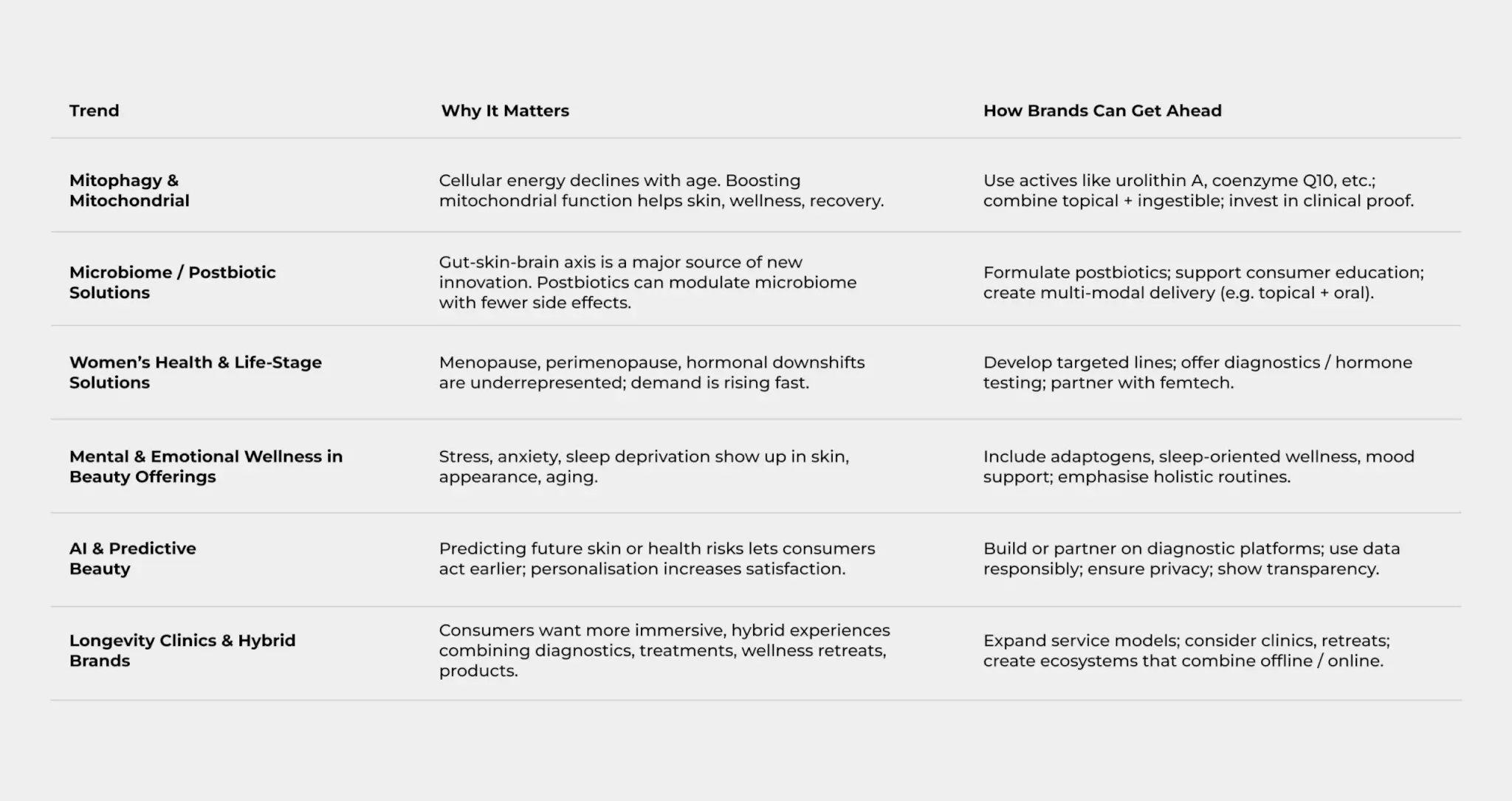

4. Key Trends to Watch Through 2026

Below are the specific directions likely to grow strongest in the near future, based on INNOCOS Beauty & Longevity Summit plus wider market signals.

These trends highlight not just where consumer demand is heading, but also where science, technology, and brand strategy are aligning to create entirely new categories of beauty and wellness.

BEAUTY, TECH & LONGEVITY SUMMIT

February 18-20, 2026 | Hayes Mansion, Curio Collection by Hilton, Silicon Valley

Turning Data Into Decisions in the Age of Intelligent Beauty

5. Challenges & Risks

Every trend has its challenges. For brands and investors moving into longevity, these are the main obstacles to watch:

- Regulatory Complexity: Claims about longevity, biomarkers, diagnostics are under greater scrutiny. Misleading claims could backfire.

- Scientific Rigor & Replicability: Some actives and investigations are still early; small studies or animal data may be promising but not yet sufficiently conclusive.

- Consumer Fatigue & Skepticism: Overselling is a problem. If brands overpromise without proof, trust erodes fast.

- Access & Cost: Personalized diagnostics, biotech actives, hybrid clinics tend to cost more. Ensuring accessibility or scalable versions is key.

Data Privacy & Ethical Use: Health, skin and biomarker data are sensitive. Brands must handle data carefully and transparently.

Regulatory Differences: EU vs. US Markets

One of the most complex challenges for longevity-driven beauty and wellness brands is navigating the very different regulatory environments in the European Union and the United States.

United States (FDA Oversight):

In the US, the Food and Drug Administration (FDA) regulates cosmetics, supplements, and medical devices under separate frameworks. The FDA generally does not pre-approve cosmetics or supplements, but it does enforce strict rules around disease claims. Any product that claims to diagnose, treat, cure, or prevent disease may be reclassified as a drug, triggering costly clinical trial requirements. For longevity brands, this means words like “anti-aging therapy” or “extending lifespan” can quickly create compliance risks.

European Union (EFSA & EMA Oversight):

In Europe, the European Food Safety Authority (EFSA) governs supplements and health claims, while the European Medicines Agency (EMA) oversees drugs. The EU’s Health Claims Regulation is far stricter than US standards: every claim must be backed by pre-approved scientific dossiers. Terms like “supports mitochondrial health” or “improves cellular function” may not be allowed unless EFSA has authorized them. Cosmetics are also subject to the EU Cosmetics Regulation, which enforces more detailed safety assessments and ingredient restrictions compared to the US.

6. Quotable Moments from INNOCOS Voices

Here are some compelling quotes from my own interview sources and INNOCOS longevity summit sessions:

“More advanced customers already understand they need to act on multiple pathways of aging to really get results.” — Alena Demina, SYSTEM SKIN

“Biomarkers will play a really big role if you accept the premise that you need to think of longevity and health span from birth.” — Ayla Anaya, PIMS

“The longevity consumer isn’t just buying a serum, they’re buying a philosophy.” — Dominik Thor, Geneva College of Longevity Science

“Anti-aging is almost like an insult result. What we really need to talk about is longevity, resilience, and optimizing health at the cellular level.” — Shanti Bhatta, Founder of Cosprof Studio

“We’re entering an era where beauty brands are being challenged to think like health companies and vice versa. Longevity is not just a trend, it’s a cultural shift.” — Shivi Gupta, VEDIC LAB

“What is the point of living longer if you don’t live well? You might be 108, perfectly fit and beautiful, but if your head is not there, you are not there. For me, mental health will define the future of longevity.” — Laura Gamboa, Director, Natura Bissé

7. Strategic Implications for Brands

If you lead or work in a beauty / wellness / supplement brand, what should you consider now so you’re not just reacting, but leading?

8. Brands That Are Crushing the Longevity Game

Throughout the INNOCOS interviews, a handful of brands consistently emerged as benchmarks for innovation and credibility in the longevity space. These companies are shaping the way consumers think about beauty, health, and lifespan.

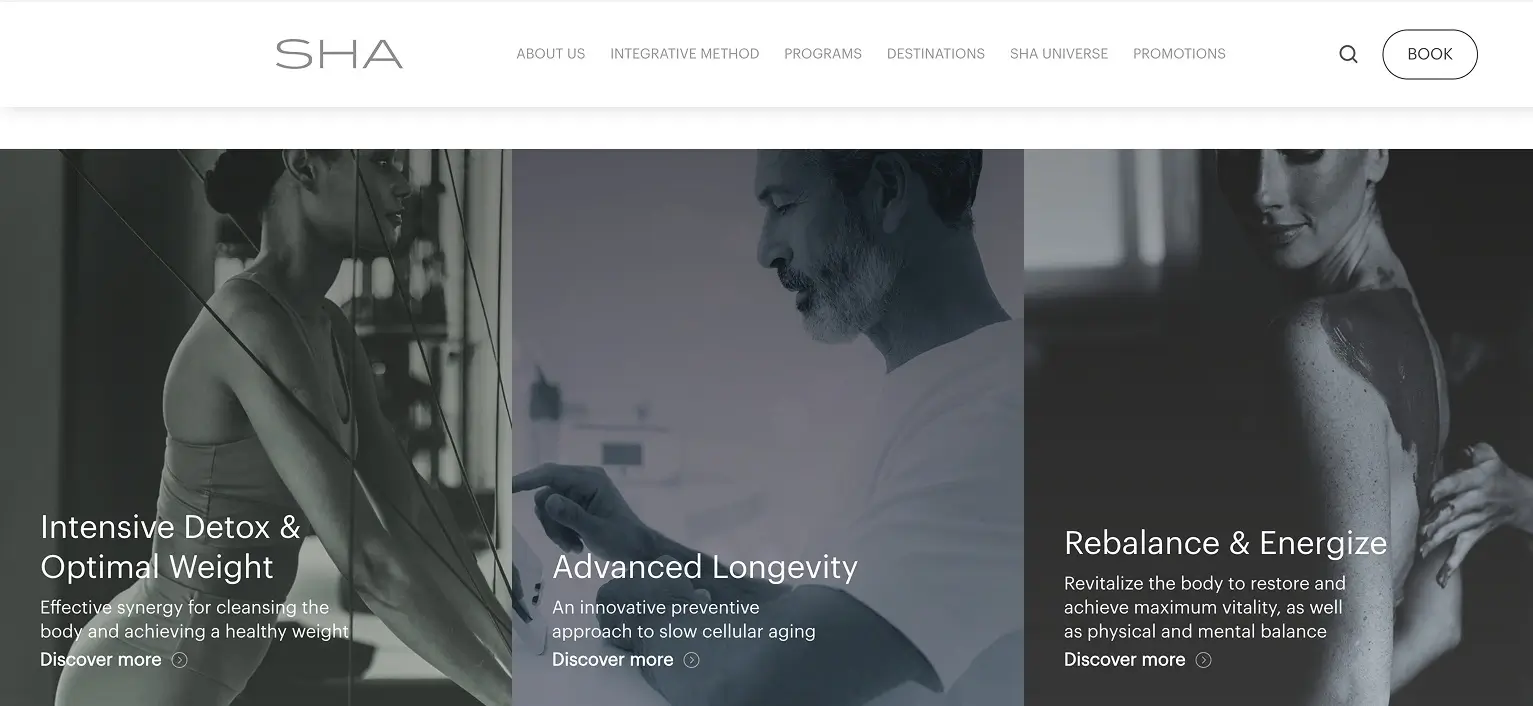

SHA Wellness Clinic: They have built a holistic ecosystem where nutrition, beauty, medical expertise, and mental wellness converge. Several interviewees pointed to SHA as proof that consumers are willing to invest in premium, multi-disciplinary longevity offerings.

Timeline Nutrition: With years of research into urolithin A and the recent relaunch of its longevity skincare line, Timeline was praised as a pioneer in bringing cellular health science into beauty. Their strategy bridges the gap between biotech rigor and consumer-friendly beauty products.

The newly relaunched skincare line from Timeline

OneSkin: Mentioned as a brand to watch, OneSkin leverages its proprietary peptide OS-01 to frame skin health as a biological marker of overall aging. By combining biotech research with consumer education, OneSkin demonstrates how brands can own the narrative of longevity at the cellular level.

Elysium Health: A name that surfaced in multiple conversations, Elysium represents the supplement-first path into longevity. With its NAD+ booster and a portfolio expanding toward broader healthspan support, Elysium is seen as an early mover setting standards for supplement transparency and science communication.

Best performing supplement ads from Elysium based on their ad longevity

Together, these brands show that winning in longevity because they are building trust, investing in science, and delivering holistic solutions that resonate with both the rational and emotional sides of consumers.

Want to know what books and podcasts the world’s leading longevity experts are actually reading and listening to? Subscribe now and get exclusive access to the curated list shared by INNOCOS longevity summit speakers and interviewees.

Titles shaping the future of beauty, wellness, and healthspan.

10. Looking Forward: What’s Next for Longevity & Beauty

Here are some of the future directions to keep close tabs on through 2026 and beyond:

- Predictive Aging – not just measuring age but projecting skin’s future condition under different lifestyle scenarios (diet, UV, sleep) and giving actionable plans.

- Multi‑Modal Delivery Systems – combining topical, ingestible, lifestyle behavior, environmental exposure interventions in one integrated regime.

- Regenerative Therapies – growth factors, stem cell derivatives, DNA repair enzymes, senolytics as cosmetic / wellness adjuncts.

- Longevity & Mental Health Interface – more overlaps between beauty & mental/emotional health, since stress, sleep, mood directly impact skin and aging.

- Circular Longevity – products and brands built with sustainability, zero‑waste packaging, ethical sourcing becoming not just “nice to have” but expected.

Conclusion of the longevity summit: Seizing the Longevity Moment

Longevity in beauty is unavoidable. Consumers expect it; science enables it; markets reward it. Brands that recognize this are shifting away from anti‑aging slogans toward holistic wellness, healthspan, and vitality.

As one executive said at the INNOCOS Beauty & Longevity Summit:

“It’s not about more years, it’s about more vitality per year.”

The future belongs to those who act now, grounded in science, authenticity, and empathy.